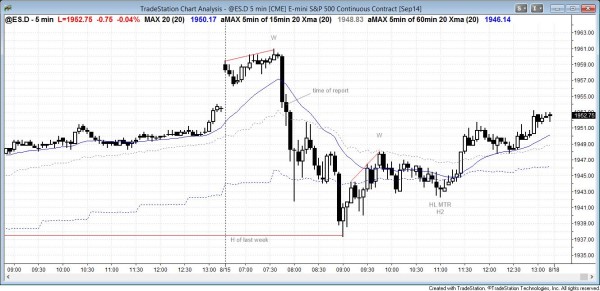

I posted this chart after the close. After gapping up and forming an island bottom on the daily chart, the S&P500 Emini reversed down strongly in a sell vacuum that tested last week’s high. As I have said several times, last week was a weak buy signal bar when compared to the strong bear bar of the week before, and therefore there probably would be sellers above. The Emini went much further above than what was likely, and it reversed down more violently than was likely, but it is still consistent with the premise that sideways on the weekly chart was probable after the weak buy signal bar. The targets for the end of the day today were yesterday’s low and close, yesterday’s high (the gap on the daily chart), and last week’s high. The bears wanted a close below all, as a sign of strength, and the bulls always want the opposite. The bulls were able to create a broad bull channel up from the low of the day, but failed to get back above yesterday’s high.

Time of update 7:48 a.m. PST.

The S&P500 Emini is forming a lower high major trend reversal on the daily chart. It gapped up and pulled back to the top of the July 31 gap and found buyers, creating an opening reversal and a possible low of the day. However, the rally lacked consecutive strong bull trend bars and was therefore more likely to be part of a trading range than a strong bull trend. The Emini had a wedge top trend reversal at 7:40 and day traders shorted as the breakout happened or on the close of the bar. Despite the big tail, it is big enough to control the price action for the next few hours. The Emini is always in short and traders will sell for any reason. The day will probably be either a bear trend day or a trading range day. It is possible that the Emini can reverse up, but when a bear trend bar is this big and the context is good, the chances of a bull trend day are small. The bears hope that this is the start of a lower high major trend reversal on the 60 minute chart.

S&P500 Emini daily and weekly candle charts

The Emini gapped up today on the daily chart and this created an island bottom over the past three weeks, which is a sign that the bulls are strong. Even though last week’s buy signal bar at the weekly moving average was only a doji candle and therefore weak, this week’s candle is a big bull trend bar and it has almost entirely erased the bearishness of the big bear candle of two weeks ago.

Today is a Friday and its price action determines the appearance of this week’s candle. If it closes on its high, this week will be a two bar reversal of that bear candle. This would be a sign that the bulls are strong and it would increase the chances that the Emini will soon reach a new all-time high. If the body of this week’s candle is noticeably smaller than that of the bull candle from two weeks ago, then the bulls might not have done enough to erase that selling pressure. This would still leave open the possibility of a lower high on the daily chart and a second leg down. It obviously would leave the bulls disappointed and create confusion.

Confusion and disappointment are the hallmarks of a trading range. They make institutions sell high and scale in higher, and buy low and scale in lower. They are not certain where the top and bottom are, but they want to make sure that they participate and make at least some profit. They are quick to take profits because the price action makes them lack confidence that any move will last long. When institutions are buying low and selling high, a trading range forms. This is why traders should buy low, sell high, and scalp when the market is in a trading range…they should be doing what the institutions are doing.

However, if today is not a strong bull trend day, then the weekly candle would not be big enough to erase all of the bearishness of two week’s ago. This would then increase the chances that the stock market would go sideways for several weeks and possibly still have another leg down. Even if the S&P500 does create a new high, the bear candle from two week’s ago represents a lot of selling pressure. This increases the chances that the Emini could fail after making a new high and then form a small double top. If so, the minimum target would be a measured move down.

The biggest problem that the bears have is the strength of the monthly bull trend. It is in a small pull back bull trend, which is the strongest type of trend, and this limits the extent of any selloff. The bears usually would have to create several strong bear trend bars to exhibit significant selling pressure before traders would become confident that the bears were strong enough to control the S&P500 for more than just a few bars. Less likely, the bears could create one or two extremely large bear trend bars from a news event, and that strong bear breakout below the tight bull channel on the monthly chart could be enough to lead to a bigger correction.

See the weekly update for a discussion of the weekly chart.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al, love the intramarket updates. It looks like the first attempt for the bulls to cause a bounce has failed. Looks like a second attempt right now. If that fails, what would the first target be for the bears? The measured move of the first leg down from 196.60 to 195.39 the low of that tail?

Yes, if this becomes a successful lower high major trend reversal on the daily chart, the first target would be a leg 1 = leg 2 measured move down.

Looking ahead to next week Monday. Because we had the strong reaction down, does that generally lead to another leg lower? So far monday, would the odds favor a move lower?

Last week, I noticed we closed up nicely on Friday and had continuation of that move early this week.