Posted 6:57 a.m.

The Emini opened with a big gap up, but went sideways in a limit order market. Unless the bears can get a strong reversal down, the odds are the any sideways to down move will form a higher low major trend reversal after yesterday’s lower low reversal. The bulls want a stop order entry, but it there is a strong breakout to the upside with good follow-through, they will buy closes and then pullbacks. The bears need a strong bear breakout. If they get it, they might get a test of yesterday’s low.

With this limit order open, the odds are that the Emini will have to fall below more support before it can rally. Obvious support is yesterday’s lower high and the 5 minute moving average. Even though the Emini is Always In Short, the odds are that yesterday’s strong reversal up will be followed by at least a small 2nd leg up today. The Emini is in the process of deciding how low down the higher low will be.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade a sell climax bull flag

As I said yesterday and over the weekend, the odds were that yesterday’s selloff was probably just a bear leg in a bull flag, even though it was an entry bar for an expanding triangle top. The channel up from the bottom of the 2 year trading range was too tight. The momentum was strong enough so that the Emini was more likely to need a 2nd signal. Also, the Monthly candlestick pattern, which closed yesterday, was a buy signal bar, and the monthly chart has a bull flag. The odds are that March will need to trigger that buy by going above the February high. However, since the buy signal is weak, the odds are that the monthly buy signal will fail, just like yesterday’s entry below the daily sell signal will probably fail.

The Emini finished yesterday with a dramatic lower low major trend reversal and a big buy signal bar. I mentioned in the room that if I was trading a fund, I would have bought in the final minutes of yesterday for a move above the February high. The Globex session is up 15 points with an hour to go before the NYSE opens. While it is too early to be certain what will happen today, everything I said yesterday remains the most likely path. Even if there is another leg down, it will probably be limited, and March will probably trade above the February high within the next week or two. However, the odds are that the bull breakout will not get too far and then fail. There is still a 60% chance of a bear breakout below the 2 year trading range before there is a bull breakout above the top.

Yesterday had a strong sell climax. There is therefore a 50% chance of follow-through selling for the 1st hour or two and a 75% chance of at least a 2 hour sideways to up move beginning before the end of the 2nd hour. When there is a big gap up above the moving average, there is a 60% chance that the initial move up or down will end within an hour and be followed by a sideways move toward the moving average. Once near the moving average, the Emini will decide between resumption up or reversal down. If there is a strong bear reversal bar on the open or a 2nd entry sell signal or a strong bear reversal, traders will swing for a trend down to test yesterday’s close. If there is a strong bull bar on the open, traders will be more cautious because the Emini will be far above the average price. They will more likely take profits within 5 – 10 bars, and this usually results in a trading range. Traders will be ready for either a trend from the open up or down, but know that any early trend will probably end up as a leg within a trading range for a couple of hours.

Forex: Best trading strategies

The EURUSD had a 2 day sell climax on the daily chart that probably ended yesterday. It formed in a 2 week tight bear channel, and the EURUSD daily chart is now back in the middle of the January/February trading range. The odds are that it will go sideways again here. Since is has gone down and sideways means up and down, it will probably begin to go up within the next day or two. There is still room to the January 5 and 21 lows, but the EURUSD is within 100 pips of the lower low.

At the moment, there is a 60% chance of a 100 pip rally before another 100 pip sell off to below the January 5 low, so the math is good for the bulls over the next few days. Targets for the bulls are the lower highs on the 60 and 240 minute chart. The strongest magnet is the February 26 top of the sell climax at around 1.1060, which is 180 pips above the current price.

The 240 minute chart has been in a tight trading range since yesterday morning and there is a wedge bottom with the February 24 an 29 lows. While it might fall more, the context is good for a rally beginning within the next couple of days, whether or not there is one more leg down for 50 – 100 pips.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

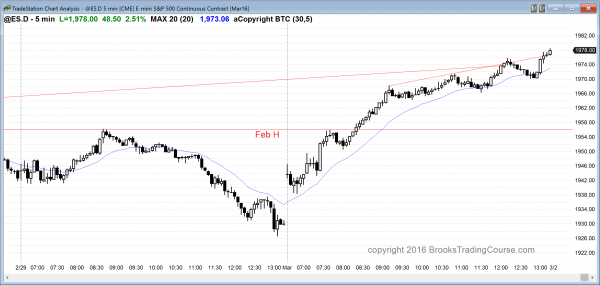

After hesitation in the 1st hour, the bulls got a small pullback bull trend day on their breakout above last month’s high. Last month was a buy signal bar on the monthly chart, and March is now the entry bar.

Today had a very strong rally to above last month’s high. This triggered a buy signal on the monthly chart. As with any extreme climax, there is a 50% chance of follow-through buying in the 1st hour tomorrow, and a 75% chance of at least a couple of hours of sideways to down trading that begins by the end of the 2nd hour. An obvious target for a pullback is the bottom of the channel that began with the pullback after 9 am today.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al..

Retrospectively, today was a huge day. Do huge days surprise you or if not, how do you get a sense to be prepared for a big day – do you take a cue from higher timeframes or just expect MTR to provide larger swings?

Also, when you do expect a huge day or start to see a small PB market like the bars 20 to 30, do you increase initial position size or just keep adding to initial position size at close of each bar? Thank you – Neil

Hi Al –

In your 20 bar EMA, do you include bars 79-81 or is your EMA calculation limited to the NYSE hours? Relatedly, the ” daily close” refers to the close on 78 or 81 each day?

Thanks for all your efforts too!

Hi Donald,

Excuse me answering for busy Al.

Al uses the full 81 bars from NYSE open to Globex 4:15pm ET close. For all EMAs and market close – ie up to bar 81.

Thank you!

Hey Al –

When you mention that price will move sideways “near the moving average,” which moving average do you specifically mean?

I use the 20 bar exponential moving average, but it will test many others as well. The market will try to move from expensive back to something of an average price.