Emini technical sell climax after Italy and Euro fears

I will update again at the end of the day

Pre-Open market analysis

The Emini had a sell climax yesterday, but it was more likely based on technical factors than fundamentals. While it weakens the bull’s case, the odds are that the selloff of the past 2 weeks is still a pullback from the rally that began on May 3. The bulls got a strong reversal at the end of the day yesterday. If they can keep this week from falling far below yesterday’s low, the odds continue to favor a move to a new all-time high this summer.

Overnight Emini Globex trading

The Emini is up 8 points in the Globex market. This represents follow-through buying after yesterday’s late bull trend reversal. Since yesterday had a sell-climax, there is a 50% chance of a sell-off in the 1st 2 hours today. However, the late rally was strong, and the daily chart is still in a bull trend. The odds are against a big bear day today. But, if there are consecutive big early bear bars, bearish day traders will look to swing trade their shorts.

A sell climax has a 75% chance of sideways to up trading trading that begins by the 2nd hour of the next day. It probably began late yesterday. Therefore, the odds favor a sideways to up day.

Yesterday’s setups

I did not trade yesterday, so no setups chart posted.

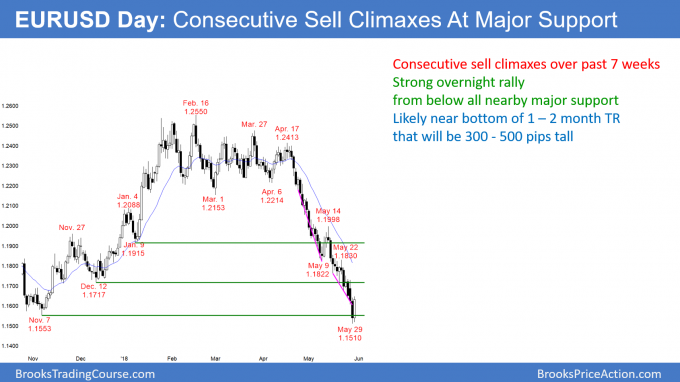

EURUSD climactic reversal at major support

The EURUSD daily Forex chart collapsed in a series of sell climaxes to major support at the November low and the 1.1500 Big Round Number. It reversed up strongly overnight. Strong buying at major support will probably lead to a 2 month trading range with a top between 1.1800 and 1.2000.

The EURUSD has sold off in a series of sell climaxes for 7 weeks. It broke below the November 7 low of 1.1553 yesterday, but reversed up strongly overnight. This probably is the exhaustive end of the selling for the next couple of months.

However, the 7 week bear channel is tight. Therefore the 1st reversal up will be minor, even it it is strong. The bulls will need some type of a double bottom if they are to test the February high. This is unlikely this year. Consequently, any 200 – 500 pip rally over the next couple of months will be a bull leg in a developing trading range. The odds are that it will lead to a test of Monday’s sell climax low.

While the bear trend can continue much further, consecutive sell climaxes down to the lowest nearby support has a 75% chance of leading to a trading range. In addition, the range will last at least half as many bars as the selloff. Therefore, the daily chart will probably be sideways for at least a month, even if there is one more brief new low to below the 1.1500 Big Round Number.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart reversed up 120 pips in a tight bull channel overnight. Yesterday’s Big Down and today’s Big Up creates Big Confusion. The result is a trading range. The bears know that this reversal is at major support and therefore will be unwilling to hold shorts near the overnight low. The bulls know that the bears will sell rallies. They will therefore take profits on rallies and look to buy again on dips.

With both the bulls and bears buying low, selling high, and taking quick profits, a trading range will begin to form. The 2 day range is big enough for day traders to look for 20 – 30 pips scalps. However, the bodies over the past 3 hours are shrinking and the tails are growing. Furthermore, after a climactic reversal, the market often enters a tight trading range. Therefore, day traders might switch to 10 pip scalps early today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini gapped up and rallied in a Small Pullback Bull Trend.

Today was a strong bull trend day. The odds are that it is a resumption of the bull trend that began on May 3. Tomorrow is the last day of the month and therefore monthly support and resistance are important. The bulls want the month to close above the April high. Since the bears want the opposite and the target is only about 10 points down, the Emini might enter a trading range just above, and then decide to close a little bit above or below.

More important, May has been a strong bull bar on the monthly chart. The odds are that the 2017 bull trend is resuming and that there will be a new high within a few months.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.