Post presidential debate stock market rally

Updated 6:48 a.m.

While the Emini gapped up and created another island bottom, the gap was small, yesterday’s tight trading range is a magnet, and the 1st bars were dojis. Hence, the odds are against a strong trend day today. Instead, today will probably have a lot of trading range price action. Yet, it still will probably have at least one swing up and one down. The Emini is now deciding which will come first. The Emini is Always In Long, but the odds are that it will trade back into yesterday’s tight trading range within the 1st 2 hours.

The Black Swan trade today would be a strong bull trend. If one begins, traders should not deny it, and they must get long. More likely today will trade down early and form a trading range day.

Pre-Open Market Analysis

Because the 2 day island top on the daily chart formed in a 9 bar bull micro channel, the odds were that bulls would buy the 1st reversal down. The Emini had an outside up day yesterday, and therefore the bulls were strong. Yet, the Emini has been in a trading range for a month. Therefore, traders expect any strength to last for only a few days before there is an opposite leg in the range.

The bulls need a new all-time high. Because the monthly trend has lasted a very long time (more than 100 bars), the odds are that the breakout would not go far before failing, Because traders will sell the new high, many will begin to sell below the high, just in case the bulls are not strong enough to create a new high. As a result, the Emini might turn down from a lower high major trend reversal. The 2 day island top is a reasonable candidate. Yet, without a strong bear breakout, the 2 day sell off is more likely a pullback in the bull trend.

The importance of Friday’s close

The most important event this week is still the close on Friday. Since the Emini has never had 8 consecutive bull trend bars on the monthly chart, a Friday close would result in the Emini doing something it has never done before. Hence, it would be the most extreme example of consecutive bull bars in the 18 year history of the Emini.

When a market does something extreme, it is creating a climax. Most noteworthy is that it can come without the presence of big bull trend bars. Any unusual activity is unsustainable and therefore climactic. Hence, the probability goes up that the behavior will regress to the mean. This means that it is likely to start behaving like it always has.

Hence, a bull close in September has about an 80% chance of a bear close in October. Traders will therefore look to sell above the October open or 10, 20, or 30 points above the October open. Many will buy outs or put spreads. They expect October to close below its open, and they therefore expect a profit.

100 point pullback

The monthly chart has had 7 consecutive bull trend bars several times in the 18 year history of the Emini. Each soon led to about a 100 point correction. The odds are that the current 7 or 8 month series of bull bars will also soon lead to a 100 point pullback.

Emini Globex session

The Emini had swings up and down overnight. It is now up only 1 point. Because yesterday was a buy climax, there is only a 25% chance of strong bull trend day today. Yet, there is a 50% chance of follow-through buying in the 1st 2 hours. A bull channel is a bear flag. The odds therefore favor a bear breakout today. While it can come from a bear trend, it more often comes from the Emini simply going sideways for an hour or two.

Forex: Best trading strategies

The 60 minute EURUSD Forex chart tested the bottom of the bull channel and has evolved into a trading range. It is therefore again in Breakout Mode. The bulls see the trading range as a Nested Double Bottom. Yet, the bears see a Head and Shoulders Top.

While the 240 minute EURUSD chart sold off strongly yesterday, it reversed up from a double bottom with Friday’s low. It is still at the apex of a 2 month triangle. Hence, it is still in breakout mode. Traders will therefore mostly continue to scalp as they wait for the breakout.

Overnight EURUSD Forex trading

The EURUSD Forex market is at the apex of nested trading ranges that began 18 months ago. It is in Breakout Mode. The 60 minute chart last night reversed up from a breakout below the bottom of the bull channel and therefore created a double bottom with the channel low. Because it also tested that low yesterday, it formed a smaller double bottom with yesterday’s low. It now is in a 5 day trading range, and again in Breakout Mode.

While it has rallied for the past 2 hours, it is only in the middle of the 5 day range. Therefore the rally is more likely only a bull leg in a trading range and not the start of a bull trend.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

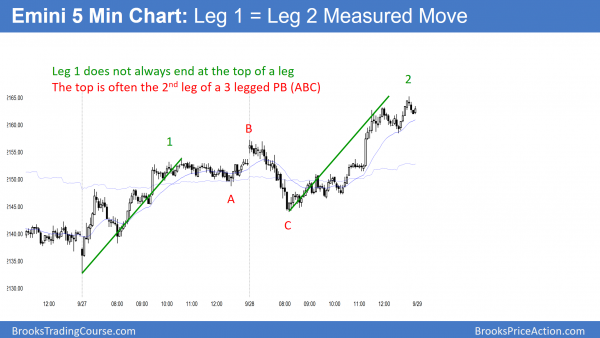

The Emini rallied to the open of the month, and then stalled. There was also a channel top and a measured move target there.

…

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.