Emini bear flag pre-election breakout attempt

Updated 6:44 a.m.

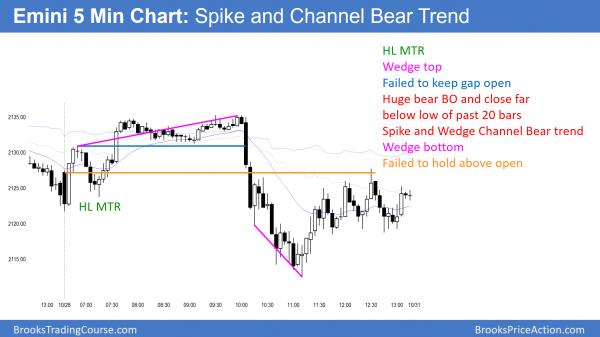

The Emini sold off on the open, but reversed up strongly. It is trying to form an early low of the day after yesterday’s big outside down day at the bottom of a 2 week trading range. Because yesterday’s bear channel was tight, this 1st reversal up will probably be minor. Therefore, the bulls will probably need a test down and a 5 – 20 bar trading range. If they get that, they might be able to create a convincing major trend reversal.

While it is possible for the reversal up to continue up all day, it is more likely that the Emini will go mostly sideways. The buy signal bar was big, so therefore the risk is big. It formed in a tight bear channel and therefore the probability of a bull trend at this point is low. As a result, the Emini will probably have an early trading range.

At the moment, it is Always In Long, but a trading range is likely. The bears are hoping for an Opening Reversal down from the moving average. While possible, the reversal up at the bottom of a 2 week trading range make that unlikely. In conclusion, the Emini is finding support at yesterday’s low and it will probably trade higher, but it will also probably need a major trend reversal 1st.

Pre-Open Market Analysis

Yesterday sold off strongly on the open and again in the final hour. It opened below Wednesday’s high and closed below its low. Yesterday was therefore an outside down bear reversal day. This is therefore a sign of strong bears. Furthermore, it increases the odds of a gap down and bear trend day today.

The daily chart has a bear flag just below the moving average. In addition, the gap above the July 2015 high is still open. While these all are good for the bears, there is no breakout. Yet, they are enough to make the probability of a successful bear breakout below the 4 month triangle slightly greater than a bull breakout.

Because the monthly chart is bullish and the bulls have prevented the reversal for months, if the bears break below the double bottom on the daily chart, the Emini will probably fall to around 2050 in just a few days.

Presidential election uncertainty

Everyone is uncertain about the election. If certainty increases enough before the election, there could be a big breakout within the next week. Yet, the market might not pay any attention to the election and the trading range might continue for several more months. Because the Emini is at a triangle apex, the odds are that there will be a breakout within a couple of weeks. Until then traders expect every swing to be followed by an opposite swing. As a result, most days will continue to be trading range days.

Emini Globex session

The Emini sold off overnight, but then reversed back to just above yesterday’s close. While it might gap down, the gap would be small and it probably would quickly close. Because yesterday was an outside day in a trading range, the odds are that today will be mostly sideways. Furthermore, inside days often follow big outside days. This is especially true in trading ranges.

Yesterday ended with a sell climax. There is therefore only a 25% chance of a strong bear trend day today, Yet, there is a 50% chance of follow-through selling in the 1st 2 hours. In addition, there is a 75% chance of at least a couple hours of sideways to up trading, beginning by the end of the 2nd hour. In conclusion, today will likely have a lot of trading range price action. Also, this price action will probably continue up to the election. Yet, the Emini will probably breakout out of the triangle within the next few weeks.

Forex: Best trading strategies

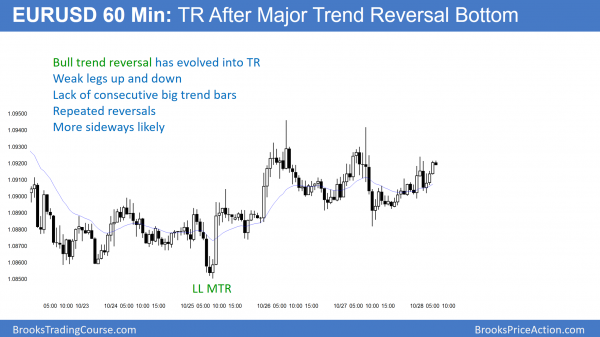

As is usually the case, the bull trend reversal after the sell climax has evolved into a trading range.

The EURUSD 60 minute chart has been unfolding as it usually does after a Spike and Channel sell climax. It sold off yesterday and formed a 2nd leg down. The selloff was strong enough for more follow-through selling. Most noteworthy is that the selloff did not reach the October 26 higher low. Therefore, there is still a magnet below. As a result, the odds are that the EURUSD will have to test it.

There is no sign that the trading range will end soon. Hence, the odds are that it will continue for at least a couple more days. Traders might be waiting for the election. Yet, if there is a strong consensus about the results before the election, there could be a breakout up or down next week.

Overnight Forex sessions

The EURUSD has had a weak rally over the past 3 hours. It is testing the top of the 5 day trading range. Because the rally is weak, it will probably fail to break far above the range. Hence, the trading range is likely to continue today. Since the 2 week selloff was so quick and without any pullbacks, the EURUSD will probably have to go sideways more before it can decide whether to reverse up to test the breakout point or resume down to lower support.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off strongly from a wedge top at the top of the 3 day trading range. It reversed up strongly from below last week’s low, and ended in a trading range.

While there was a strong selloff to below last week’s low, the Emini reversed up from a nested wedge bottom to test the open of the day. A Big Down Big Up pattern usually leads to a trading range, as was the case today.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hello Al,

How do you protect against such breaking news as the FBI Clinton probe that’s playing out right now. I was long on AAPL when that news broke out and got me completely off guard. Do you ever stay in a trade after the day is over.

I only watch the charts. I saw the big selloff in the Emini and sold. I never care what the news is. I only care about how the market reacts to the news, or to anything. If it is going down, I sell.

Hi Al, do you change your profit target when you see a big Emini selloff like today’s? Use trailing stops? I’m trying to get a sense for the strategies you use to maximize return on such rapid moves. I found it difficult today to sell, close for a 2-3 pt gain, then sell again when the market’s moving so fast for fear of getting trapped.

Hello Al, The EUR/USD is breaking up . What do you think it that breaking big enough to get follow through and end up the TR

Yes, it is big enough for at least a little follow-through, but there are lower highs around 1.1000 – 1.1050 and they should stop the rally, at least for a while.

Thank you so much.

Thank you Al

Al, I’ve only been buying low. I have criteria that defines an “extension of price to the downside”, and I get long there with a 10 point stop. I book profits at vwap. I allow myself 1 scale in and it has to be at least 4 points below my entry and preferably more. My logic is that we don’t get trend days often; and they don’t close them on the lows often. Those would be the only days I will have a bad day and possibly take a max loss. It seems to be working lately. Is this because the market has been chopping for the last 4 months? Will this edge disappear in another market cycle, say a bear market? Thanks for all!

Everything works some times, and then the opposite works. This 4 month TR is a great environment for buying low, selling high, scalping, and using wide stops. Because the Emini is at the apex of a 4 month triangle, it will probably break out within the next few weeks. When it does, the breakout will be clear, big, and fast, and limit order traders betting on reversals will probably lose big on one trade. They will then change to breakout mode, trend trading.