Emini sell signal and test of 2700 big round number

I will update again at the end of the day

Pre-Open market analysis

The Emini gapped down and triggered a sell signal on the daily chart yesterday. Since yesterday was not a big bear day, it was not a strong sell entry bar. Because yesterday was a bear day, it is a weak buy signal bar for today. Consequently, yesterday will probably be the start of a bull flag. The pullback could last for a few days.

Less likely, the bears will get a big bear trend day today. If the bears start to create big bear days this week, the pullback from the breakout above the April high will grow into a bear trend reversal.

Overnight Emini Globex trading

The Emini is down 2 points in the Globex market. Because the past 4 days were mostly sideways, the odds favor a lot of trading range trading again today. Furthermore, there will probably be at least one more small leg up on the daily chart within the next week. Therefore, today will probably not be a big bear trend day.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market double top bear flag and parabolic wedge sell climax

The EURUSD daily Forex market broke strongly down from a small double top bear flag. Since the 4 week selloff is climactic, the odds favor a trading range beginning in 2 weeks.

The EURUSD daily Forex chart broke strongly below the May 9 bottom attempt. Yet, the 2 day selloff is climactic. In addition, it is following a parabolic wedge sell climax. Climactic selling usually leads to a trading range. That range will probably last at least a month and be at least 300 pips tall. Furthermore, it will probably begin within a couple of weeks.

However, there is no bottom yet, and there are magnets below. But, a bottom can come at any time after consecutive sell climaxes to near support. Therefore, if there is a strong bull reversal day within the next week, traders will see it as a buy signal bar. It would be a lower low double bottom with the May 9 low. The bulls would begin to buy. They will buy above strong bull bars and below prior lows. In addition, the bears will switch from selling at the market to selling rallies. Furthermore, they will take profits below prior lows. The result will be a transition into a 2 month trading range.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart fell 90 pips overnight. While it has been in a bear channel for 4 hours, the channel is tight. That reduces the chance of a big rally within the next few hours. Since channels typically evolve into trading ranges, that is what is likely over the next couple of hours.

Because the daily chart is in a sell climax, a strong reversal up can come at any time. If there is a sharp 50 pip rally, the bulls will swing trade, expecting follow-through for at least a day. Until then, they will only scalp for 10 pips.

Since the daily chart is in a sell climax and near support, the bears will be quick to take profits. In addition, the selling has slowed over the past 2 hours. Consequently, day trading bears will sell rallies and scalp for 10 – 30 pips. While the overnight selling might continue all day, it is extreme and more likely to stop. The odds favor a trading range for the next few hours.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

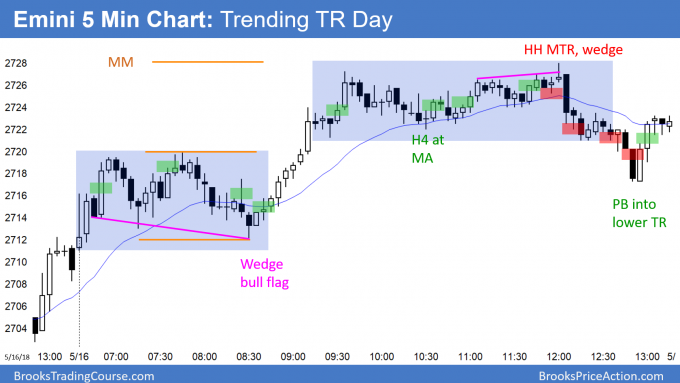

The Emini rallied in a Trending Trading Range Day. It reversed down strongly at the end of the day.

The Emini was in a bull trend today. By going above yesterday’s high, it triggered a buy signal on the daily chart. Also, by going back above the April high, it again triggered a buy signal on the monthly chart. However, the late selloff turned today into a weak entry bar for the bulls and tested both buy signal bar highs. Yet, the odds still favor a move above Monday’s high within a few days. At a minimum, the bulls want a 2nd consecutive bull bar on the weekly chart, which means that they want Friday to close above Monday’s open.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

why BA bar11

it will be 2nd leg up at top of a TR

also bar 11 is big; so big risk

& bar 6 to 9 is strong enough to expect a 2nd leg down

is it because bar 5 is a reasonable BTC bar ?

I always think in terms of Always In. Despite the 4 bear bars, the selloff was still above the MA and the market was still Always In Long. If a bull is trading Always In and he exited on the selloff, he has to buy again above a bull bar. The selloff was strong enough to make him wait for a 2nd entry buy. That outside up bar was the 1st reversal back up and the 2nd buy signal bar.

Hi Al,

I shorted below 15 as a 2nd failed higher high from yesterday. The next bar was a decent looking bull closing near its high. Would it have been reasonable to move your stop one tick above that bar, from above bar 15?

Thank you

When the correct stop is above the bear signal bar and getting out above the bull bar is only a few ticks better, it is better to keep the original stop unless the bull bar is giving a strong buy signal. That was not. Had I shorted below 15, I would have relied on my original stop. If a trader exited, he would sell again below the outside down bar that followed.

Al,

The first 3 buy stop entries that you show today (bars 2, 11, 22) didn’t end up with a 2:1 Reward : Risk ratio if you did not allow any pullbacks. Should a trader use a target limit order for 2 points if the possible initial risk was at least 4.75 points (bar 2), actual risk was just slightly better than 1 : 1 reward : risk.?

Thank you in advance

I am more interested in 2:1 using actual risk. Also, I don’t show profit taking on those trades and therefore the reward is not knowable. Those are all reasonable entries for scalps or swings. If a trader was swing trading, he would have made nothing on the 1st 3 setups unless he used wide stops. However, he would have had a big reward from the 4th entry. Most swing setups result in small wins or losses. Only 40% give a reward of at least 2:1.