Posted 7:05 a.m.

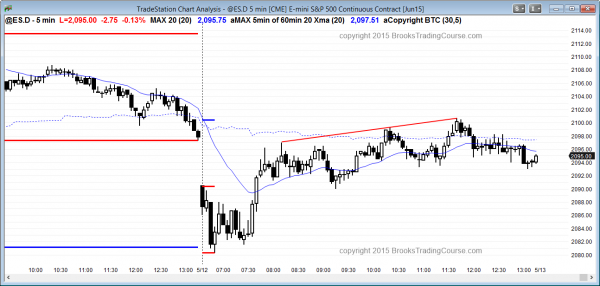

The bears had a trend from the open bear trend, but the bulls created an opening reversal up from a test of the December high, after a sell climax. The selloff alternated bull and bear bars, and the initial rally had tails on the tops of the bars. This is trading range price action and it increases the chances that the Emini will be mostly sideways for the first hour or two, and possibly all day. The early lack of follow-through is a sign that traders do not think the Emini will go very far without attempting to reverse, and this makes daytraders more likely to buy low, sell high, and scalp. Traders are willing to swing trade, but they will probably wait to see a strong breakout with strong follow-through in either direction.

Since the Emini is oversold and at support, traders will be watching for a good buy signal bar for a swing up. The swing trading bears probably will wait for the Emini to get closer to the moving average. They will attempt to form a double top there.

At the moment, the Emini is Always In Short, but it is trying to reverse up from the December high. The bulls need to do more before traders believe that the bulls have taken control. The context is good for the bulls, but they need a signal bar or a strong breakout.

My thoughts before the open: Candlestick pattern is an island top

The Globex Emini is currently trading well below yesterday’s low, and the day session of the S&P Emini futures contract will probably gap down. This is after Friday’s gap up, and the gap down today then will create a 2 day island top at the top of a 4 month trading range.

I mentioned in the price action trading room early yesterday that bears would short early yesterday to try to create another 60 minute lower high, and they succeeded. However, most reversals within trading ranges do not go very far, and the odds for this current one are the same as for all of the earlier ones. Traders learning how to trade the markets should realize that it is more likely that this selloff will end up as just another bear leg within the trading range.

When there is a gap down, the day trading strategy is to look for a trend day in either direction. The bulls sometimes get a strong bull reversal bar on the first bar, and then a strong entry bar and strong follow-through. There might be a 20% chance of an early, strong bull reversal, and daytraders need to be ready to swing trade a long early on.

It is less likely that there will be a big bear trend bar on the first bar followed by strong follow-through selling, but it can happen. Usually when the Emini gaps far from the moving average, it has to get closer to the moving average before he trend down can resume. It sometimes will selloff for an hour or so, but when it does, it then usually goes sideways for an hour or two until it gets closer to the moving average.

Whether there is an early move up or down, the highest probability trading is to be ready for a trading range to form within the first hour or two. If that happens, it often will form a double top or a double bottom, or both, and these candlestick patterns can lead to swing trades. Traders learning how to do online trading need to be prepared. If there is a swing trade from within an early trading range, it usually begins with a strong signal bar. The bulls will want a bull bar that closes on its high or has only a 1 tick tail on top. The bears will want a bear bar that closes on its low or has only a 1 tick tail on the bottom. If signal bars are not strong when traders are looking for a swing trade, the move usually does not go far.

Forex trading strategies for today: Strong Canadian dollar

Traders learning how to trade Forex markets for a living should look for swing trades in the Canadian dollar today after a pullback. The GBP has been strong for several days, but is forming 60 minute wedge reversals against other currencies. For example, in the GBPUSD, traders will begin to sell rallies, despite the bull trend, and the EURGBP looks like it will form a trading range today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The S&P Emini futures contract reversed up from the December high and a higher low major trend reversal, and stopped at a wedge top at a measured move up.

The Emini sold off to a measured move down from yesterday’s range, but then rallied and closed the gap. The Emini is still within a very tight range on all time frames. It is overbought on the monthly chart, but the ascending triangle on the daily chart has a slightly better than 50% chance of a bull breakout. If the Emini bulls get their breakout, the triangle will probably be the final bull flag before a reversal.

Forex price action for tomorrow

As I mentioned this morning, the Canadian dollar was strong today. The EURUSD is still in its tight trading range on the daily chart after its climactic rally over the past month. The 60 minute GBPUSD and GBPJPY are forming wedge tops. These will probably be followed by 2 legged pullbacks and then trading ranges. The other Forex markets are in 60 minute trading ranges, allowing online foreign currency trading in both directions.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi AL,

if you look at a longterm monthly chart of the indu you can see a large mega phone pattern, starting in 2000. Next point of hitting the lower support trendline would be approximately 5500 around 2017.

How do you see the probability?

thx Andre

I believe the breakout above the double top has been so strong that the INDU will never get back to the 2009 low around 6500. However, I do believe it will test back below the to pof the double top around 14,000. Will it get down to 10,000? I don’t know and it depends on how high the current rally goes. If it works up to 25,000 before the next crash, then it probably will never fall to 10,000.