I will post around 7:24 a.m.

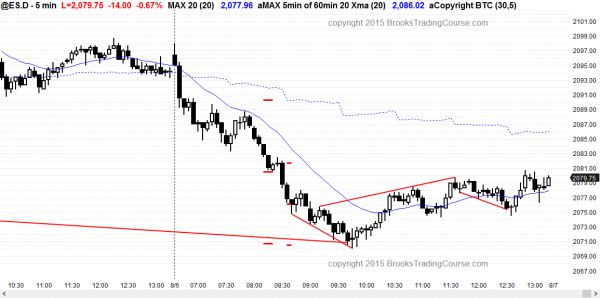

The Emini began with a trend from the open bear trend. The bulls hope that the selloff will lead to an early low of the day. There is a 2 day wedge bull flag, a parabolic wedge, and an expanding triangle. However, after 7 bars without a pullback, the bulls need a strong reversal, a series of consecutive bull bars, or a micro double bottom before day traders will believe that they have taken control.

After selling off 11 points below the open, the odds of a bull trend day are small. The bulls can have a swing up that can last for hours, but it is unlikely that will will be able to close much above the open if they are able to rally. More likely, the best they can hope for at the moment is a trading range day.

Because of the 6 day trading range and today now being near the bottom of the range, the odds of a big bear trend day are also not high, but the bears have a better chance of a trend day than the bulls.

At the moment, the Emini is in a bear trend and is breaking below a double top bear flag. The target is a measured move down. When there is a double top bear flag, there are often buyers near the target and they can create a swing up. However, the bulls need to generate some buying pressure. They either need a strong reversal up, a series of bull bars, or a major trend reversal. Because the Emini is at the bottom of a 6 day trading range, the bulls have a reasonable chance for a swing up. However, until they create a bottom, the bears are in control and traders will continue to sell rallies, betting that the bulls will fail.

My thoughts before the open: Learn how to trade futures in a trading range

Day traders see the Emini as neutral on all time frames. This makes sense since tomorrow’s report will influence the Fed’s decision on the timing and size of the rate hike. The 60 minute chart is Always In Long after last week’s strong reversal up, but yesterday’s reversal down weakened the bull case. Yesterday sold off, but then went sideways for 3 hours.

Even though the odds favor mostly more trading range trading today going into tomorrow’s report, there is almost always at least one 4 point swing that begins in the first hour or so, and it usually begins with a good signal bar. Day traders will look for a candlestick pattern that could support the swing trade.

If yesterday’s trading range price action continues today, day traders will mostly scalp, and many will enter with limit orders and scale in. They will buy bear closes and buy below bars near the bottom of the trading range, and sell bull closes and above bars near the top of the range. Traders learning how to trade the markets should only enter with stops. If they are trading reversals in a trading range day, they should wait for 2nd entries and good signal bars.

Can today have a strong trend? When trading price action, a trader always has to be open to anything. When a strong trend day is unlikely, there is always the potential for a pain trade. This is a low probability event. Since it is low probability, traders continue to bet against it and constantly have to exit their bets with losses.

For example, if there is a weak rally, bears keep selling and adding on higher. When they see the rally continue to work higher, they keep buying back their shorts with losses. This can continue all day and create a big trend day. If today stays either above or below the moving average all day, even if the trend does not look strong, day traders should look for trades in the direction of the trend, and bet that strong reversals back to the moving average will fail.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off strongly to the bottom of the 60 minute bear channel. It reversed up from consecutive sell climaxes, and then had a 2nd leg up from a higher low major trend reversal,and a 3rd leg up from a double bottom higher low major trend reversal.

Although the bear trend was strong, the Emini is still in the middle of the trading ranges on the higher time frame charts, and nothing today has any predictive significance for tomorrow. The Emini will probably gap up or down, and then decide whether to trend or reverse. Day traders need to approach tomorrow with absolutely no opinion, regardless of what the pundits on TV say.

Best Forex trading strategies

The Forex markets, like all financial markets, are waiting for tomorrow’s unemployment report, and all are in trading ranges on the 60 minute charts. Today will probably be a quiet day. Sometimes markets will breakout on the day before a report, but usually remain in trading ranges. Traders learning how to trade the markets should assume that most breakout attempts in trading ranges fail. They should not buy strong rallies or sell strong selloffs unless the moves break out of the range and have strong follow-through. Those trading Forex for a living will bet that every attempt will fail, and instead will be looking to buy low, sell high, and scalp. They also will be entering with limit orders, betting that small breakout attempts will not go far.

The most overdone currency on the 240 minute chart is the Canadian dollar, and it has the best potential for a reversal that could last a week or more. The 240 minute chart of the USDCAD is in a strong bull trend and has been in a triangle for a few days. A triangle late in a bull trend often becomes the final bull flag. If there is a bull breakout today or tomorrow (like after the report), online daytraders should be ready for a reversal. Any trend can continue long after traders decide it is overdone, and the rally is climactic, but it has the highest probability of a reversal of all of the major Forex crosses.

On the 5 minute charts overnight, the British Pound had the biggest move. The EURGBP had a strong breakout, but it lasted only 10 minutes and now has had a 50% pullback. The bulls see this as a breakout above a 60 minute higher low major trend reversal, and are hoping for at least a 2nd leg up. When the breakout is this brief and the pullback this deep, the odds of a trading range are greater than the odds of a bull trend. This means that the breakout could completely reverse.

There was a similar move in the GBPUSD. The bear breakout lasted about 15 minutes and the pullback was a sharp reversal up. The rally did not reach the 50% pullback level, but it was strong enough to make a trading range likely over the next hour. If the bears can prevent much more of a reversal, this rally could become a bear flag that is followed by a Forex swing trade down.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.