Published 6:54 a.m.

The Emini began with a trend from the open bear trend. The bears want to get 1 tick below yesterday’s low to trigger the sell signal. Since yesterday was a weak sell signal bar, there will probably be buyers below. The bulls are trying to prevent the sell signal from triggering They want this early selloff to be a sell vacuum test of yesterday’s low, and they hope for a trend up.

At the moment, the Emini is Always In Short. The selloff is strong enough so that the 1st reversal up will probably be minor, which means that it will probably be followed by a test back down. The bears have not done enough yet to convince traders that this will be a big bear trend day. The context on the daily chart is good for the bears because of the micro double top and the double top. However, the tails on the bottoms of the 1st several bars creates uncertainty, and increase the chances of an early trading range. The bulls need a major trend reversal, or a very strong reversal up to convince traders that they have taken control. It is more likely that the best the bulls can get over the next 2 hours is a trading range. A bull trend day is unlikely, but today might be an inside day and trading range day. The bears still might get a bear trend day, but the odds favor a trading range for the next 1 – 2 hours.

Pre-Open Market Analysis

S&P 500 Emini: Failed breakout price action for online day traders

The Emini yesterday got to within 1 point of the April 20 all-time high. I am writing the start of this report before today’s unemployment report. With yesterday’s close just below the all-time high, today could gap up. If so, today could be a trend from the open bull trend day and it could be a breakout on the daily chart The 2 month trading range is 75 points tall. The 1st obvious target for the bulls is a measured move up, which would be to around 2180. The Emini has been in a 300 point trading range for 2 years. The next major target for the bulls would be a 300 point measured move up to around 2400.

Unlike the Emini, which is only 1 point from a new high, the cash index is 29 points below its all-time high of 2134.72 from May 15, 2015. If there was a 30 point rally to the old high and then a reversal down from the double top, the Emini would also reverse down from about 30 points above its all-time high. That makes the 2135 area an important resistance level in the Emini.

Whenever a market looks likely to do something, like gap up today, trader’s always have to be prepared for the opposite. If the opposite occurs and institutions are heavily positioned as bulls, there could be a big selloff tomorrow. It could come from either a gap down, or from a gap up or early rally to a new all-time high that reverses down.

The momentum on the daily and weekly charts is strong, so a bull breakout is more likely that a reversal down. Because the Emini is testing the top of a 2 year trading range and is waiting for a possible Fed interest rate hike in June or July, the context increases the chances of a big move beginning at some point in June or July. The 2 year trading range can continue for many more years. However, the Emini appears to be poised for a 75 point or bigger move up or down, which can start any day.

The report just came out and although the Globex chart reached a new all-time high, before the report, the Emini sold off 10 points on the report. If it opens here, it will be in the middle of yesterday’s range. Even though yesterday was a bull bar, it was a potential micro double top with Tuesday’s high and it is therefore a sell signal bar. If today falls below yesterday’s low, it will be the 2nd sell signal in 3 days, and it will be a lower high double top with the April all-time high. The momentum up is strong on the daily and weekly charts. Yesterday had a bull body and is a weak sell signal bar. The odds still favor a breakout to a new all-time high. However, today’s selloff might be the start of a pullback for a few days before the bulls try again for the new high.

Because this is a failure at the top of the 2 year trading range and the bears got their minimum goal of a micro double top, this might be the start of a reversal down to the middle or bottom of the 2 year trading range. However, with the bull momentum as strong as it has been since February, traders want to see either a stronger top or a strong reversal down for several days before they believe that the odds have shifted in favor of the bears.

It is also too early to tell what today will be like for day traders. It is still possible that this Globex selloff will be bought and the day session might rally to a new all-time high, but that is unlikely because the selloff was strong.

Forex: Best trading strategies

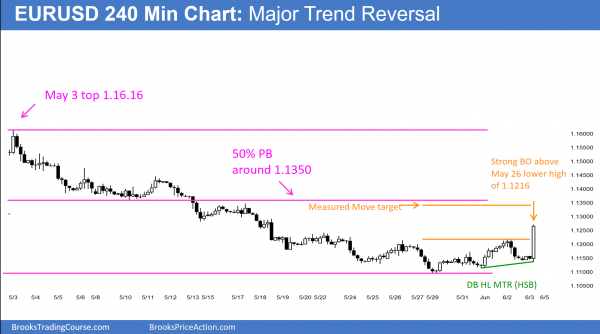

The 240 minute EURUSD Forex chart is beginning the strong bull breakout that I have mentioned over the past week.

I am writing the start of this report before the unemployment report and the EURUSD Forex chart will probably be very different after the report is released at 5:30 a.m. today. The bears see a small double top bear flag with the May 26 lower high. It is at the moving average, and yesterday was a good sell signal bar. However, it is forming after 5 consecutive sell climaxes and at the bottom of the bull channel that began on March 16.

This is a buy zone. The odds favor a rally lasting a couple of weeks and about 200 points. There is no credible bottom yet. However, after 5 consecutive sell climaxes, the odds of a sustained move down without at least a 2 week pullback are less than 40%. It is much more likely that there will be a 2 legged rally that lasts a couple of legs and covers 200 points. There might be one more push down 1st to test the March 16 low, but the odds favor a rally within a week or so.

Because the 4 week selloff from the March 3 high has been in a tight channel, any rally would probably be a minor reversal, which means a bull leg in a trading range. This means that bulls will sell out of longs and bears will short at resistance. A common target is a 50% pullback. Since the 2 month range is about 400 pips tall, the target would be about 200 points above the low, whether the low formed last week or will form in the next week.

I have written several times about the May 13 gap, which is the space between the May 10 low and the May 17 high. The EURUSD Forex chart reached the measured move target last week at around 1.1100. May 18 was another big bear breakout. The pullback on May 23 did not overlap the breakout point, which was the May 13 low. This gap might be a measuring gap. The measured move down from the May 3 high to the May 13 low projects down to 1.0950. A measured move based on the middle of the gap projects down 30 pips lower. Both are still above the March 10 low of 1.0821.

The reason I do not think the EURUSD Forex chart will fall to these levels without first having a 10 day rally is because there have been 5 consecutive sell climaxes. That is fairly extreme. When the EURUSD does something extremely bearish, it tends to run out of sellers and has to go higher to find more sellers. Five sell climaxes usually makes the odds favor a bear rally. However, if there is a strong bear breakout after today’s report, traders will begin to look at May 18 as another measuring gap.

The report just came out and the EURUSD Forex chart rallied over 100 pips. This is a very strong breakout and it increases the chances that the rally will continue up to the target area around 1.1350 over the next 2 weeks.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

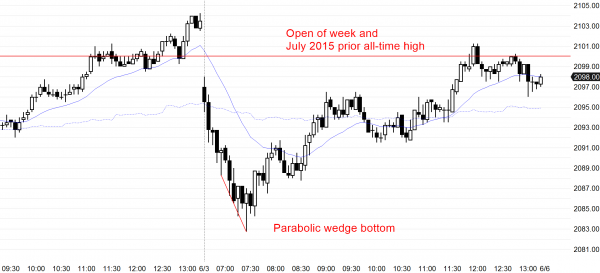

The Emini sold off on the open to below yesterday’s, but reversed up from a parabolic wedge and formed a reversal day.

The early selloff was a test of yesterday’s low. By going below yesterday’s low, the Emini triggered a 2nd entry sell signal. It formed a micro double top with Tuesday’s high and a double top with the April high. However, yesterday was a big bull bar so the odds were that there would be buyers below. The Emini will probably reach a new all-time high next week. It is too early to know if the breakout will be strong or weak. Even though the Emini is at its all-time high, the cash index is about 30 points below its high. There will probably be profit taking there, which means that there will be some selling 30 points higher in the Emini. The next resistance above that is a measured move based on the height of the 2 month trading range, which is about 75 points tall.

The Emini is in a tight trading range. It could gap up to a new all-time high, or gap down and form an island top. If there is a gap on Monday, the odds favor the bulls.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al, I have a persistent problem. I have difficulty deciding in real time, when a reversal is JUST A PULLBACK or a change in trend. How do you decide the difference?

Hi Henry,

You are asking the $64 million question. If we knew that we would all be insanely rich, right? Not going to happen which is why we are using price action to trade. You just need more time to read the live market so do not give up.

To answer question, you must review what has happened to the left of pullback, ie the market context. Is the PB at support/resistance? At a measured move? At extreme of 2 legs up/down? etc… And if yes, has PB broken a trendline- and if so, allow for possible retest of extreme before going in on possible MTR setup.

So to decide difference you watch what happens and wait for the appropriate setup. Maybe a MTR, maybe a High 1 in a strong bull trend, or High 2. The PB itself can also be a Breakout PB trade of course. Again, context will tell you if that is probable.

Assess the probability of what you think will happen and take the trade for scalp or swing along with correct stop. And if no setup do not trade. Wait.

See Al’s video on ‘Best Trades’ to help see differences between reversals and breakouts. And keep studying the whole course to build your skills to see all this real-time. That’s what the course is all about. 🙂

Hope that helps.

Richard

Gee thankyou Richard. A great response. I agree completely with your answer.

I guess like everyone I wish for a magic bullet, but Al has made it crystal clear why there “Cant” ever be a magic bullet. I understand that.

What I have grown to understand in my trading is……”the speed of the moves and the range that accompanies that speed has “unsettled me”. I am learning to cope with that and took Als advice in times of great speed and volatility, I reduce the size of my trade.

Again thankyou for a comprehensive response

Henry

Hi Al,

Yesterday closed on its high and HOY was above Wed.s high, therefore H1 long was triggered on daily chart. Then why yesterday was a weak sell signal bar? is it because yesterday made a ATH?

Thanks a lot.

Yesterday formed a micro double top with the Tues high, and a double top with the April high. Tues was a sell entry bar when it fell below the low of the prior day. Today falling below yesterday’s low was a 2nd entry for the bears. However, yesterday was a strong bull day, which is a weak sell signal bar.

I agree that yesterday was a High 1 entry bar, but the market often has opposite signals at the same time.