Emini sideways ahead of North Korean summit and FOMC

I will update again at the end of the day

Pre-Open market analysis

The Emini rallied for 2 weeks and broke above a 3 month triangle. It is getting drawn up to resistance at the March high, just above 2800.

Despite the rally, the Emini might stall around the March high ahead of Wednesday’s FOMC announcement. In addition, it might be waiting for news from Trump’s summit with North Korea’s president Kim Jong-un.

Overnight Emini Globex trading

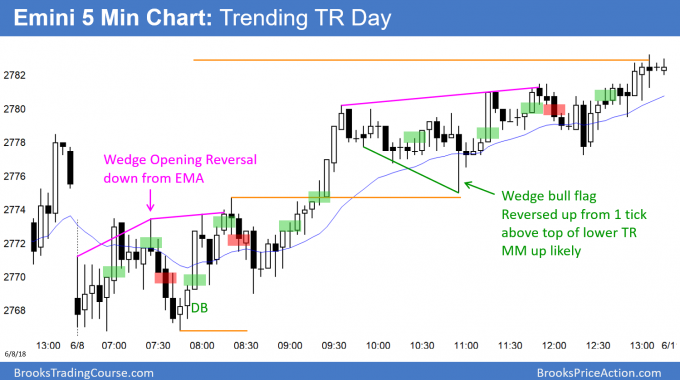

The Emini is down 1 point in the Globex session. Friday was a trending trading range day and it closed near the top of its upper range. Today will therefore likely test the bottom of that upper range, which is around 2775.

It was also a Spike and Channel Bull Trend day. There is usually a test of the bottom of the channel, which is the bottom of the Friday’s upper range. Then, the bull channel typically evolves into a trading range. Furthermore, the uncertainty of the North Korean summit and Wednesday’s FOMC announcement also increase the odds of mostly sideways trading.

Because the daily chart is in a bull trend, there is an increased chance of a bull trend day. Furthermore, most days in a bull trend have at least a small early selloff that forms the low of the day. Finally, a late rally and a close near the high of the day is also more likely. Selloffs will probably only last 1 – 2 days.

Friday’s setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

The EURUSD daily Forex chart is testing last week’s high, the 20 day EMA, and the May 22 high. This bear rally might continue up to the May 14 high before evolving into a trading range.

The EURUSD daily Forex chart has rallied to minor resistance. The bear rally might continue up to the May 14 major lower high at around 1.200 before testing down. Since the 2 week rally is in a small parabolic wedge, it will probably begin to go sideways to down before reaching that target.

Because the 2 month bear channel was tight, the 8 day rally is minor. Consequently, it will lead to a test down. The minimum target is a 50% pullback, but it might test back to below the May low at around 1.1500.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has been in a 25 pip range for 4 hours and in a 100 pip range for 3 days. Yesterday was a High 1 bull flag. But, it was a bear bar and at resistance. There will likely be more sellers than buyers above yesterday’s and last week’s high. This will probably lead to a continuation of the 3 day range through Wednesday’s FOMC meeting.

Since the 3 day range is tight, day traders will scalp for 10 pips today. They will sell above yesterday’s and last week’s highs and buy around yesterday’s low. While a trend can come at any time, one is unlikely today since the 2 week bear rally is stalling at resistance.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had a brief breakout above a small trading range. It then entered another trading range for the rest of the day. Today was, therefore, a trending trading range day. The late selloff dipped back into the lower range, which happens 60% of the time.

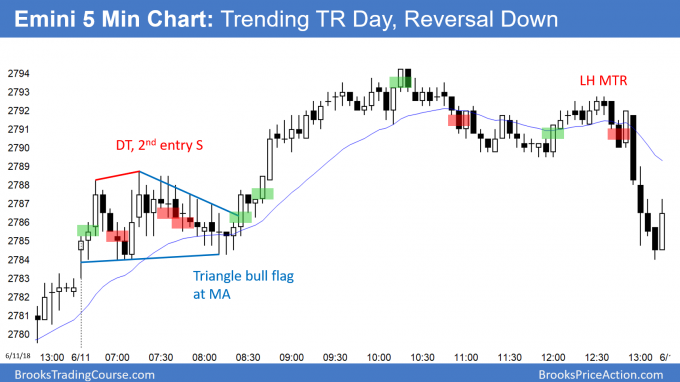

The Emini was in a trending trading range day today. The late selloff from a lower high major trend reversal turned the day into a reversal day as well. Since the bull channel is tight on the daily chart and today closed above the open, today is a weak sell signal bar for tomorrow.

The Emini had 13 consecutive bull bars on the 60 minute chart over the past 3 days. Today final broke the streak with a bear bar for the 4th hour. However, after 13 bull bars, the best the bears could get was a pause in the bull trend on the 0 minute chart.

The Emini is now testing the 2800 Big Round Number and the March major lower high. It might go sideways until there is information from the North Korean summit and Wednesday’s FOMC announcement.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.