Posted 7:15 a.m.

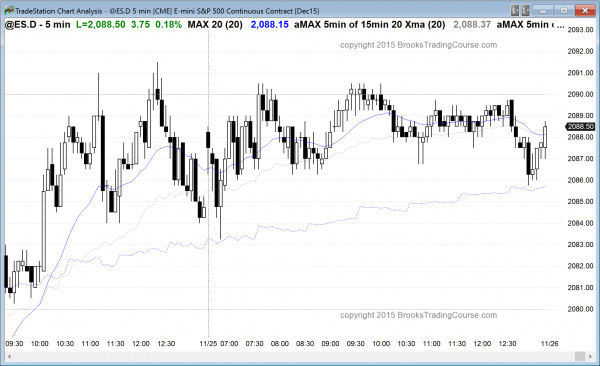

After an initial selloff to the 60 minute moving average and below yesterday’s double bottom, the bulls got an opening reversal up. However, the rally stalled in the middle of yesterday’s trading range. Although the Emini is Always In Long, it is still in Breakout Mode. Traders are buying low, selling high and scalping, and will continue to do this until there is a strong breakout up or down. This trading range price action increases the chances that today will be a trading range, which means that it will probably have both a 2 – 3 hour rally and selloff. It is too early yet to know which will come first. While it still could be a big bull trend day, traders need to see a strong sustained move before they will swing trade.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade before a holiday

Tomorrow is Thanksgiving, which means that today will give online day traders a chance to learn how to trade before a holiday. The 60 minute chart had a wedge top buy climax that ended on Thursday. It reversed up yesterday after 2 legs down and met the minimum objective of those who trade the markets for a living. Those learning how to trade the markets should understand that when a market goes too far too fast, traders take profits and then usually wait for a couple of legs of sideways to down trading. If the bears fail to create a trend reversal after about 10 bars and 2 legs, the bulls begin to doubt that the bears are strong. The bulls buy again, looking for another leg up. That is what happened yesterday.

However, the Emini has been unable to break strongly above the August 17 top of the bear trend, and then the all-time high from July, which is just a little above that. As long as the bulls continue to fail, the odds remain at 50% that they will succeed, despite the strength of the rallies since the October low. Until there is a breakout, there is no breakout. The end of the year has psychological importance. The bulls want a new all-time high before year end, and they want the Emini to close the year above the July all-time high. These are signs of strong bulls. The more signs of strength that they can create, the more traders will be confident that the Emini is going higher, and the more willing they will be to buy at the high.

The bears always want the opposite. As long as they are able to prevent a new all-time high, they still have a 50% chance of a test back down to the October low. The bulls have momentum on their side. The bears have strong resistance on the theirs. The net result is that the probability is the same for both.

The Emini yesterday has an especially strong bull breakout at 8:25 a.m. PST. that lasted for 3 bars on the 5 minute chart. One of the bars opened on its low, and that low did not overlap the prior bar. This was unusual buying pressure and it resulted in a bull trend that ended with a higher high major trend reversal in the last hour. That reversal might result in a trading range today because that is what follows most trend reversals. Also, there is resistance above and today is the day before a holiday, and traders will be distracted and less willing to commit to the markets.

The Globex chart rallied overnight and then has been sideways in a tight trading range for 4 hours. It is up 5 points at the moment, just below yesterday’s day session high. The November high of 2110.25 is about 20 points above. While the Emini could easily get the breakout on most days, there might not be enough volume to get there today, especially after yesterday’s buy climax, and when 3 of the past 4 days were doji candlestick patterns on the daily chart. That is trading range price action. When most of the recent price action has been in a trading range, the odds of more trading range price action is high.

If there is a strong breakout up or down, online day traders will look to swing trade their positions. Going into the day, traders will be cautious and will lean toward scalping until there is either a clear buy setup, like a double bottom bull flag, or a clear sell setup, like a double top, or until there is a strong breakout up or down.

Forex: Best trading strategies

The EURUSD has been in a sell climax for a month, but it still is above the April higher low. The 240 minute chart had a wedge bottom over the past week. There is a 75% chance of a bull breakout. The bears got a bear breakout below the wedge bottom last night. When there is a bear breakout below a bottom, there is usually about a 50% chance that the breakout will lead to about a measured move down. Since the wedge was about 200 pips tall, a measured move down would project down to around 104, which would be below the March low and it would create a new 12 year low. The odds for the bears reaching the March low without a significant pullback are probably higher than 50% in this case because of the strong magnetic pull of the March low, which is now close to the current price.

There is also usually a 50% chance that the bear breakout will fail and reverse up. In this case, the probability of a significant pullback before testing the March low is less than 50%. The selloff last night was strong enough to have at least a 2nd leg down. The EURUSD 5 minute chart had a small 2nd leg down about an hour ago. It is too early to know it that is enough. The bulls need a strong reversal up to convince traders that they have regained control. Without that, the odds favor at least a little more down. Because there is a 50% chance of a reversal up over the next few days, bulls will look for bottom formations and strong bull reversals. Bears will continue to swing their shorts and sell rallies, expecting a breakout below the March low.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a tight trading range all day

The Emini has had 4 doji bars in the past 5 days on the daily chart. It is stalling at the all-time high. Monday is the last day of the month, and the Emini is around the open of the month. The monthly bar might end up as a doji as well. The odds are for more trading range price action. Day traders will continue to scalp until there is a strong breakout up or down.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

As Al wrote: “One of the (5 minute) bars opened on its low, and that low did not overlap the prior bar”. I find it even more interesting that there was a gap on the 60 minute chart (around the same time of day) with a bar that opened on its low and never closed the gap below. I was not in the room so it’s possible Al talked about it as it unfolded.

Note: This is referring to yesterday’s price action (pre-open market analysis for today).

Yes, I mentioned the gap on the 15 min chart, but did not notice it on the 60 min. This is the usual issue of measuring gap versus exhaustion gap, and exhaustion gaps are more common. This means that a test back down there is likely in the next week or two.