Posted 7:08 a.m.

The Emini began with a limit order open, which increases the chances of a lot a trading range price action today. Trading range days have at least one swing up and one swing down, and either can come first, and both usually last at least a couple of hours. When there is a limit order open in yesterday’s trading range, it often takes an hour or more before traders know whether the swing up or down is forming first.

Until there is a strong breakout with follow-through, or a channel up or down that lasts 5 – 10 bars, the odds favor reversals. Trader will continue to buy low, sell high, and scalp, and mostly enter with limit orders. Any day can become a strong trend day up or down, but the higher time frames, yesterday’s trading range, and today’s trading range open make trading range price action more likely today.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade a bear breakout on the 60 minute chart

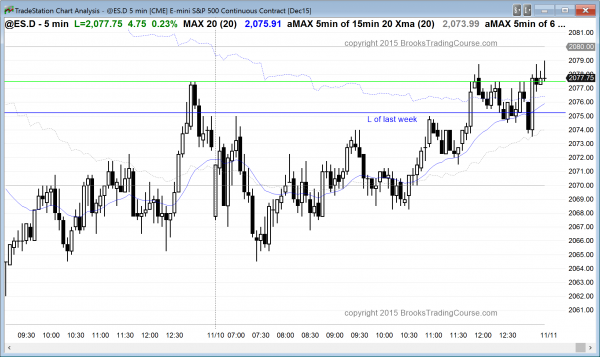

After 6 weeks without a pullback on the weekly chart, yesterday finally traded below the low of the prior week. Last week’s low led to a measured move down, and the trend reversal at the end of the day stalled at last week’s low. It clearly is an important price. When there are 6 consecutive bull trend bars on any time frame, traders learning how to trade the markets should know that there is about a 70% chance that the 1st reversal down will be bought and that the bears will need at least a micro double top before there is a reversal down. The pullback usually only lasts 1 – 2 bars (here, weeks) before the market tests back up.

On the daily through monthly charts, the bears want a double top major trend reversal with the all-time high, and then an endless pullback from the 6 week rally. They want the bulls to finally give up, creating a bear breakout below the bear channel, and then a bear breakout below the October low, which is the neck line of the yearlong double top. They then want a measured move down, which would be about 300 points below the October low. Whether or not they ultimately achieve their goal, it is not likely to begin for at least a couple of weeks because the bull momentum has been so strong. Bull trends usually transition into trading ranges before reversing into bear trends. This limits the downside potential for at least a couple of weeks.

The daily chart has a Low 5 short top, which triggered 3 days ago. Yesterday was the 3rd consecutive day down. The odds are that the daily chart has entered a TBTL PB (Ten Bars, Two Legs). This means that there probably will be sellers above yesterday’s high and that the upside will be limited for the next week or two. This is consistent with the buyers below last week’s low on the weekly chart. The Emini is probably in the early stages of a 2 or more week trading range, despite the seasonally bullish time of the year and the strong 6 week rally that broke above the August bear trend high.

Will the Emini break to a new all-time high? The momentum and seasonality clearly favor the bulls. However, the 6 week rally on the daily chart contained 6 consecutive buy climaxes. When that happens, it is more likely to pullback for 10 or more bars before the bulls try again to break to a new all-time high.

With an early trading range likely underway on the daily chart, there will probably be more trading range price action on the 5 minute chart as well on most days. The daily chart has had a 3 day pullback in a strong bull trend. The odds are that the buyers will come back today or tomorrow and the Emini will trade above the high of the prior day. Because a trading range is likely, there probably will be sellers above, even though the bulls see the 3 day pullback as a bull flag. When the market is in a trading range, there are usually sellers above bars and buyers below, and the moves up and down tend to be limited. Traders who trade the markets for a living know that at some point, the market then decides whether the trading range on the daily chart is a bull flag or a topping pattern. Traders will know by the direction and strength of the breakout when it eventually comes.

The Globex session is down 3.50 and it has been in a trading range for 4 hours, and it is within yesterday’s 4 hour trading range. The odds favor a sideways open. The bulls want a 3 day bull flag. The 60 minute chart had 2 big bear trend bars yesterday, and the reversal up did not go above Friday’s low. The bears see those 2 bars as a measuring gap and a bear breakout below a 3 day bull flag. They will try for a 2nd leg down at some point today. The bulls want to erase this bear breakout. They need a rally above Friday’s low and then above the top of those 2 big bear bars. At the moment, the odds favor a 2nd leg down on the 60 minute chart. If the bulls close the gap, the a trading range becomes more likely.

Forex: Best trading strategies

The EURUSD 60 minute chart is in a bear trend. Friday had a big bear breakout below a wedge bottom attempt. The odds were then for 2 legs and a measured move down. The EURUSD broke to the downside again over the past hour and is having its 2nd leg down. It is at a measured move down from the November 4 gap between the October 28 low and the November 5 high. As strong as the selling has been, the odds are that it will end today and that the EURUSD 60 minute chart will begin a TBTL correction (Ten Bars, Two Legs) sideways to up.

Day traders should begin to look for a swing up starting at some point today, even though the EURUSD is still in a bear trend. The bears will continue to sell until there is a strong bull breakout, and they will sell the swing up as well, betting that the best the bulls will get is a bear flag on the daily chart and that the selloff will work its way down to the April higher low. They might be right, but the odds favor a day or two up on the 60 minute chart.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini reversed up from a double bottom with yesterday’s higher low and then rallied in a broad channel. However, it was mostly just an extension of yesterday’s trading range.

The Emini bears were again unable to get follow-through selling after yesterday’s selloff on the open.

Today is the 3rd consecutive day on the daily chart with a low below the prior day’s low. Since the 6 week rally was strong and a 4th consecutive lower low would be unusual for the first reversal down, tomorrow will probably trade above today’s high.

The odds are that the Emini has entered a trading range that will last 2 or more weeks. The bulls will see it as a bull flag and expect a breakout to a new all-time high. Momentum and probability are on their side.

The bears will see any double top in the trading range as a sell signal, and they see the entire rally as a double top with the all-time high. Since the Emini is at the top of a trading range, the risk/reward favors the bears. The bears are looking for follow-through selling and a test of the 2050 bottom of the 60 minute wedge bull channel. The odds are that they will get there within a week or two, whether or not there is a rally that tests last week’s high before then.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

Do you use previous daily close?

I only use the open of the day. From my personal trading I don’t think I have found any significance using previous daily close at the moment.

I always pay attention to yesterday’s close because the mkt does. Yesterday’s, last week’s, and last month’s open, H, L, and C are also common support or resistance, as are Globex values. However, the further to the left, the less important. Also, most traders usually can do well focusing on today. Those other values increase the number of trading opportunities.