Posted 6:53 a.m.

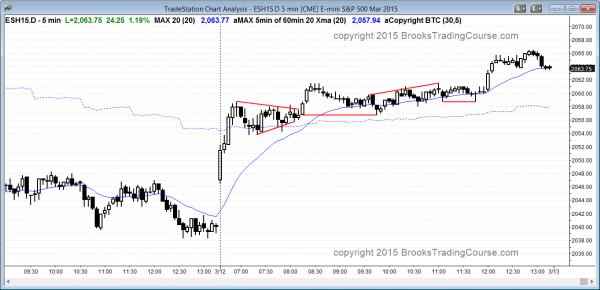

The Emini broke strongly above the 5 minute broad bull channel and had good follow-through on the breakout. The top of the 60 minute bear channel is around 2052, and that is an obvious target. With such a strong reversal up from such an oversold market, there is a 70% chance that today will remain a trend from the open bull trend. What traders do not know yet is the type of bull trend. It is possible that it could be a small pullback bull trend or a tight channel bull trend, which are strong. It could also be a trending trading range day. Finally, after a strong early rally, the market often then spends most of the day in a trading range. After 11 a.m., it decides between trend resumption up and trend reversal down. This is the most likely of all of the possibilities.

It is too early to think about shorting, even though the rally is testing the 60 minute moving average and the top of the channel. Bears should wait for a strong reversal down, or for a trading range and a topping pattern. The odds of this are small for then next couple of hours.

My thoughts before the open: Oversold and at support

The 60 minute Emini chart had a 10 bar bear micro channel late in a bear swing, and that is usually a climax that leads to a couple of legs up. It is also at the bottom of the bear trend channel and just above the bottom of the daily bull trend channel. This could lead to a rally today. Tomorrow is Friday, and if the bears are in control, they don’t mind a rally today as long as they can close the market down at the low of the week tomorrow.

Less likely, today will have a bear breakout below the 2 day broad bull channel on the 5 minute chart.

Summary of today’s price action and what to expect tomorrow

The Emini formed a trend from the open bull trend day. Although most of the day was in a tight trading range, it held above the moving average and reached measured move targets by the close, and it closed the gap on the daily chart.

After a 10 bar bear micro channel in the 60 minute chart, and a weak breakout below the 60 minute bear channel, the odds favored a reversal up today. The big bull trend bar on the first bar of the day made the day always in long and it stayed that way all day.

The bears triggered major trend reversal shorts within the 4 hour trading range, but they failed to have big bear breakout bars and follow-through. The bulls bought the close of every bear trend bar, betting that the bear reversals would fail.

The rally closed a gap on the daily chart. The bulls need to get above the 60 minute lower high at 2075. As long as the 60 minute chart is forming lower highs, it is in a bear trend. Since that is an obvious magnet, the market might get there tomorrow. The bears will short there as they try to create a double top bear flag. The bulls will buy because if they can get above the lower high, they will be more confident about being able to reach the all-time high.

Tomorrow is Friday so weekly support and resistance is important. Today rallied off the weekly moving average, just as it has done many times over the past 3 years. The weekly open is 2064.50 and the high of the week is 2075.00.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.