Emini and Forex Trading Update:

Monday March 22, 2021

Pre-Open market analysis of daily chart

- Weekly double top sell signal bar on weekly chart. But prominent tail below bar, tight bull channel, and 4,000 magnet above so probably minor reversal.

- Daily chart has High 1 bull flag pullback to 20-day EMA, and 3,900 Big Round Number, but there is a small bear body so this is a weak buy setup.

- Final week of strong 1st quarter, so might see higher prices from institutions trying to make their portfolios look good for quarterly reports (window dressing).

Overnight Emini Globex trading on 5-minute chart

- Emini up 10 points in Globex session.

- Friday was a trading range day that closed almost at the open. It was therefore neutral.

- 3-day pullback after a strong rally typically attracts buyers. The bulls want to break above Friday’s high, to trigger the High 1 buy signal on the daily chart, and resume the 3-week bull trend.

- Bears want to break below last week’s low, which was Friday’s low, to trigger weekly sell signal.

- Most days for the past 10 days had at least one swing up and one swing down. Day traders will expect at least one reversal after the 1st 1- to 3-hour trend.

- If there is a series of strong trend bars in the 1st hour in either direction, there will be an increased chance of a trend day. At the start of the day, day traders will expect another mostly sideways day.

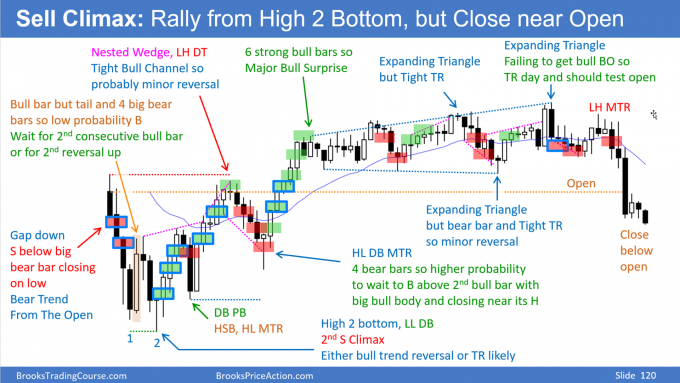

Friday’s Emini setups

Because I often get questions about what subscribers to Daily Setups see, today I am including the example below of that version.

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

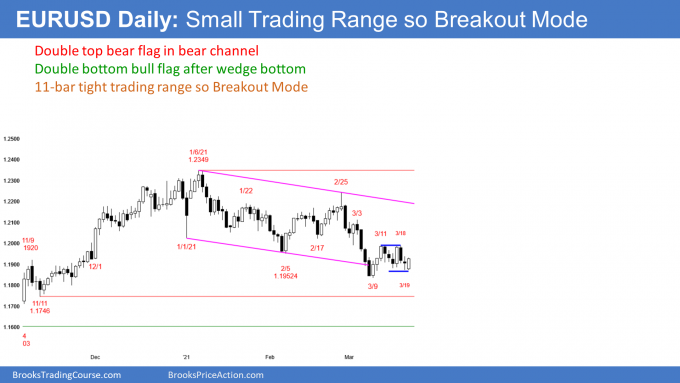

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- Turning up from double bottom bull flag after 3-month wedge bottom. Oversold and bulls expect test of March 3 sell climax high.

- Today is pullback from small double top bear flag in 3-month bear channel. The November 4 low is the bottom of the final leg up in last year’s wedge top on the weekly chart, and therefore a magnet below.

- Credible buy and sell setups so Breakout Mode. That means there is about a 50% chance of a 100-pip measured move up, and a 50% chance of a 100-pip measured move down

Overnight EURUSD Forex trading on 5-minute chart

- Reversed up from just above Friday’s low over past 3 hours. Rally has been strong enough so day traders have only been buying.

- Range is almost as big as average range of past 3-weeks, and therefore might not continue much higher.

- If there is a 20-pip pullback, day traders will switch to trading range mode. That means they will buy reversals up, sell reversals down, and scalp for 10 pips.

- Bulls want today to close near its high so that it will be a strong buy signal bar for a double bottom on the daily chart. That would increase the chance of a rally over the next couple weeks.

- Bears want today to close near its low, but that is unlikely. Instead, they would like it to close back in the middle of the range. That would increase the chance of a sideways day tomorrow, and lower prices later in the week.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

I will post chart after the close.

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

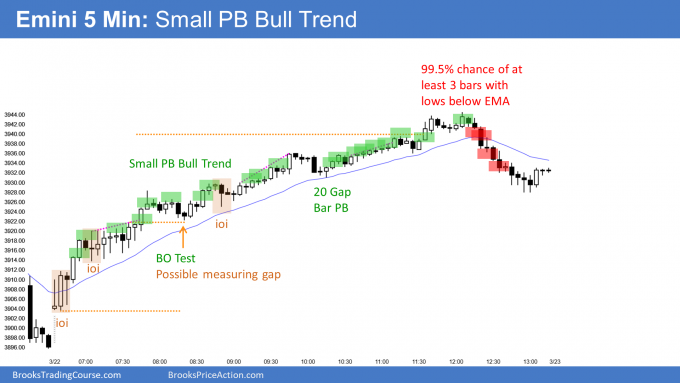

End of day summary

- Began as weak Small Pullback Bull Trend, but became strong after 2nd hour. Even then, there was a 99.5% chance of at least 3 bars with lows below EMA late in day, and it happened today.

- Since buy climax day on 5-minute chart, there is 75% chance of at least a couple hours of sideways to down trading beginning by end of 2nd hour tomorrow.

- Triggered High 1 bull flag buy signal on daily chart by going above Friday’s high.

- At resistance of 50% pullback from last week’s selloff, 3,950 Big Round Number, and middle of 2-week trading range so might stall tomorrow, especially after exhaustive rally today.

- Might get enough end-of-quarter window dressing to hit 4,00 before end of March.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time (the Emini day session opens at 6:30 am PT, and closes at 1:15 pm PT). You can read background information on the intraday market reports on the Market Update page.

Like the recent change to bullitt points — easier to read.