Posted 6:58 a.m.

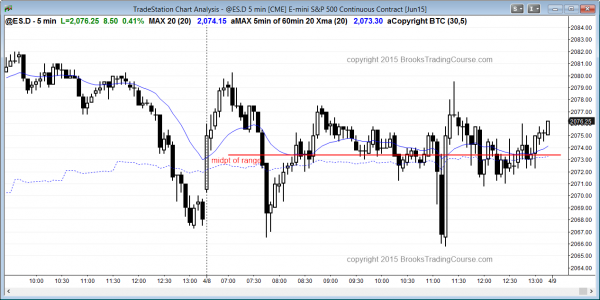

The Emini opened with a strong reversal up. However, because there was no clear bottom, like a major trend reversal or a wedge, the odds are that the bulls will need a pullback to form a higher low major trend reversal before they can go much higher.

The Emini is always in long and bulls will buy a 5 – 10 bar pullback, both for a swing and for a scalp. The bears have been able to make a couple scalps today. This increases the chances of a pullback soon. Skilled bears will sell above bars and use wide stops for scalps. It is too early for stop entries and swing trades for the bears. Most bulls should wait for a 5 – 10 bar pullback to buy. If the pullback is strong, bulls will be disappointed and they will more likely scalp, and the market will then more likely enter a trading range. If there is not much selling pressure, the odds of trend resumption up from Monday’s rally are greater. Because this reversal up does not have strong bottom, the odds are that the market will go sideways for at least an hour or two. While it is possible for a big bull trend, like Monday, after yesterday’s big selloff, a trading range is likely to form soon.

The bears are hoping for one more small push up and then a parabolic wedge top, followed by a big reversal down. It is better for them to wait to see the strong reversal down before considering swing trading.

My thoughts before the open: Still contained by support and resistance

The Emini reversed up strongly on Monday from the bottom of its month long trading range, but had bad follow-through yesterday, which is more trading range behavior. There is still a double bottom and double top within the range, and the daily chart is still in breakout mode. Although the weekly and daily tops would have a better wedge shape if there was a bull breakout and then a reversal down, it is possible that the top for the next many months is already in.

The monthly ioi sell signal has not triggered because April is still holding above March’s low. The odds of a new high are slightly higher than those for the downside breakout and a swing down on the daily and weekly charts because the bull trend is still intact, but the more bars that get added to the trading range, the more the probability falls to 50% for the bulls and bears.

As big as yesterday’s bear reversal was, it was small compared to Monday’s bull reversal. This means that it is more likely a pullback from Monday’s bull trend reversal. The Emini has had many strong bull trend reversals from support on the daily chart. Each had strong follow-through buying. The Emini is much later in its trend and therefore closer to forming a trading range on the monthly chart and a bear trend on the daily chart.

However, as long as it keeps forming higher highs and lows on the higher time frames, it does not matter that the trend is becoming more two-sided. The bull trend is still intact. Yes, the monthly chart is extremely overbought, but the bulls continue to win. Traders learning how to trade the market should see this price action as an example of the 80 – 20 rule…80% of trend reversal attempts in bull trends fail and become bull flags.

On the 5 minute chart, day traders have to decide whether yesterday was a pullback from a bull trend reversal on Monday or simply a buy vacuum test of resistance at the top of the month long trading range. At the moment, the bull case is stronger, but until there is a breakout, there is no breakout, and the Emini can have many very strong legs up and down.

If this is going to be a successful breakout above the double top, the bulls need bull trend resumption today or tomorrow and a breakout above the top of the trading range at the December high. This could create a strong swing trade today. If they fail to do that, the market will then again test the bottom of the range over the next week or so for a possible swing trade down.

In strong bull trends, pullbacks often last for a day or two, but usually not much longer. Because of the big up and big down of the past two days, traders might be inclined expect a trading range day, which would make them more likely to scalp today. The bulls need trend resumption today or tomorrow, or traders will assume that the trading range will continue, and that Monday was meaningless.

Summary of today’s price action and what to expect tomorrow

Today had several big swings up and down, but was a trading range day. It twice triggered a short on the daily chart by falling below yesterday’s low, but reversed up strongly both times.

Yesterday was a low 2 sell signal bar on the daily chart. It triggered twice today, but reversed up sharply both times. This is bullish, but the Emini is at the top of a month long trading range, and until there is a breakout, the odds are against the bull breakout.

The 2nd reversal up today from below yesterday’s low was extremely strong. This increases the chances of follow-through buying tomorrow.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

The chart is from Al’s weekend update, not today’s e-mini.

I fixed it.

Thanks!

Al