Emini weak sell signal bar ahead of FOMC meeting next week

I will update again at the end of the day

Pre-Open market analysis

The Emini sold off yesterday after Wedesday’s buy climax, but it reversed back up late in the day. Since it has a bear body, it is a sell signal bar on the daily chart. However, it is only a bear doji bar, which is a weak sell setup. Furthermore, after 4 bull days, the Emini will probably not fall far today. The Emini might begin to go sideways into Wednesday’s FOMC meeting.

Overnight Emini Globex trading

The Emini is down 8 points in the Globex market. The past several days on the daily chart are important for today. A big bull trend day is unlikely today after a bear doji day yesterday and a buy climax Wednesday. Also, a big bear day is unlikely after a bear doji and 4 bull days.

In addition, yesterday was mostly a trading range day, which increases the chance of a trading range day today. Finally, with the uncertainty of Wednesday’s FOMC announcement, the Emini will probably go sideways for the next few days.

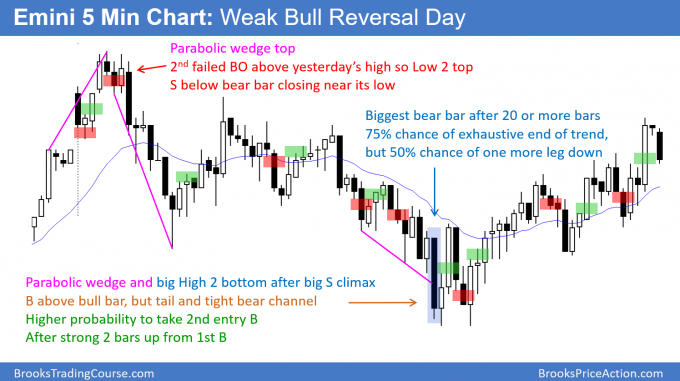

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

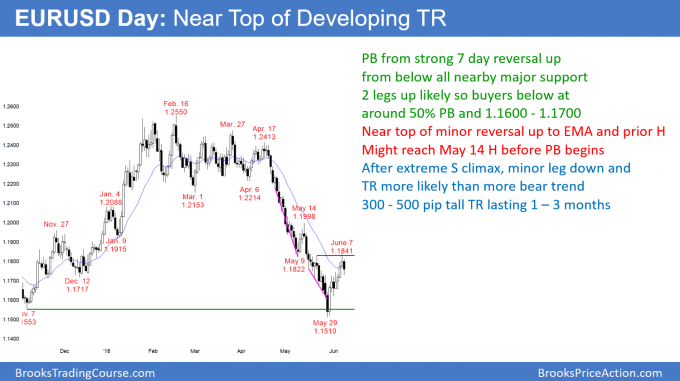

EURUSD Forex double top in trading range after sell climax

The EURUSD daily Forex chart sold off over the past 2 days at the 20 day EMA after breaking slightly above the May 9 high. Since the 8 day rally was strong and it followed a sell climax, a 2nd leg sideways to up is likely after a test down. And, so is a trading range for at least a month.

The EURUSD daily Forex chart traded to below yesterday’s low today. The 8 day rally was strong, but it is stalling at resistance. It broke slightly above the 20 day EMA and the May 22 lower high. However, a Big Up move after a Big Down move creates Big Confusion.

When traders become less certain, they take quick profits. In addition, they prefer only to sell high and buy low. This creates a trading range. Consequently, this rally is a bull leg in a trading range. Therefore, there will soon be a bear leg, and then at least one more bull leg.

This process will take at least 1 – 2 months. The bulls are now probing to find the top of the 1st leg up. Yesterday’s high is a reasonable candidate, but so is the May 14 major lower high just below the 1.20 Big Round Number.

While today is trading below yesterday’s low, yesterday had a bull body. That is a weak sell signal bar. In addition, the 8 day rally was in a tight bull channel. The bears will probably need at least a micro double top to end the 1st leg up.

Therefore there are probably more buyers than sellers below yesterday’s low. However, many buyers will prefer to buy around a 50% pullback. In any case, the odds are that today’s selloff will probably not last more than a few days. For example, the market might go sideways into Wednesday’s FOMC meeting.

Just as there are probably buyers below yesterday’s low, there are probably sellers above its high. At a minimum, today is the start of a few sideways days, but it might be the end of the 1st leg up.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart sold off 70 pips overnight and 110 pips from yesterday’s high. Since this is following a strong 7 day rally and it is already fairly big, there will probably not be much more selling today. The odds are that the 5 minute chart will continue the trading range that began 3 hours ago.

In addition, after a sell climax on the daily chart and a buy climax on the 60 minute chart, the 5 minute chart will probably be in a trading range for a few days. Therefore, day traders will mostly scalp for 10 – 20 pips.

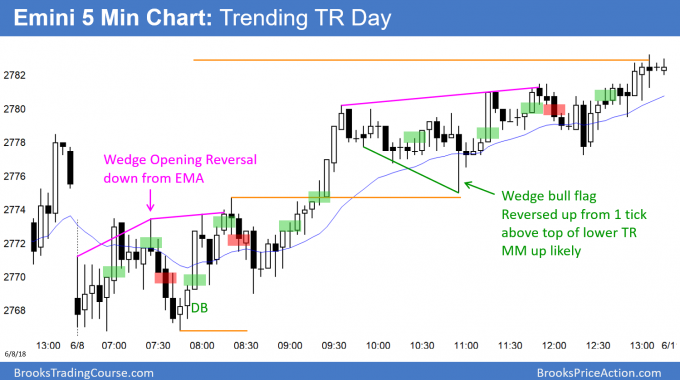

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a trending trading range today and it closed near its high.

The Emini today spend most of its time in trading ranges, despite the brief mid-day bull breakout and the close near the high. The rally might stall around 2800 ahead of Tuesday’s North Korean summit and Wednesday’s FOMC announcement. However, the bull trend has resumed on the daily and weekly charts.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.