Emini forming second leg down from wedge top

Updated 6:48 a.m.

Today is rollover day. I usually trade March today because it has more volume. I then switch to June tomorrow.

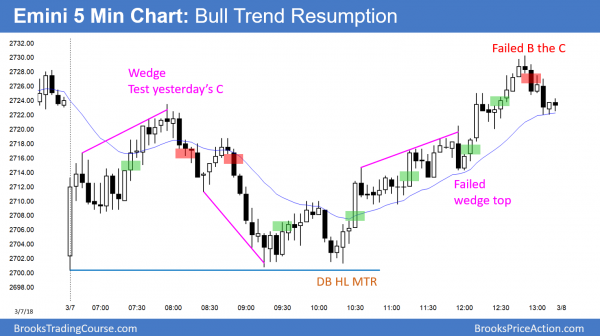

The Emini gapped above yesterday’s high, but reversed down on the 2nd bar. The open is also a test of the top of yesterday’s bull channel. The bulls want a measured move up from yesterday’s double bottom. However, a bull channel usually transitions into a trading range. Therefore, the odds are against a strong bull trend from the open.

Yesterday’s bull channel was tight. Therefore, the best the bears can probably get in the 1st 2 hours is a bear leg in a trading range.

The Emini is currently Always In Long. There are measured move targets up around 2750. Yet, the open is not strong. But, the bears will probably not get a bear trend day. That leaves a trading range day as the likely outcome today. The 1st 4 bars are sideways. That also increases the odds of a trading range. The gap will probably close and the Emini will probably test down to yesterday’s close within the 1st 2 hours.

Pre-Open market analysis

The Emini had a bear reversal day yesterday. It then had a bull reversal from a double bottom. It was mostly a trading range day. It was mostly a trading range day.

Traders are deciding if the 2 day selloff was the end of the 2 legs sideways to down from the month-long wedge rally. The correction does not have as many bars as a typical pullback has. Therefore, there is a risk that there will be one more leg down to 2600 – 2650.

The weekly chart so far has a bull inside bar. It is a High 2 bull flag above the 20 week EMA. Furthermore, the bulls are still on their buy signal from last week. This is true even though last week was an outside down bear bar. It did not fall below the lower of the 2 bull bars in the ii bull flag. Therefore, the bulls are theoretically still long.

Tomorrow’s close is important. If the week closes on its high, it will be a good buy setup for next week. That would increase the chance that the 10% correction is over and that the bull trend is resuming.

Alternatively, if this week is not a strong bull bar, it will increase the odds of more sideways to down trading for the next few weeks.

Overnight Emini Globex trading

The Emini is up 11 points in the Globex market. The 4 day rally is still likely a pullback from the 1st leg down from a wedge top on the daily chart. However, it could be a resumption up from a 2 legged rally. If so, there might be one more new high and a bigger wedge top on the daily chart. The momentum up is good. Hence, there will probably be follow-through buying today.

The bears will try to create a 2nd leg down from the wedge top on the daily chart. There is a measured move target on the 60 minute chart around 2750. Therefore, they will look for a reversal pattern in that area. They hope it would lead to a selloff over the next couple of weeks.

Today and tomorrow are important. If the bulls can close the week on its high, the odds will favor a test of the February 2794.75 lower high within 2 weeks.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

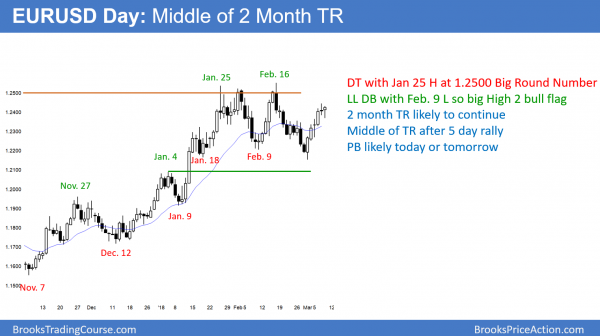

The EURUSD daily Forex chart pulled back from a 5 day bull micro channel. The rally is still just a leg in a trading range.

The EURUSD 5 minute Forex chart has been sideways for 3 days. There were buyers below yesterday’s low overnight. In addition, there was a sharp rally about an hour ago. However, the odds favor a micro double top with Yesterday’s high or slightly higher. Consequently, the bears will look for the rally to reverse down.

Even if the bulls break strongly above yesterday’s high, the rally will still probably reverse down from below the February high. Therefore, the bears will begin to look for sell setups, expecting about a 150 pip selloff.

Because the daily chart is now in the top half of a 2 month trading range, the bulls will take profits above prior highs. In addition, they prefer to buy pullbacks and are less willing to buy a breakout above a prior high.

The odds are that the 3 day trading range will continue today. However, there will probably be a 150 selloff within the next week or so.

Overnight EURUSD Forex trading

The EURUSD daily Forex chart reversed up from below yesterday’s low. This was likely after a 5 day bull micro channel. However, every rally and selloff in a trading range is more likely to fail than lead to a breakout. Consequently, it is more likely that this rally will reverse down before breaking strongly above the February high.

Since the weekly chart is in a bull trend and there is a magnet of a bear trend line above, the odds favor a bull breakout within a couple of months. However, to trade like any one leg up or down will lead to a successful breakout is a low probability bet. This is because 80% of breakout attempts fail when there is a trading range.

Most reversals come from micro double tops and bottoms. The bears will try to create a micro double top over the next few days. The minimum goal would be a 100 – 150 pullback from the 5 day rally.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

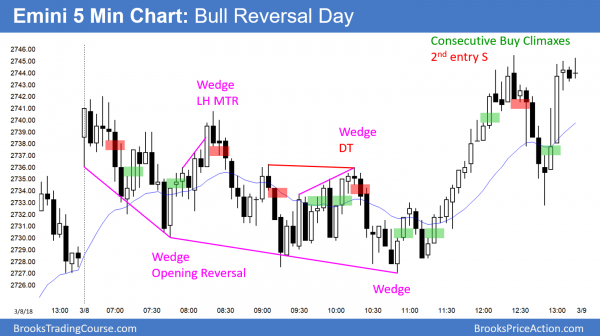

The Emini sold off in a broad bear channel today. It reversed up strongly from a wedge bottom at the end of the day to test the open of the day. After consecutive buy climaxes, it reversed down again. After a late rally, it closed near the high.

Today formed a double top with Tuesday’s high. The bears therefore hope that it is the start of a 2nd leg down on the daily chart. However, it was not a strong bear day and therefore it is a weak sell signal bar. More likely, the Emini will go higher.

Tomorrow is Friday and the weekly chart so far has a good looking ioi bull flag. This reduces the chances of a selloff tomorrow on the daily chart. If the bulls can close the week near the high, it will increase the odds of higher prices next week.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

If I went long above bar 76 (20 gap bar long setup), and bar 77 has a big tail on top, shall I exit my position or hold it to test prior high??

What kind of factors shall I consider here??

Thanks

It always depends on a trader’s goals. In the final minutes, traders typically scalp. The easiest way is to decide on a reasonable profit, like 2 – 4 points, and exit with a limit order. Because of the 4 bear bars, the odds of a new high were less, but it is reasonable to hold and try. These are the 2 reasonable choices. Exiting after the big tail is also ok because it is disappointing. That tail was created by those scalpers who took profits with limit orders 2 points above. That tells you that many traders correctly thought that was a reasonable choice.

Thanks Al

Al,

Could you let me know the software that you have used for screen recorder of your trading room video. Thanks!

Hi Shu,

Al uses the built-in video recorder with his GoToWebinar software.

The BPA Admin guy has some way of removing quiet periods from recording so if interested in that you need to contact him on bpa_admin AT brookspriceaction DOT com