Posted 7:07 a.m.

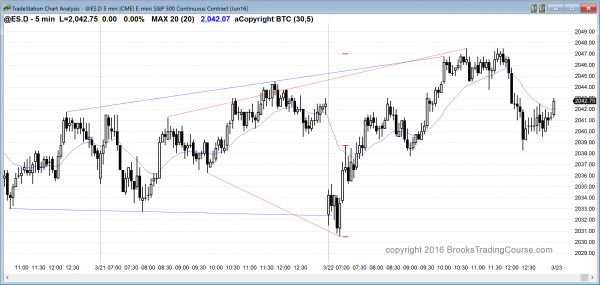

The Emini opened with a gap down, and it formed a 3 day expanding triangle bull flag at the 60 minute moving average. It had a 2nd entry buy signal and a big bull entry bar closing on its high. The day is Always In Long, and there is currently a 50% chance that we have seen the low of the day. Because the Emini is overbought on all higher time frames and it has been sideways for 2 days, the odds are against a big bull trend day. However, the rally was strong enough so that the 1st reversal down will probably be bought, and today will probably not be a bear trend day.

There were repeated reversals on the open, and the follow-through bar stalled at the moving average and had a big tail on top. This increases the chances of trading range price action, which means that there could be a deep pullback, and then a trading range lasting several hours. The Emini might begin a bull channel after a small pullback, and form a spike and channel bull trend. Buyers are in control and the 1st reversal down will probably be bought. However, this is not starting like a strong bull trend day. That means a weak bull trend or trading range is more likely over the next 2 hours.

Less likely, this is a buy climax and early high of the day. The bears will either need one more push up and a parabolic wedge, or a strong reversal down.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade the end of a buy climax

The Emini continues to be overbought on the 60 minute, daily, and weekly charts, as I wrote yesterday. Although it is down only 9 points in the Globex market, there is a 70% chance that it will fall at least 30 points this week. The stop is so far for the bulls that they have to reduce their risk, and enough will do it by profit-taking so that there will be at least a small pullback. The bull trend is strong enough so that the reversal will be minor. This means that bulls will buy the 1st selloff and the best the bears can hope to see over the next few weeks is a trading range. Because the rally is extreme enough to be climactic, the chance of a major reversal without even a small double top is higher than with most rallies, but the odds are about 70% that the first 50 point pullback will be bought. The bears will probably need a major trend reversal on the daily chart, which would take at least a few weeks to develop.

The rally on the 60 minute chart is a Spike and Channel bull trend. Although there is currently a wedge top, it is not convincing and many computers will see the two day trading range as a bull flag. There might be one more rally for a day or two before the pullback begins.

Since the Emini has been in a trading range for 2 days, the odds favor more trading range price action today. Bears will begin to sell new highs, and bulls will begin to take profits at new highs. This would be the transition of a bull trend into a trading range, and it is likely to begin today or tomorrow. There is only a 30% chance that this rally will continue up to the all-time high without at least a 50 point pullback.

If there is no clear top on the 5 or 60 minute charts, bears will wait for a strong bear breakout before they will swing trade. Bulls are willing to swing trade, but will be quick to take profits because the Emini is late in a buy climax. The odds favor a pullback and not much more of a rally.

Forex: Best trading strategies

Many major financial markets are overdone, and are deciding if a pullback is beginning, or if there will be one more leg before the pullback comes. One example is the daily chart of the USDCAD. There is a 70% chance that the 2 day bear breakout of March 16 and 17 is an exhaustive sell climax, and that there will be a 300 pip rally to above the March 16 high of around 1.3400 within the next few weeks.

The gap between the March 17 close and the March 11 low will probably be an exhaustion gap instead of a measuring gap that leads to an acceleration down and a measured move down. When the strongest consecutive bear bars occur after a bear trend has gone on for 20 or more bars, it is usually at or near the end of the move. There is often one more brief push down before the pullback begins, and that is what the Forex market is currently deciding. There is only a 30% chance of the USDCAD daily chart continuing down for more than 2 weeks without first testing the March 16 high.

The bear channel is tight. This means that the reversal up will probably me minor. A minor reversal usually only leads to a leg in a trading range and not a bull trend. No one knows where the top of the trading range will be, but an obvious candidate is that March 16 high. If the USDCAD daily chart then enters a trading range at that point, the bulls will look for a bull breakout and then a measured move up. If they get it over the next few months, that would retrace about 50% of the 3 month selloff. The bears want a bear breakout below the trading range and at least a measured move down. The odds also favor a trading range soon because the current sell climax is near the support of the March 2015 trading range high around 1.285, which is also the bottom of the October 2015 trading range low. That support is about 200 pips below the current price. It might be tested before the bounce to the March 16 high, but the odds are 70% that the USDCAD will get to the high within the next few weeks.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini reversed up from the 60 minute moving average and below yesterday’s low. It was a 3 day expanding triangle bottom. After going outside up, it reversed down from an expanding triangle top and closed around unchanged.

Today was an outside day, as was yesterday. Consecutive outside days create a tight trading range. If tomorrow is a bear inside day, it would be a sell signal bar in an overbought daily and weekly bull trend.

There is a 70% chance of profit taking over the next few days and a 30 – 50 point pullback. The selloff at the end of today might be the start of the profit taking. The bulls want the rally to continue up to the all-time high. Because the daily and weekly charts are so overbought, it is more likely that there will be profit taking and a pullback over the next week. There is only a 30% chance of a continued rally for 2 more weeks without at least a 30 point correction.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Dear Dr. Brooks,

What about your take on EUR/USD today ? I was looking forward to that.

Thanks & regards,

Nili

I try to do it everyday, but the USDCAD had an interesting situation. Nothing has changed with the EURUSD. Traders are deciding if it will have one more push up and form a wedge top from the March 10 low, or if the wedge is already complete, with the 1st push up being the March 2 low. The 3 day selloff lacks momentum so the odds are that traders will see it as a bull flag on the 240 min chart and not the start of a bear trend. The bulls and bears are balanced and have equal probability at the moment. The bears on the daily chart have not yet convinced traders that the top is in. The bulls have the problem of a strong rally on the daily chart, but near the top of a trading range. This is common in a trading range. The bulls often have momentum, but the bears have probability. Both sides need more information so sideways is likely.

Thank you !