Posted 7:07 a.m.

The Emini traded below yesterday’s low, creating the pullback on the daily chart. The odds are that it will be bought and be followed by a 1 – 3 day rally to above the March high, and then have a trading range. What we do not yet know is how far below yesterday’s low the Emini will go today, and whether the pullback will last for only an hour or two, or for a couple of days.

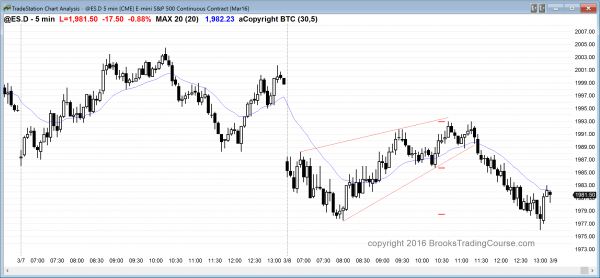

The day began with a limit order market. Swing traders are looking for a stop entry up or down where there is a good signal bar. If they do not get it, they will then wait for a strong breakout. Until either comes they will scalp. The bears are hoping for a wedge bear flag at the moving average, and the bulls are hoping for a major trend reversal. This trading range might last 1 – 2 hours before day traders will begin swing trading.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade a buy climax pullback

The Emini is still overbought on the daily chart, and the odds are that today will trade below yesterday’s low. However, nothing has changed from my weekend post when I wrote that the 1st pullback probably will be bought within a day or two and then the rally would resume for at least a few days. Once the rally goes above Friday’s high, a downturn from there would set up a Low 4 sell signal, like in October. Like I said then, at least a TBTL Ten Bar, Two Leg correction was likely. The same is true here as well.

Will that correction be the start of the move below the 2 year trading range? Probably not, because in a trading range, every rally looks like it will be followed by a breakout to a new high (like the current rally, the October rally, and all of the other rallies), and every selloff looks like the start of a bear breakout. One will succeed, but betting on any one before there is a breakout is a low probability bet.

In the meantime, smart traders will by bear breakout attempts when they are near the bottom of the 2 year range, and sell bull breakout attempts near the top. The Emini is getting near the top and one more new high after a brief pullback will make the bears begin to sell again.

The Emini is down about 9 points in the Globex session and just above the day session low. There is a 70% chance that today will trade below yesterday’s low, creating a pullback. With the rally in February being as strong as it was, and the current 5 day bull micro channel having so many strong bull bars, the odds are that the move below yesterday’s low will be a 20 – 30 point pullback and it will then be bought.

It is possible that this 5 day rally is an exhaustive end of the February rally and a lower high in the daily bear trend. If the bears start to get a series of consecutive big bear bars, then traders will see last week’s bull breakout as a failure, and they will sell.

It is more likely that this selloff will be bought and that there will be one more new high, just like the October 30 pullback was bought. Traders will then be more aggressive about selling any reversal down because it would be a Low 4 (actually a Low 5 variant) sell signal, which has a 70% chance of at least a TBTL correction.

Forex: Best trading strategies

I wrote last week that the EURUSD would probably enter a trading range that would last a couple of weeks after the February sell climax. I also said that the minimum target for the 1st leg up was a 200 pip rally that would test the February 26 high, which was final sell climax. The EURUSD tested it on Friday and again at the start of the European session last night. This created a micro double top on the daily chart and a double top on the 60 minute chart. While it is possible that the EURUSD falls below the neck line at 1.0940 and then for a measured move down, both legs up in the double top were strong and that makes it more likely that any selloff today or tomorrow will be bought. This could create a triangle on the 60 minute and 240 minute charts.

In any case, the rally on the 240 minute chart broke strongly enough above the February bear channel so that there is a 60% chance that the first selloff back to the February low will be bought and then followed by a Major Trend Reversal buy signal and a 2nd leg sideways to up. This would create a trading range on the daily chart, which currently is likely to form and last at least a couple of weeks.

If there is a test of the bottom of the February low and then a Major Trend Reversal buy signal, it could come from either a higher or lower low. Since the rally has been strong and covered 200 pips, the odds are that the bulls will buy the selloff before it fell below the February low. However, the Major Trend Reversal would be just as valid if it came from a new low.

Less likely, this rally will be just another lower high in the bear trend of the daily and weekly charts, and it will fall below the December low without a bounce. Also unlikely, the EURUSD will keep going up to the February high without a Major Trend Reversal on the 240 minute chart.

The EURUSD is deciding if the 5 day rally has gone far enough to create a top of what will be a 2 week trading range. If it goes higher, it probably will not go much above a 50% retracement of the February bear trend before testing back down. That is the 1.1100 level, or about 100 pips above the current price. It has been in a 40 pip trading range for 24 hours.

It might have one more leg up for about a measured move before it tests down, but the odds favor a test down to maybe a 50% pullback to 1.0900 to 1.0950 over the next week or so. At that point, the odds favor the bulls coming in and forming a higher low for a 2nd leg up on the 240 minute chart.

Day traders have been scalping for 10 pips for the past 24 hours and will continue to do so until there is a strong breakout up or down.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini finally had a pullback on the daily chart. Today was a trading range day.

The pullback on the daily chart will probably only last a day or two before the bulls come back and push the market above Friday’s high. Once there, the bears will try to create a Low 4 sell setup for a TBTL pullback on the daily chart. Less likely, Friday’s high will be the end of the rally, and the Emini will trade down to the February low.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.