FOMC report created failed bear flag

I will update around 6:50 a.m.

The Emini had a big gap up after yesterday’s buy climax. While it still might rally for about 10 bars in the 1st 2 hours, the odds are that by the end of the 2nd hour, it will have at least a couple of hours of sideways to down trading. Then, traders will decide between trend resumption up or trend reversal down at the end of the day.

While it is possible that it forms an early high of the day and forms a bear trend, there is only a 20% chance it will close the gap above yesterday’s high. Yesterday was so strong that the odds are that the best the bears will probably get is a trading range. If today is a bull trend day, it will probably be in a channel and therefore be much weaker than yesterday.

The Emini is Always In Long at the moment. If the bears can create an early micro double top, they might be able to stop the bulls for a couple of hours. That would be the 2 hours of sideways to down trading that I have discussed.

Pre-Open Market Analysis

The Emini failed to get a bear breakout yesterday and reversed up. The odds therefore now favor a test of the all-time high before closing the gap above the July 2015 trading range high. If today gaps up, the gap would therefore create a 3 week island bottom. As a result, if the bulls are able to keep the gap open for 2 – 3 days, the odds are that the Emini will rally to a new high within a week or two.

Yet, the odds also are that the gap above the 2 year trading range will close before the Emini can rally much higher. Hence, if the Emini makes a new high, traders will watch for a reversal down. That would be a wedge top above a 2 year Final Bull Flag. The minimum target is the closure of that gap at 2084.50.

Emini Globex session

As I mentioned yesterday, the bull breakout of the bear flag on the daily chart was so strong that today might gap up. The Emini is up 8 points in the Globex session. It will therefore probably gap up and create a 3 week island bottom.

Because yesterday had climactic buying, there is a 50% chance of follow-through buying in the 1st 2 hours today. Yet, there is only a 25% chance that today will trend strongly up all day. Hence, traders expect a pause. There is a 75% chance of at least a 2 hour sideways to down move that starts by the end of the 2nd hour.

The odds are that this rally will test the all-time high. Yet, the Emini will probably have a difficult time going much above that high. The gap above the 2 year trading range is too strong of a magnet this late in a bull trend. The Emini therefore still has a 70% chance of testing below 2084.50 before it can go much above 2200.

Forex: Best trading strategies

The EUERUSD 240 minute chart reversed up yesterday from a Double Bottom (DB) at the neck line of the Head and Shoulders Top. The rally is strong enough so that bulls will buy the 1st pullback. The odds are that there will be at least one more leg up. Yet, the rally is still part of a trading range, and not yet the start of a bull trend.

The daily EURUSD chart yesterday formed a bull trend bar and a Micro Double Bottom. Since it also has a double bottom with the August 31 low, it is a nested pattern. Hence, the probability of a bounce is higher. Furthermore, it is at the bottom of a 3 week trading range. The odds are that it will rally over the next few days.

Yet, if it breaks below yesterday’s low, it could quickly fall for a measured move down. Since most tops fail and the daily chart has nested Head and Shoulders Tops, the odds are that the chart will go sideways to up, rather than down, for several days.

Overnight EURUSD Globex session

The EURUSD daily chart reversed up strongly yesterday in a double bottom with the August 31 low. That was the neck line of a 2 month Head and Shoulders Top. Since most tops fail, the odds were that this one would as well. Yet, a failed top does not mean a bull trend. It means either a bull trend or a trading range, and a trading range is more common.

The rally continued overnight on the 60 minute chart. Yet, it lacked consecutive big bull bars closing on their highs. While the rally is moderately strong and will probably have a 2nd leg up after the 1st pullback, it looks more like a bull leg in a trading range rather than the start of a bull trend.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

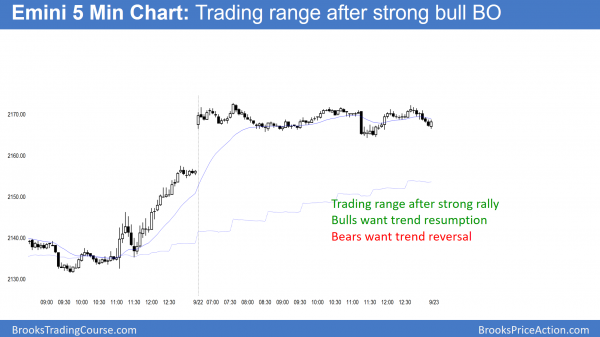

The Emini gapped up and created a 3 week island bottom. Yet, it was a trading range day instead of a strong bull day.

While today’s gap up created an island bottom, the bulls were unable to create follow-through buying after yesterday’s rally. The odds still favor a test of the all-time high. Yet, the Emini will probably fall about 100 points before it gets much above 2200 because of the gap above the July 2015 high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

can you clarify gap of July 2015 comment?

It’s the price between Jun 8 high and Sep 12 low, which was only traded on July 8 during a bull BO, and therefore can be interpreted as a gap.

Hey Al – have a question on valid trend lines. On ESZ6, if I connect the high from August 23rd to the lower high of September 7th, I form a downward trend line that meets today’s high. Is that a valid resistance line?

Yes. However, the top of that TR and the all-time high are more important magnets because they are very close and more computers are interested in the all-time high. I think the TL is minor resistance, and the magnets just above it will pull the market up through the TL.

Thank you.