Posted 7:00 a.m.

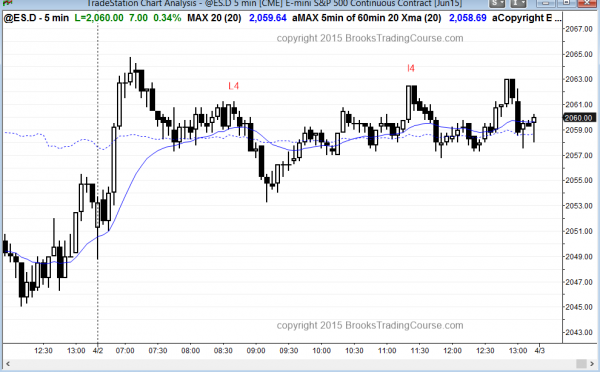

The bulls had a breakout above yesterday’s trading range and strong follow-through. This reaffirms the always in long condition. The breakout is big enough so the there probably will be buyers below for at least one more leg up. With so much time spent sideways over the past week, this breakout might be followed by a trading range that can last for hours.

Can this breakout fail? With the bars as big as they are, the bears will probably need a 2nd entry short to reverse this bull breakout. Alternatively, they can create an endless pullback that breaks to the downside after 20 or more bars. More likely, there will be follow-through buying after any pullback. The breakout is big enough so the it will probably be followed by some kind of measured move up at some point today.

Traders have to be open to the possibility that the market can reverse abruptly, but this is unlikely. If the bears are able to create an strong reversal down with follow-through, then traders will be willing to swing trade shorts. Until then, bears will only scalp, and it is too early for that at the moment.

My thoughts before the open: Broad bull channel testing the bull trendline

The Emini has been in an 80 point trading range for 2 months, and that range is within the upper half of a 150 point tall, 6 month trading range. The market is testing the bottom of the smaller, upper range. Even though the monthly chart is exceptionally overbought, the odds still favor higher prices since most trend reversals fail. However, one of these attempts to reverse the bull trend on the daily chart will succeed. The probability of lower prices will only go up after a strong bear breakout, which has not yet happened.

The market is closed tomorrow and tomorrow has the monthly unemployment report. Since surprises are common, there might be a gap up or down on Monday. Although the bears might succeed in creating a bear breakout today, breakouts usually fail, and the odds are that today will be a quiet day and mostly sideways, like yesterday, going into tomorrow’s report. The range still might be big enough for swing trading, but traders learning how to trade the markets should look at the past several days. They will see that traders have been quick to take profits. Traders need to be careful to not buy strong bull legs near the top of the range or sell strong bear legs near the bottom. Skilled traders are doing the opposite, and they will only trade breakouts after they see a strong one with follow-through. Until then, they will look to buy low, sell, high, and mostly scalp.

Summary of today’s price action and what to expect tomorrow

After a brief, strong rally on the open, the day stayed always in long, but formed a trading range day.

The market is closed tomorrow, but it is also the unemployment report day. This could lead to a gap up or down on Monday. Today was another trading range day where bears were selling the close of every strong bull trend bar and bulls were buying the close of every strong bear bar. Day traders were buying low, selling high, and scalping.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.