Posted 6:54 a.m.

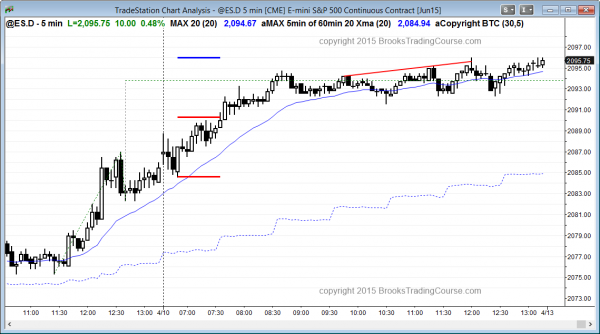

Yesterday ended with a 10 bar tight trading range and today opened with more trading range bars. Although the Emini is always in long and the rally was in a tight channel, the rally contained consecutive buy climaxes. This will tend to limit the upside over the first hour or two. Bulls will prefer to buy a pullback to the bottom of the small trading range, which would be a pullback to the moving average and the December high. They are willing to buy a strong bull breakout, but would prefer to buy a pullback after consecutive buy climaxes.

The bears are hoping that the breakout above yesterday’s high fails and becomes the high of the day. They would prefer a second entry sell signal. Since yesterday’s bull channel was tight, the odds are that the best the bears will get over then first couple of hours is a trading range. If they get that, they will then try to create a major trend reversal and then a trend down.

At the moment, the Emini is always in long, but it is forming a trading range and the bulls prefer to buy a test down. They want to buy an opening reversal up from support, not a breakout without a pullback.

My thoughts before the open: breakout above the double top

Yesterday had a breakout above the double top of the past month and this was good follow-through from Wednesday’s strong reversal up after triggering a sell on the daily chart. The bulls will try to extend the rally today. The bears want the breakout above the double top to fail. If the bears succeed, this would create a type of wedge top since the breakout above the double top is a third push up (the double top created the first two legs up). A reversal down would also be a lower high major trend reversal on the daily chart. February through April is one of the most bullish times of the year, so the seasonal tendency is also good for the bulls.

Today is a Friday so weekly support and resistance is important. Last week’s high is only 2 ticks above the December high of 2081.25, which has been important support and resistance since December.

Summary of today’s price action and what to expect tomorrow

The Emini had persistant follow-through buying after yesterday’s bull breakout, but it then entered a 4 hour tight trading range.

The bulls had a small pullback bull trend day for the first couple of hours, and then the market was exhausted and entered a tight trading range. Traders learning how to trade the markets will correctly see this as climactic behavior. The Emini will probably soon pull back on the 5 minute chart, but the reversal up earlier this week was strong enough so that the Emini will probably test the all-time high soon.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.