Posted 7:47 a.m.

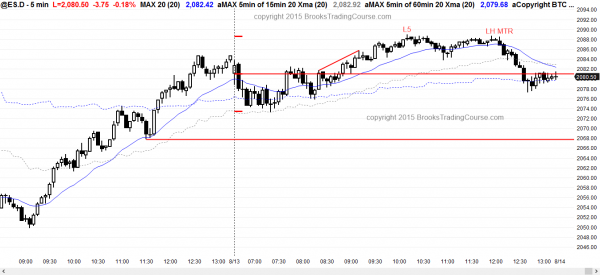

The Emini tested yesterday’s high on the open, and could not get above it. This is similar to July 8, which also followed a huge bull day. Day traders have to be aware that yesterday was a big day, and today might try to be an inside day, which means an early high of the day.

The initial sell off had big bear bars, but bad follow-through. This reduces the chances that today will be a strong bear trend day. If it becomes a bear trend day, it will probably be in a broad bear channel. This is two-sided trading and it increases the chances that there will be a lot of trading range price action today. The bulls will try to prevent a bear trend. If they can hold the day as a trading range, they will then try to get trend resumption up above yesterday’s high at some point today.

The bulls want to keep the selloff from falling below the 2067.75 bottom of the final rally from yesterday. If they do, then they will try to convince the market that this early selling is just a big bull flag. The bears obviously always want the opposite. If they can drive the Emini below that higher low, then the bull argument is much weaker. Traders instead will see today as either a bear trend or a trading range.

At 7:40 a.m., the bulls finally got a strong breakout. However, because there has been so much trading range price action today, the rally might end up as a bull leg in a trading range. At the moment, the Emini is Always In Long and the odds favor that there will be buyers below and the first selloff will be bought. The bulls will try to get above yesterday’s high.

Today could still be a big bull trend day, but because of the two-sided trading, the odds are against a strong bull trend day. The next bar had a bear body. This is disappointing follow-through and it increases the chances that this rally will end up as a leg in a trading range day.

The bears hope to form a major trend reversal, but they will probably need a 2nd entry short after this strong bull breakout.

My thoughts before the open: Learn how to trade futures after a rally

The Emini had another strong reversal up from the bottom of the 7 month trading range. Each prior one had follow-through buying for a week or two, but every strong move up and down became just another leg in the trading range, and this one will probably be like all of the others.

If you watch Fast Money on TV, you will notice that whenever there is a big bear day, they bring a bearish guest, and whenever there is a strong bull day, they have a bullish guest. It’s TV! They are trying to make money and are giving the audience what it wants. Viewer see the big bear day and feel better if an “expert” reassures them that the day was truly big and it might be the start of a bear trend.

After yesterday’s big bull day, they made sure to have a guest who told us that this was the start of a bull trend. This is nonsense. The Emini is neutral and any idiot can see that. These pundits have an opinion when the market is screaming at them that they cannot have an opinion. This makes them look like fools to professional traders. The market is not ready yet to tell us whether the breakout will be up or down, and anyone who has an opinion is not a trader. He is an entertainer.

Yesterday was a buy climax. There is therefore an 80% chance that it will have at least 2 hours of sideways to down trading that begins by the end of the first 2 hours, and at least a 50% chance that there will be follow-through buying for the first hour or two. The rally yesterday was strong enough to increase the odds of follow-through buying for the next week or so, even if there is a 50% pullback in the next couple of days (the odds are against that deep of a pullback today or tomorrow). The day trading tip for the day is to be ready for follow-through buying, which can provide a swing trade and good day trading for beginners, and then be ready for two-sided trading for at least a couple of hours. It is possible that today will be another big bull trend day. If it is, it will still probably have at least a 2 hour trading range.

It is also possible that today can be a bear trend day. However, the buying was so aggressive (the pullbacks were very small) that traders will probably buy even small pullbacks, and this makes a bear trend day unlikely. Whenever something is unlikely, it creates a possible pain trade, so day traders have to be ready to swing trade shorts if a bear trend day begins to form.

Best Forex trading strategies

The financial markets had climactic moves yesterday and have been consolidating overnight. The 240 minute EURUSD rallied from a higher low major trend reversal (a head and shoulders bottom) only to stall at a lower high from mid-July. The rally was a buy vacuum test of resistance. It has been pulling back since yesterday morning.

The bears want the pullback to be an endless pullback and a reversal into a bear trend on the 5 and 60 minute charts. The bulls want it to be a bull flag. The 60 minute rally was in a wedge channel, and traders learning how to trade the markets know that the odds favor at least 2 legs sideways to down.

Although the 60 minute chart has had 3 legs down, the legs were in a tight channel. When that happens, those who trade for a living wonder if the 3 legs are just subdivisions within what will become the first of 2 larger legs. In any case, the selloff was steep enough so that the first rally on the 60 minute chart will probably be sold and the price action will probably be sideways for at least another day or two.

The 60 minute chart of the EURJPY also had a spike and channel buy climax and has started to turn down over the past few hours. However, the selling has been weak on the 5 minute chart, and a trading range is more likely than a bear trend today.

The USDJPY sold of strongly yesterday on the 60 minute chart, and it rallied back to around 50% overnight. There will probably be sellers around the current level. Since the rally was strong, the market might go more sideways to up before it has a swing back down to test yesterday’s low.

The 240 minute chart of the USDCAD has been sideways for a month, but it is at the top of a tight wedge channel. The selloff over the past two weeks has been in a broad bear channel. It reversed up strongly over the past week. Traders who trade Forex markets for a living will be ready to sell this rally for a swing down if it forms a lower high major trend reversal. A 50% pullback from the current leg down is about 50 pips higher.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a trading range day today. After a weak rally, it sold off from a lower high major trend reversal and closed at the open of the day in the middle of the range.

Yesterday’s buy climax was so extreme that today was likely to have a lot of trading range trading. Today’s rally will probably be a bull leg in a trading range that will probably last at least another couple of hours and possibly another couple of days.

The bears see today as a pullback in the bear channel of the past couple of weeks. Today is therefore a breakout pullback sell signal bar. This is a low probability trade. More likely, there will be buyers below. However, the Emini might test down to the bottom of the final buy climax from yesterday, which was at 2067.75. The bears need a strong breakout below that level to have a chance of a test of yesterday’s low.

If the bears are able to test there, the bulls will buy and try to create a double bottom bull flag. The need to get above last week’s lower highs up to 2108.50. If they are able to rally to that level, the bears will sell and try to create a big double top lower high major trend reversal.

This is a range, and the Emini will probably trade both down and up over the next week before it can break out up or down.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al/Admin, I am sure I speak for everyone when I say we all look forward very much to the Ask Al articles!

Can the next one perhaps be about swinging? We have had a lot about scalping for one or two points, but what about swinging for four or more points? Specifically I would like to know more about this idea of having to take every 40% probability swing vs just looking to take the 2-3 best swing trades a day.

Thanks!

Hi Angus,

Believe it or not, but next one planned is ‘Swing trades: definition & discussion’. 🙂 ‘Time stops’ after that, then some more psychology.

Thanks for your kind comments.

Richard

BTC Admin

PS. If anyone else has suggestions for Ask Al, please drop a comment in the Ask Al blog area.