House and Senate Congressional elections causing stock market breakout

Updated 6:43 a.m.

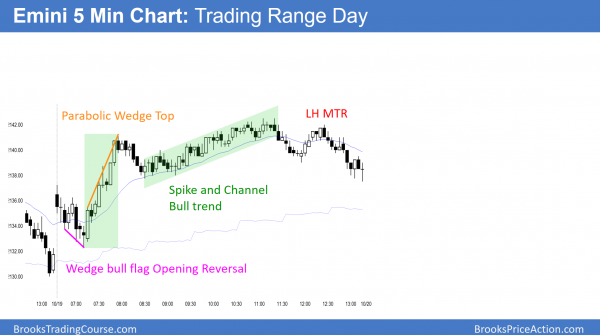

The Emini opened within yesterday’s 3 hour tight trading range, and the 1st bar had tails up and down. This initial trading range price action therefore increases the odds that today will be mostly a trading range day. While yesterday is a sell signal bar on the daily charts, the bears need a strong breakout below. This open reduces the chances of that. The bulls need a strong breakout above yesterday’s high. The odds of that are also small.

If today becomes a trend day, it will probably be a weak trend day, like a trending trading range day or a broad channel. Furthermore, it will probably have a lot of trading range price action. Yet, if there is a strong breakout in either direction, or if it begins to form gaps, traders will assume that in fact it is trending. More likely, it will have at least one swing up and one swing down. Therefore, today is likely to be mostly a trading range day. Hence, there will probably be a lot of limit order scalping.

Pre-Open Market Analysis

While yesterday was up on the day, it stalled at the daily moving average. Furthermore, the bulls were unable to keep the gap open. In addition, yesterday is now a Low 2 sell signal bar just below the moving average. Therefore, if today trades below yesterday’s low, that will trigger another sell signal. Yet, because the Emini has been in a tight range for months, stop entries have low probability.

Because the gap down to the July 2015 H of 2084.50 has a 60% chance of closing before there is a new high, traders have to be ready for a 2 – 5 day 50 – 80 point selloff. Yesterday was a 5 minute version of what I have been writing about for weeks in my weekend blog. When there is a major trend reversal that where the signal is within a tight trading range, and there is a double top in that range, there is a 40% chance of 2 legs down. Furthermore, the 2nd leg down is often much bigger than what appears likely. Therefore, traders have to be ready for a quick move down on the daily chart to the 2040 – 2060 area. Bulls usually buy the selloff and this leads to a sharp rally. Therefore, there might be a brief buying opportunity within a week or two.

The Election

While Trump has little chance of winning, the House and Senate are uncertain. Hence, if the certainty increases before the election, there can be a fast, big move up or down in the next few weeks. Until it comes, traders will continue to bet that most days will be trading range days. Therefore, they will look for at least one swing up and one swing down every day.

Overnight Emini Globex session

The Emini is up 4 points in the Globex session. While yesterday was a good sell signal bar with good context for the bears (Low 2 bear flag below the moving average), the bears need a strong entry bar today. Furthermore, the then need strong bear follow-through over the next few days. Because the Emini is at the bottom of a trading range, the probability is that it will continue in the range. Hence, there are probably more buyers below yesterday’s low than sellers. Because the setup and context are good for the bears, traders will be ready for a bear trend day, even though the odds are against it.

Forex: Best trading strategies

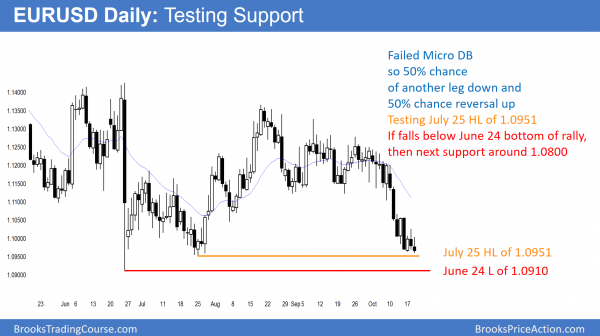

The daily chart of the EURUSD formed a Micro Double Bottom 2 days ago, yet turned down from a Micro Double Top bear flag yesterday. It is testing the July 25 low.

The bulls tried to create a higher low major trend reversal yesterday on the 60 minute chart. Yet, they were unable to create a strong breakout. Furthermore, the rallies on October 13 and 17 were weak compared to the selloffs before and after them. Hence, the odds of a reversal are less. In addition, the odds of a strong bull trend are even less. Yet, the bears have been unable to get a breakout below the July 25 higher low. Because this is support, the bulls will try to create a credible bottom. Since they have been failing, the EURUSD will probably fall below the July 25 low of 1.0951 before the bulls will try again.

While there is little doubt about the presidential election, the House and Senate are uncertain. If the outcome becomes clearer before the election, there could be a big move in all financial markets. Furthermore, it can be up or down. The EURUSD monthly chart might finally break below its 2 year bear flag. Yet, the probability is the same for a sharp reversal up on the weekly chart.

Until there is a strong breakout, most days will continue to be small. Furthermore, most day traders will continue to mostly scalp.

Overnight Forex session

The daily chart tried to reverse up from a Micro Double bottom 2 days ago, just above the July 25 low. Yet, yesterday reversed down from a Double Top Bear Flag instead. The location is great for the bulls. With a stop below the June 24, their risk is small. They are looking for a test of the September trading range low, 150 pips above. As a result, they have great risk/reward. Hence, traders know that the bears have higher probability and worse risk reward.

The overnight selloff was only 35 pips, and therefore weak. Since there was a bottom attempt 2 days ago and it failed, there is a 50% chance that the bear breakout will fail. Therefore, the bulls will try to create a bull reversal bar today or tomorrow on the daily chart. If the bulls succeed, they will have a low risk, big reward buy setup.

Yet, if the bears break strongly below the July and June lows, then the EURUSD will test the next support. That is around 1.0800.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After a wedge bottom opening reversal rally, the Emini formed a Parabolic Wedge top. Instead of a reversal, the selloff became a pullback, and led to a bull channel. Yet, the bulls were unable to break above Friday’s high. As a result, there was a small reversal down. The day ended with a Lower High Major Trend Reversal and small leg down.

Today was a quiet day. While it traded above yesterday’s high, it is still stalled at the daily moving average. Furthermore, it is another Low 2 sell signal bar going into tomorrow. The bulls need a strong breakout above this bear flag. Traders will continue to mostly scalp until there is a strong breakout up or down.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.