Emini island top, island bottom, and possibly second island top

Updated 6:53 a.m.

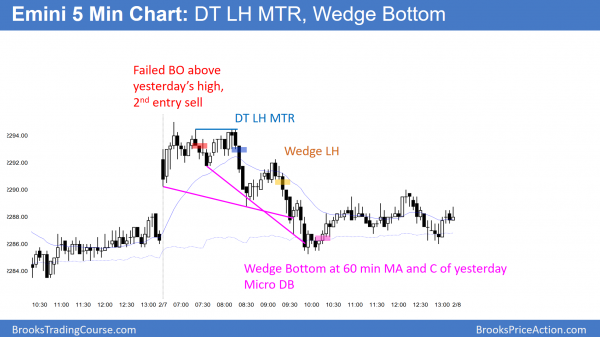

The Emini opened above yesterday’s high, but fell below yesterday’s high on the first bar. Hence, it closed the gap. Yet, it immediately reversed up for an opening reversal up from a test of yesterday’s high.

The rally is similar to those of the last 2 days, which led to trading range trading. It lacks consecutive big bull trend bars and therefore will probably be a leg in a trading range rather than the start of a bull trend day. Yet, it is strong enough so that the bulls will probably buy the 1st reversal down.

Hence, the bears will probably need at least a micro double top if they are going to create an early high of the day. Most likely, this will be another day with a lot of trading range price action. The Emini is looking for the top the trading range. The odds are it will be higher than the current high.

The Emini is Always In Long and the bulls want a new all-time high.

Pre-Open Market Analysis

Yesterday sold off in a trending trading range day, but found support at the 60 minute moving average. The odds still favor higher prices.

Last week had both an island top and an island bottom. If it gaps down in the next few days, it will create a 2nd island top. While islands sometimes lead to trends, most lead to trading ranges. A second top has a higher probability of success. Yet, the odds still favor at least a little more up before the 5% correction begins. The bears still need a big bear trend bar on the daily chart to convince traders that they have taken control.

Overnight Emini Globex trading

The Emini is up 5 points in the Globex session. Therefore, if it opens here, it will gap above yesterday’s high on the daily chart. Hence, it would create follow-through buying after Friday’s gap up to an island bottom. Since the island top bears have stops above their island top at the all-time high, that high is a target. Hence, there is an increased chance of a bull trend day today.

Bull trend days on the daily chart usually have at least a small tail on the bottom of the bars. This typically comes from a selloff in the first hour that reverses up. Hence, if the Emini sells off on the open, day traders will buy a reversal up. They will therefore watch for a double bottom, a wedge bottom, or a high 2 bull flag at support. Since the moving average and yesterday’s high and close are important prices, an early selloff could simply be a test. Bulls will then buy a reversal up.

The bear case

The bears want a repeat of last Wednesday. Hence, they do not mind a gap up as long as the Emini sells off strongly below support. They therefore want a failed breakout and a bear trend day. They will try to drive the Emini down strongly below support to make the bulls give up. Because the Emini has been mostly sideways for 2 months, another trading range day is more likely than a bear trend day.

EURUSD Forex Market Trading Strategies

While the daily EURUSD Forex chart has sold off for 4 days, there have been no consecutive big bear bars closing on lows. This is therefore likely a bear leg in the 2 month trading range.

The 240 minute EURUSD chart fell below the next line of its head and shoulders top yesterday. It will therefore probably test support at one or more of the minor higher lows in the 2 month trading range. Hence, it is testing theh January 20 low of 1.0620.

Just like the 2 month rally looked like a bull leg in a trading range, this selloff is weak. It therefore looks like a bear leg in the trading range. Hence, the bears need to create big bear bars closing on their lows to make traders believe that this is a resumption of the bear trend that began on November 9.

Overnight EURUSD Forex Trading

After selling off relentlessly since yesterday afternoon, the EURUSD has been sideways for 6 hours. The selloff was strong enough to make lower prices likely. Furthermore, the EURUSD market has been in a trading range for 4 months. Hence, it probably will have to fall below support before bouncing. Therefore, it will probably fall below last week’s 1.0620 low this week. Because of this, traders will sell rallies. Yet, as long as this small trading range continues, many will scalp.

Since it is in a 4 month trading range, the bear breakout will probably fail. The EURUSD will probably reverse up to a lower high on the daily chart and then fall again for one more leg down. That would therefore be a small head and shoulders top. I talked about this yesterday when I said that the 240 minute head and shoulders top was probably the head of a developing larger head and shoulders top.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off from above yesterday’s high, but the bulls prevented it from falling below yesterday’s low. It therefore was not an outside down day. After a wedge bottom at the 60 minute moving average, it went sideways for the final 3 hours.

The bears again stopped the bulls from a new all-time high. Today is a bear bar on the daily chart and therefore a sell signal bar for tomorrow. The daily chart has a micro double top and a double top, yet there is also a bull trend. While the odds still favor higher prices, the odds also favor a 5% correction in the next 2 months.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.