Emini bulls want breakout above 2700 and bull trend resumption

I will update again at the end of the day

Pre-Open market analysis

The Emini had a trading range day yesterday. Since it closed just below the open, it was a bear doji bar on the daily chart. There was therefore no follow-through buying after Friday’s strong rally. Hence, the bulls need at least 1 – 2 bull days this week for traders to conclude that this rally will continue up to the all-time high.

They especially need a strong break above the April 18 major lower high of 2718.00. Without that, traders will assume that the trading range is still in control. That means that the bears would still have a 40% chance of a break below the April low.

Trump is supposed to announce at 11 a.m. PST today his decision about pulling out of the Iran deal. Day traders should be careful or flat before the announcement. Whether or not he pulls out, the announcement could lead to a big move up or down. Therefore, the reaction might be similar to that after an FOMC announcement. If there is a surprisingly big breakout at 11 a.m., there will be a 50% chance of a big reversal in the 1st 10 minutes. Most day traders should wait at least 10 minutes after the announcement before resuming trading.

The daily chart is at the apex of a triangle and therefore in breakout mode. Consequently, day traders have to be ready for a big move up or down. Trump’s announcement could be the catalyst for a breakout above last week’s high or below last week’s low. Furthermore, the breakout could lead to a swing lasting a week or two.

Overnight Emini Globex trading

The Emini is down 6 points in the Globex market. If it trades below yesterday’s low today, it would trigger a sell signal on the daily chart. However, it if trades above last week’s high, it would trigger a buy signal on the weekly chart.

Both signal bars are weak and therefore unreliable. Instead of buying with a stop above last week’s high or selling with a stop below yesterday’s low, traders should wait to see how strong the breakout is and then decide on whether to trade with it or against it.

Yesterday was a trading range day. Trump’s possible 11 a.m. announcement would be a likely catalyst for a big move up or down. Therefore, today might continue trading range trading up to the report. If there is an announcement, especially if he pulls out of the Iran deal, there will probably be a trend up or down in the final 2 hours today.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market parabolic wedge sell climax, but no minor bottom yet

The EURUSD daily Forex chart is in a strong bear trend. Since the selloff has been in a series of big bull bars interrupted by 3 bull bars, it is a parabolic wedge sell climax. There is no sign of a minor reversal up yet.

The EURUSD daily Forex chart is in a free-fall. Since the selloff has a series of big bear bars interrupted by 3 pause bars (bull bars), it is a parabolic wedge. This is a sell climax. The selloff will therefore likely have at least a 150 pip bounce beginning within a week or so.

However, the selling is so strong that the reversal up will be minor. That means that it will be a bear flag. Trapped bulls will use it to sell out with a smaller loss and bears who missed the selloff will short it. Consequently, it will lead to at least one more leg down.

The next support is the December 12 low of 1.1717. A more important support is the November 7 low of 1.1553. The bear trend will probably get there within a couple of months.

Sell climaxes can last much longer than what seems possible. Therefore, this one might continue down to the December or November support levels before it ends. Parabolic wedges typically bounce after 3 legs. This sell climax now has had 4. That increases the chance of a minor reversal beginning within the next week.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart sold off 70 pips in a tight bear channel overnight. While there is no bottom yet, there is a 70% chance of a bull breakout above this channel today. That would convert the 5 minute bear trend into a trading range.

Since the daily chart is in a parabolic wedge sell climax, the odds are that there will be a sharp rally on the 5 minute chart within a week. Trump says that he will announce today at 11 a.m. PST whether he is pulling out of the Iran deal. That could be the catalyst for a rally on the 5 minute chart and a 1 – 2 week bounce on the daily chart.

As long as the 5 minute chart is in a bear trend, day traders will continue to sell rallies and take profits at new lows. The overnight bounces have been too small for the bulls to scalp. However, as the bear channel loses momentum, the bulls will begin to buy below prior lows for 10 pip scalps.

Traders should be careful around 11 a.m. PST today because of Trump’s possible announcement. It could lead to a big move up or down. It is important to know that, even though there is a sell climax on the daily chart, there could be a final big plunge before it ends.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

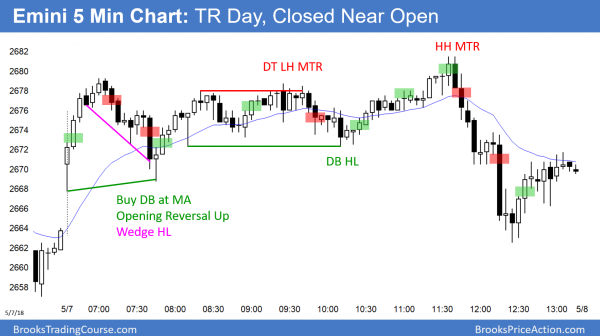

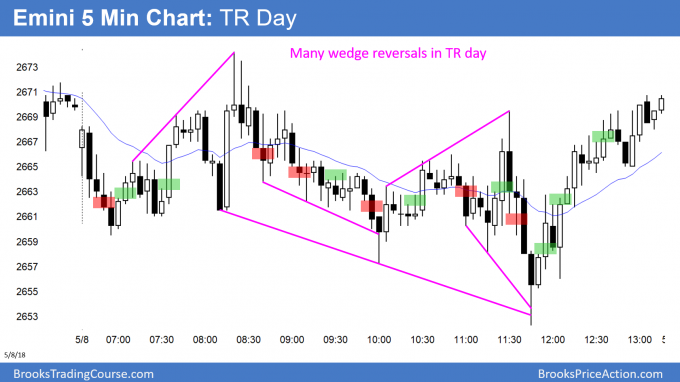

The Emini was in a trading range today and reversed down from a brief rally after Trump’s 11 a.m. PST announcement on Iran. It then reversed back up and formed a trading range day.

By trading below yesterday’s low, the Emini triggered a sell signal on the daily chart. However, today was another trading range day. It is a weak buy signal bar for tomorrow on the daily chart. The Emini is at the apex of a triangle on the daily chart and therefore in breakout mode.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.