Posted 6:53 a.m.

The Emini tested the 60 minute moving average and the bottom of the channel on the open, but the selloff from yesterday’s high was only about 10 bars and that is probably not enough to correct a rally that lasted 60 bars. Yesterday was an outside day at the top of the 3 month trading range so today will probably be an inside day or a day with a lot of overlap with yesterday.

At the moment, the S&P Emini futures contract is always in long, but it is not moving. A trading range day is likely, and this reversal is not strong. It is a limit order market start to a day that will probably not have big swings. Until there is a strong breakout with follow-through in either direction, online daytraders will be looking to scalp instead of swing trade. The channel down does not have enough bars to convincingly correct from yesterday’s rally, and there is also a trend line below. However, yesterday was so strong that the bulls will probably try for a test of yesterday’s high, possibly early on, but the odds of a strong breakout above the high are small unless the Emini can begin to create consecutive big bull trend bars.

My thoughts before the open: Day trading tip is to expect a trading range

The SP Emini futures contract had a 6 bar bull microchannel on the 60 minute chart yesterday, but it is at the top of a 3 month trading range and it looks like it will open with a small gap down to the 60 minute moving average. After yesterday’s strong rally in a tight channel, online daytraders expect that the S&P Emini futures contract would pull back for at least a couple of hours today. This can be sideways to down. There is often some early follow-through buying for the first hour or two.

Traders learning how to trade the markets should realize that yesterday was a bull channel, and bull channels behave like bear flags. There is a 70% chance of a downside breakout and then about 20 bars of trading range price action trading. It can be more, but usually that is a reasonable minimum. Since a trading range is likely, the trading tip for today is to be prepared to buy low, sell high, and scalp.

The odds of a protracted swing like the one yesterday are small, but there usually will be at least one or two smaller swings every day. The usual swing trading strategy is to be prepared to buy a reversal up at support and sell a reversal down at resistance if there is a strong candlestick pattern and signal bar.

The candlestick pattern on the weekly chart is still a tight trading range, and the monthly chart is so overbought that this pattern could be a top for many months rather than a bull flag.

Online currency traders saw that the Forex price action in the Euro was strong last night, but its rallies against other currencies was in a broad bull channel. The best Forex trading strategy for today is to be prepared for trading range trading. For traders learning how to trade Forex markets for a living, this means that they will be mostly scalping Forex markets today for 10 – 20 pips

Summary of today’s price action and what to expect tomorrow

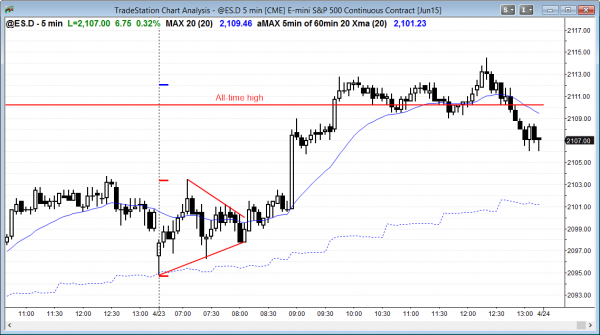

As expected, the S&P Emini futures corrected for about 2 hours today after yesterday’s buy climax. It then broke strongly to the upside, but failed to close at a new all-time high.

The S&P Emini futures contract broke out to a new all-time high today, but sold off at the end of the day from a higher high major trend reversal. The moving average gap bars at 11:50 were likely to lead to the final bull leg before an attempt at the reversal, and the bears were successful at turning the market down. The selloff was strong enough so that the day trading tip for tomorrow will be to look for a second leg down after another test of the all-time high.

I mentioned in the trading room today that tomorrow is Friday and therefore weekly support and resistance are magnets. I also said that today broke out of the 3 month tight trading range on the daily chart and the ioi on the monthly chart. So far, the breakout is not small. The bulls want a big breakout bar for the candlestick pattern on the weekly chart when it closes tomorrow. The bears want the opposite.

Whenever an overbought market reaches an new all-time high, technical traders are ready for either a measured move up or a reversal down. With the weekly and monthly charts as overbought as they are, the odds favor that any bull breakout will not last too long before it fails and the market reverses. Since I am talking about the monthly chart, “not too long” could easily be several months, but the odds of a test of the monthly moving average this year are high.

The Forex price action today was very good for scalpers. There was also a good swing trade for the bears in the USDCAD. Forex trading for beginners should begin with swing trading, like trading the trend in the USDCAD. The best Forex trading strategy for more experienced traders was to be scalping Forex legs with limit orders, especially if a trader could use wide stops and scale in. For example, bulls were buying pullbacks in the EURUSD.

When the Forex market entered trading ranges, bears were also scalping new highs for 10 pips, by selling new highs and scaling in higher. When gaps stay open, as they did today in the EURUSD, Forex scalpers have to be very careful when choosing which new highs they should scalp. They need to be confident that the breakout phase has ended and that a trading range phase has begun.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Good evening Mr. Brooks my name is Mike Adkins and I am new student to your ecourse and price action books. This may seem a very basic question but I was under the impression 2117.75 was the all time high on the emini not 2114.50 the /ES[M5]

contract reached in the last hour of the U.S. session.

I’m guessing this has something to do with the different delivery months, however the SPY didn’t take out the Feb 25th high but the S&P 500 cash did.

I was keeping track of where the all time high was on the /ES[M5] and the SPY. I had no idea the emini hit the all time high today. That somewhat explains the swift reversal. Could you clarify what I’m not getting here. Thanks.

You are right…sort of. That is the highest price ever recorded in the Emini and it occurred on the March contract. Traders use “continuation contracts” for charting because they want to be able to look at monthly charts that go back many years, long before the March contract started trading. If they looked at a monthly chart and it was only the March contract, the chart would only have about 15 bars, and they would not see all of the Emini trading from several years earlier.

Since June was about 7 pts lower on rollover day, all of the prior bars were adjusted down, making 2110.25 the high that traders see and use.