Emini bull breakout ahead of next week’s FOMC meeting

I will update again at the end of the day

Pre-Open market analysis

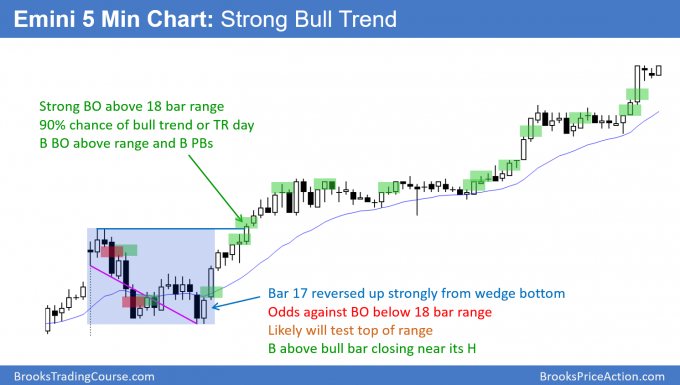

Yesterday was another bull trend day. The odds are that the rally will continue up to the March high, just above 2800. However, if so, there will probably be 1 – 2 day pullbacks along the way. Since most days in a bull trend on the daily chart have bull bodies, traders will look for an early low every day.

Overnight Emini Globex trading

Today is rollover day, but most day traders will continue to trade the June contract. The Emini is up 6 points in the Globex session. Since yesterday was a buy climax, there is only a 25% chance of a strong bull trend today. Yet, there is a 50% chance of some follow-through buying within the 1st 2 hours. Finally, there is a 75% chance of at least a couple hours of sideways to down trading beginning by the end of the 2nd hour. After 4 consecutive bull trend days, a strong bear trend day is unlikely.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex strong bear rally to resistance after extreme sell climax

The EURUSD daily Forex chart rallied strongly for 7 days. The rally has been a breakout for 4 days. However, it is now at the resistance of the 1.1800 Big Round Number, the 20 day EMA, and the May 22 sell climax high. It will probably go sideways for a few days.

Overnight EURUSD Forex trading

The EURUSD daily Forex chart had extreme consecutive sell climaxes over the past 2 months. However, the bulls got a strong reversal up last week from below major support. Since the rally has been surprisingly strong, last week’s low will probably be around the bottom for the next 2 months.

As strong as the rally has been, the 1st reversal up after a tight bear channel has an 80% chance of being minor. While a bear flag and a resumption of the bear trend within a couple of weeks is unlikely, a trading range is very likely. This rally is probing for the top of the range.

It is currently at major resistance, but the May 14 sell climax high around 1.20 is even stronger resistance. The momentum up might be strong enough to reach that level before the developing range has its 1st leg down.

Because the rally is now at the 1.18 Big Round Number, the 20 day EMA, and the May 22 sell climax high, it is likely to stall. This is especially true because the daily chart went sideways here a few weeks ago and next week’s FOMC meeting creates uncertainty.

Overnight EURUSD Forex trading

The EURUSD 5 minute chart rallied another 50 pips overnight. Since the daily chart is at resistance, the odds favor a trading range today. The chart has been in a 25 pip range for the past 6 hours, and a strong rally from here is unlikely today. Day traders will mostly scalp.

The Bears willing to hold for several days will begin to sell above prior 5 minute highs and hold for a 30 – 50 pip pullback. In addition, the bulls will look to buy below 1.17 for a 50 – 100 pip test back up.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

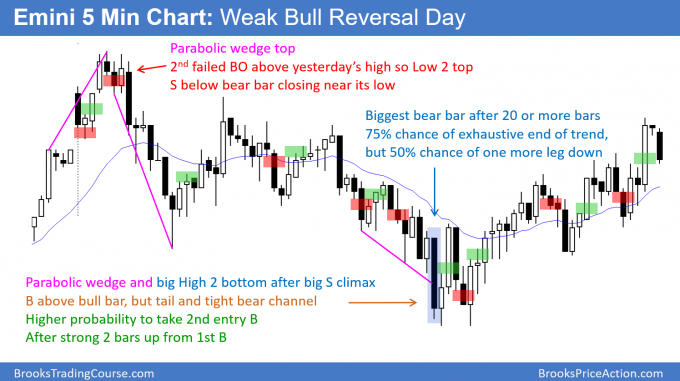

After yesterday’s buy climax and today’s brief buy climax on the open, today sold off to the 60 minute EMA. It then had a bull reversal late in the day, but closed below the open.

The Emini sold off in a Spike and Channel bear trend after yesterday’s buy climax. It reversed up late the day. The day was a bear doji on the daily chart, and therefore it is a weak sell setup after 4 bull days. Hence, any reversal down will probably be minor. The Emini might enter a tight trading range ahead of Wednesday’s FOMC meeting, but the odds still favor a test of the March high and 2800 over the next couple of weeks.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Thank you for all the replies and appreciate the feedback and suggestions.

I would not bother spending time finding trades with 1 point SL.

You are going to burn out emotionally and fear will clear your account before you know it.

And reason why most traders can not make it is down to emotions.

You are better off just waiting for best set ups where SL is reasonable and just go for it.

When you study trades, which Al marks on the chart most of them has minimum PB and great advantage of good trades on stop is, they let you out on be, when they go against you, if you manage it right.

If you really wanna do it, just take best set ups and hope for best, but do it correctly.

For example, I went long on stop bar 26 (not great) went long on limits 2 points lower 2nd contract and got out on be. When you do right thing you manage to avoid a loss most of the time.

If you wanna go for limit orders, I would prove yourself first you can do it in sim.

Hi Al,

Question about probabilities from the morning update (a 25% chance of strong bull trend, 50% chance of some follow-through buying… and a 75% chance of a couple of hours of sideways to down trading…) –

Why the total percentage of the 3 possible scenarios is 150% instead of 100%?

Thank you

Let me answer with an example. There is a 50% chance of an early rally and a 75% chance of at least a couple hours of sideways to down trading that begins by the end of the 2nd hour. If there is a strong rally for the 1st hour and then a 3 hour selloff, that would be 50% + 75% = 125% if a trader simply added the numbers. But the events I described happen in a sequence and not at the same time. Therefore, adding the percentages is not correct.

Hi Al,

This is kind of a generic question,but it comes up because I’ve been a part of the webinars just recently. What do you recommend for someone who is trading one contract with an unwillingness to take more than a 4-5 tick risk? There doesn’t seem to be many trades to enter, unless you are doing limit orders and you repeatedly say beginners should not do limit orders. I guess I know what you will say, but I think I just want a confirmation of it. I believe you will say that because of those parameters i just need to wait until I find a trade that matches them. Obviously those of us with small accounts will have less choice when it comes to trades we can enter. Or do you suggest I take more risk and rely on that common sense stop?

Hey D L,

I know you are waiting for Al’s response but I have heard him answer this question in the room many times before so I thought I would share what I think he would say. I’m sure you still want to hear what he has to say but I thought I would weigh in in the meantime.

His 2 most common responses to this question are:

1) If you are not willing to risk to where the true stop should be, you shouldn’t take the trade. Having your stop anywhere in between is what Al calls a skunk stop (in the middle of nowhere). He usually recommends for traders to wait for a setup that would have a risk that they would be willing to accept (which is what you mentioned in your question)

2) You can trade FOREX which allows you to practice with much smaller size and use the appropriate stop. Or, if you want to follow along with Al’s updates and analysis, you can trade SPY which is pretty much identical to the E-mini but allows traders to trade with smaller size until they are able to use the correct stop in the E-mini.

Hope this helps!

I agree with Faizal. I think that risking only 4 – 5 ticks is not practical. In quiet days, there is often a bull flag just above the EMA with a small buy signal bar. Then, a trader has a good chance of not having a 4 tick stop get hit and catching a swing up. The same is true of a bear flag in a small pullback bear trend. However, if a trader is looking to actively day trade, he has a much better chance of making money by using the stop that the market is telling him he needs instead of the one he wants. The math is best if a trader can risk to below a buy signal bar or above a sell signal bar, and that is usually more than 4 ticks.