I will post around 7:48 a.m.

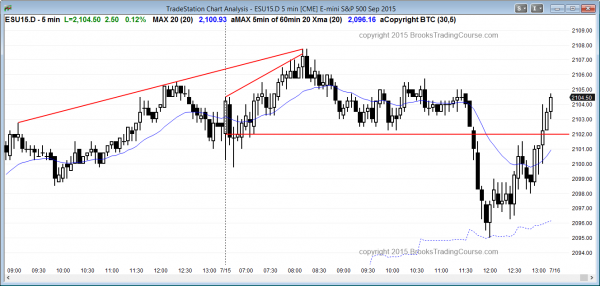

The Emini began with a limit order market and it has been in a broad bull channel. The odds favor a swing down at some point today once this rally exhausts itself, which will probably be within the next hour, but the bears need to wait for a credible sell signal bar or a strong bear breakout with follow-through. Until then, the bulls are barely in control. It is possible for the bulls to have a weak trend up all day, like the past 2 days, but the probability is low. Sideways to down for at least a couple of hours is most likely at some point.

My thoughts before the open: Daytraders will look for trend reversal candlestick patterns

The Emini is overbought on the 60 minute chart and it is getting near the top of the 8 month trading range. Since it is in a trading range, the odds are that the 3 day rally will disappoint the bulls today or tomorrow, and the Emini will probably test back down to test the 2080 top of last week’s trading range. Although the daily chart has consecutive bull bars closing on their highs, which is a bullish candlestick pattern, the rally on the 5 minute chart has had many small bars with prominent tails and a lot of overlap. This type of price action is more typical when a rally is part of a trading range.

The Emini is still Always In Long in the Globex session, but it has been in a tight trading range all night, and it is late in a 3 day rally. The day session had a moving average gap bar yesterday and then a selloff into the close. Bears will look for a major trend reversal on the 5 minute chart today. Bulls want the bull channel to continue, but bulls will be quicker to take profits at new highs because the rally has been weak and the Emini is in the top 3rd of the 8 month trading range. Bears will see every new high as a major trend reversal sell setup for a bear swing trade. The odds are that the best the bulls will get today is a trading range, and they will end up mostly scalp trading, and that the bears will get a test down to top of last week’s trading range and the gap up either today or tomorrow.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After selling off in two legs from a wedge top, the Emini reversed up from its sell vacuum test of the 60 minute moving average. The rally went back above the open of the day.

The Emini had the expected selloff today after 3 days up in an 8 month trading range. The bulls bought the 60 minute 20 gap bar buy signal, and closed the Emini above the open. The day ended as a doji day after 3 days up. It still has not tested the gap up and the top of the two week trading range below. The bulls hope that it will instead break to a new all-time high.

However, it is still in an 8 month trading range and it will more likely disappoint the bulls by testing down to support before breaking above the range. The reversal up from the 60 minute moving average was strong, but it failed to get above the top of today’s bear breakout. The bulls need to get above it tomorrow, or the bears will test back down to today’s low. If the bulls succeed in getting above the top of the bear breakout, a measured move up projects to the all-time high, which is their most important target.

At the moment, the odds favor a test of the top of today’s bear leg tomorrow for either a breakout above or a reversal back down. The reversal up was strong enough to generate confusion and increase the chances of an early trading range tomorrow.

Best Forex trading strategies

The EURUSD is testing yesterday’s low, the bottom of the 2 week trading range, and the May low. The bulls hope for a 60 minute head and shoulders bottom and the bears want the bear breakout. There was a bear breakout of the overnight range on this morning’s report, but since the EURUSD is at those other support levels, the bears need support, or else the selloff will be a sell vacuum test of support at the bottom of trading ranges on several time frames and a sell climax that will lead to a reversal back up in the trading range. The bar after this morning’s bear breakout had a bull body and a big range. This reduces the chances that there will be strong follow-through selling, although the EURUSD on all time-frames is Always In Short.

Traders learning how to trade the markets can see that the bulls got a bull breakout above yesterday’s bull flag in the USDJPY. It is getting close to the top of the month long trading range. The bulls need a strong breakout, but since most breakouts fail, the odds are that it will at least pull back if it reaches the 124.40 top of the range. This is still 70 pips higher than the current price, but the follow-through from this morning’s bull breakout has been week, and it looks like the USDJPY will probably enter a trading range. Those trading Forex markets for a living will then look for either trend resumption up to the top of the trading range, or a trend reversal down. Right now, the USDJPY is Always In Long on the 5 minute chart and the odds favor the bulls, but the more bars that get added to a trading range, the more the probability slips down to 50-50.

The USDCAD is having some follow-through buying after his morning’s bull breakout. There is room to the top of the wedge channel on the 60 minute chart, and this might provide the best potential for Forex trading for beginners. However, the buying is climactic and the rally could be a buy vacuum test of the top of the trading range.

Forex day traders will probably mostly scalp today, but the EURUSD is currently in a swing down and the USDCAD is in a swing up. Both might have follow-through.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al–

I will post this question in tomorrow’s blog if you don’t see this one after hours.

Re: Trader’s Equation

how does the TE change if one uses a breakeven stop after x ticks of profit? Say a trade with an 8t SL and a 16t profit target; move to BE at +8t.

A related quandary: I document my signals (2+ years worth) of my favorite trade. I use a BE stop. I have have documented a 45% chance of a winner, 25% BE, and 30% chance of looser. what is my TE for this particular trade? perhaps I should just ignore the BE’s and consider this a 75% winner “setup.”

(rule of thumb is fine.) Thanks so much.

I talked about this some a few days ago in response to another question. Using risk to set profit goals is one of many ways to determine profit targets. The math is always ok if a trader goes for 2x actual risk, but most traders on most trades go for more.

I general, BE stops are rarely the best choice, except in 2 instances. If a scalper’s trade gets close to his target, he can move to BE. If a swing trader has a PB to his entry, and the trend resumes in his direction, he can go to BE. In most other trades, other stop management is better.

If a BE stop results in a profit that is at least 2x actual risk, the math is ok. If it typically results in less, then it can make the strategy not work.

I have made the videos on risk clearer for the new version of the course, but I won’t have it ready until the end of the year.