Posted 7:00 a.m.

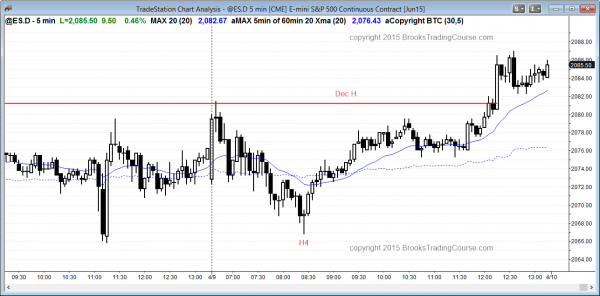

The Emini had a big bull trend bar on the open, but the breakout above yesterday’s high failed. The reversal down lacked strong follow-through selling. This is trading range price action and it formed after yesterday’s trading range day and in a 3 day trading range at the top of a month long trading range.

The bulls are hoping for a double bottom. The bears will hope that any rally forms a double top. Until there is a strong breakout with strong follow-though, day traders will be hesitant to swing trade. Instead, they will look to buy low, sell high, and scalp.

My thoughts before the open: Trading range for day traders

Yesterday had big swings, but it was still a trading range day. The market is now at the top of the month long trading range. Because yesterday reversed up strongly twice from below the low of the day before and that daily candle was low 2 sell signal on the daily chart, the odds of some follow-through buying are greater. This is especially true because the 2nd bull reversal was so strong.

However, there is no breakout above the top of the trading range, and most breakouts fail. The bulls are hoping that the double bottom bull flag on the daily chart leads to a bull breakout. Trading ranges usually have very strong rallies near the top and selloffs near the bottom. This is due to the vacuum effect and it does not increase the chances of a breakout. Until there is a breakout, there is no breakout, and the odds favor every attempt failing.

If the bulls continue to be unable to break strongly above the trading range, the Emini will test down again. The bears will hope that the double top lower high major trend reversal results in a successful bear breakout.

Traders learning how to trade the markets should know that because yesterday was a trading range day, the odds are that today will be as well. This is especially true since the momentum up was strong, but the market is at the top of the month long trading range. The bulls and bears are balanced at the moment.

Summary of today’s price action and what to expect tomorrow

The Emini had a broad bear channel where the breakouts had bad follow-through. It reversed up from a high 4 buy signal and trended up for the rest of the day, closing above the December high resistance.

The bulls are trying for trend resumption up after their strong reversal up yesterday from below the low of the day before. By breaking above the December high and the 60 minute double top, the bulls are hoping for a measured move up to a new all time high. The bears hope that today’s breakout above the month long double top will fail. Today was the third push up. A failed breakout above a double top is a variation of a wedge top.

The bulls want any reversal to be a pullback that is followed by trend resumption up. The 60 minute follow through bar at the end of today was weak and it increases the chances that any continued rally will be a bull leg in a trading range rather than in a strong bull trend. It is too early to know which side will win. However, the current top on all of the higher time frames is not strong. If the market goes to a new all time high and then reverses, the reversal has the potential to create a strong wedge top. If this happens, that would give bears more confidence that the top for the next several months is in.

For tomorrow, the bulls are hoping for follow-through buying and the bears want today’s breakout to fail.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.