Posted 7:10 a.m.

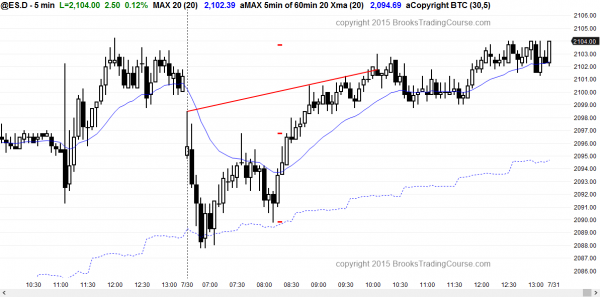

The Emini sold of sharply on the open and became Always In Short. The bulls want the selloff to lead to the low of the day. They hope for an opening reversal up from the micro double bottom at the 60 minute moving average and just above yesterday’s low.

The selling was strong enough so that the bulls will probably need at least a small double bottom or major trend reversal if they are going to get a swing trade up. This means that the first reversal up will probably be sold and that the Emini will then test down again within about 10 to 20 bars. In other words, the best the bulls can reasonably hope to get over the next hour is a trading range.

The bears hope that the selling was strong enough to be followed by a channel down and a bear trend day. However, with this selloff being the first pullback to the 60 minute moving average in a strong 2 day rally, the odds are that the Emini will at least bounce soon. Also, with yesterday being a trading range and tomorrow being the last day of the month, odds of a strong trend day are lower.

At the moment, the Emini is Always In Short, but it is trying to form a low of the day at support. The selling was strong enough so that the best the bulls will probably get over the next hour is a trading range. The bears need a strong breakout below support if they are going to get a bear trend day. As strong as the selling has been, the odds favor a trading range for an hour or so. However, the bears are in control and today still could be a bear trend day. A bull trend day is unlikely without a major trend reversal up forming first.

My thoughts before the open: Daytrading when the price action pattern is neutral

Those learning how to trade the markets should realize that as strong as the rally of the past 2 days has been, it is still only a 50% pullback of the selling of the four days before. Tomorrow is Friday, and tomorrow’s close determines the monthly candlestick pattern, which can be bullish, bearish, or neutral, all based on what happens today and tomorrow. It is currently neutral.

This is a good location for the bears to buy September or October puts, taking a chance that the 10% correction will begin in that window, which it probably will. As always, the probability is higher once the breakout it clear, but the risk will be bigger for the bears because the stop will be further away, and there will be less reward remaining in the swing trade.

The 5 minute rally of the past two days was strong, but the Emini became more two sided yesterday, increasing the chances of at least a 2 hour swing trade down today. It might simply form a trading range in the middle of the July 24 60 minute gap (big bear breakout), and then wait for tomorrow to decide on how the monthly candlestick pattern should appear.

The 5 minute Globex chart has traded down over the past couple of hours and is now down about 5 points. If the Emini opens here, it would be in the middle of tight trading range from yesterday that formed before the FOMC report.

The big reversals up and down and up over the past week have reduced probability for bulls are bears to about 50%. Trading ranges always generate confusion by the lack of follow-through after strong moves. The risk and reward for the bulls and bears is about the same because the Emini is now in the middle of the 7 month trading range. The Emini is neutral and day traders will look for an early swing trade setup in either direction, or a strong breakout with follow-through in either direction.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off sharply to the 60 minute moving average and a test of yesterday’s low, but reversed up in an opening reversal. This was followed by a higher low major trend reversal and a bull trend.

Although today rallied up from the 60 minute moving average, tomorrow’s price action is important, and traders learning how to trade have to be aware that anything can happen. They should not begin tomorrow’s day trading with any thought that either the bulls or bears have an advantage because neither does.

The bulls can rally back above June’s high for the 2nd time this month. The bears can get a selloff back down to the open of the month. The chance of them getting a bear trend down to the low of the month is small.

Best Forex trading strategies

In overnight trading, the Euro was weak and the dollar was strong. The 60 minute chart of the EURUSD turned down from a wedge top a few days ago. It tried to bottom yesterday, but had a bear breakout last night, which is probably a measuring gap. The EURUSD is now testing near the measured move projection and near the bottom of the bull channel that began on July 22.

The 5 minute chart tried to form a wedge bottom around midnight, but there was a bear breakout below the bottom. When that happens, there is a 50% chance of a measured move down and a 50% chance of another bottom attempt. There was a big outside bar on the report a few minutes ago and it is enough of a climax to possibly be the end of the selling for the next couple of hours.

Those who trade Forex for a living expect that the odds are that the 5 minute chart will trade sideways to up for a couple of hours, and that there is probably very little left on the downside for the next couple of hours. Although they will be willing to swing trade, they expect that any rally will probably be less than 50 pips, and that it will probably stall near the gap down at around 1.0990.

The 60 minute chart of the USDJPY broke above a tight bull channel of the past few days and above the high from 2 weeks ago. The 5 minute chart just had a big outside bar on the report, and it might be a buy climax and end of the rally for the next couple of hours.

Since the bull channel is so tight on the 5 an 60 minute chart, those learning how to trade the markets should realize that the odds of a trading range are greater than a significant reversal when there is a buy climax at the end of a tight bull channel. There is support down to around 124.00, and day traders will be looking for 10 – 20 pip Forex scalps in both directions, and possibly a small swing trade down.

The 5 minute chart of the USDCAD also had a buy climax a few minutes ago. The bears are hoping for a lower high major trend reversal on the 60 minute chart, but the trading range of the past couple of weeks will instead probably continue. Online day traders will be mostly be scalping Forex trades today. The other major Forex crosses were in small trading ranges last night.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al I have a trade management question. I entered short on bar 16, what I read as a failed high 2 from the move up from 60 ema test or a second entry from the 15 ema test. I had a two point target on both contracts. When bar 17 formed, I considered that poor follow through and moved my stop to above bar 17, but then took the next opportunity to scratch the trade on bar 18. Bar 18 continued to hit my two point target. Was this correct? If not, what would have been the management here?

Thanks.

I mentioned in the room that I thought it would probably test below the bar 7 H, but that it would then probably try to form a HL MTR. Whenever I take a trade and it violates my premise and I can get out around breakeven, I usually exit. However, in this case, had I sold, I would have exited above 17 or 16 because the logic was good. It was a 2nd entry short at the moving average after a LH in what was likely a TR.