Emini 50% retracement of 2 day selloff ahead of FOMC

I will update again at the end of the day.

Pre-Open market analysis

Yesterday retraced about half of the 2 day selloff. The odds were that the Emini would bounce at the 20 day EMA and try to get more neutral ahead of today’s FOMC meeting.

However, the 2 day selloff was surprisingly strong. A Surprise reversal usually has at least a small 2nd leg sideways to down. But, sometimes there is a bounce that retraces all of the selloff before the bears get their 2nd leg. Therefore, the odds are that traders will sell this rally, even if it tests Friday’s high. The bears are trying to create a lower high major trend reversal and head and shoulders top on the 60 minute chart.

Because yesterday had a strong rally, there is a 50% chance of some trend resumption up early today. However, the Emini is now around the middle of the 2 day selloff. It will therefore likely go sideways ahead of today’s FOMC meeting.

Overnight Emini Globex trading

The Emini is trading about 6 points below yesterday’s close. It will therefore likely open within yesterday’s 4 hour upper trading range. The legs up and down yesterday were big enough to make at least one swing likely again today. But, today’s FOMC meeting is an important catalyst. Financial markets usually do not have big trends on the day before major news announcements.

A 1 – 3 day rally was likely after the 2 big bear days. The odds favor a test of Monday’s low. I said last week that a 50 – 100 point selloff was likely. Therefore, the Emini will probably form a lower high this week and have a 2nd leg sideways to down. While that can begin today, it likely will wait until after the FOMC report. Furthermore, today’s report could lead to a rally to Friday’s high at around 1850 before there is a 2nd leg down.

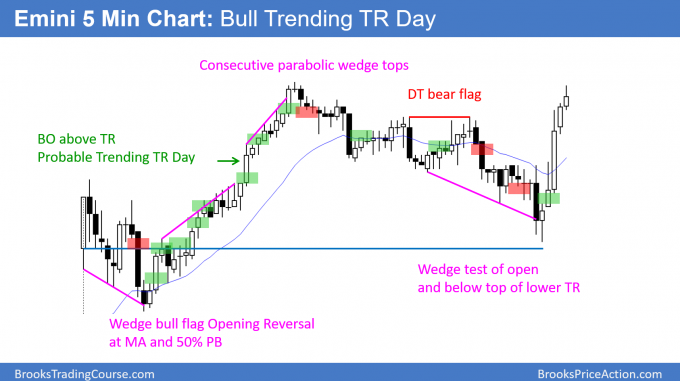

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not in a position at the moment, these entries would be logical times for him to enter.

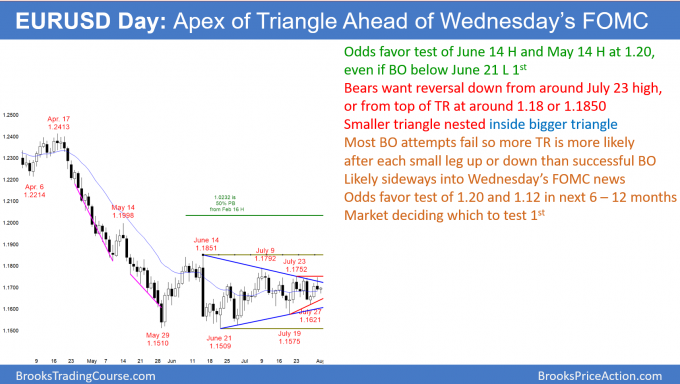

EURUSD Forex at apex of triangle ahead of Wednesday’s FOMC news

The EURUSD daily Forex chart has nested triangles within a 3 month trading range. Yesterday reversed down from a breakout above the top of the bigger triangle. There was no strong selloff today yet and the chart is still in breakout mode.

The EURUSD daily Forex chart is at the apex of nested triangles that are within a 3 month trading range. Yesterday reversed down from a breakout above the bear trend line of the bigger triangle. Today, so far, is a bad entry bar. The bears now want a successful breakout below the triangle after the failed bull breakout. But, the bulls see the 2 day selloff as a pullback from the breakout attempt.

Trading ranges are constantly trying to breakout, but 80% of attempts fail. All financials markets will probably go sideways into today’s 11 a.m. FOMC announcement. While traders hope that the news will lead to a successful breakout, the odds still favor a continuation of the 3 month trading range. There is no breakout until there is a clear strong breakout with follow-through. While that will probably happen soon, traders are unwilling to hold onto positions for more than a couple of days until it occurs.

Overnight EURUSD Forex trading

Today is the entry day for the reversal down from the top of the triangle on the daily chart. Yet, the 5 minute chart has been in a 30 pip range overnight. There is no sense that the price is horribly wrong and that the market has to quickly move to a new price. Today’s 11 a.m. FOMC announcement is the next obvious catalyst. The extremely tight trading range of the past 2 weeks will probably continue at least until then. Therefore, day traders will keep scalping.

A breakout can come at any time. But, unless it is strong and has good follow-through, day traders will keep looking for reversals.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

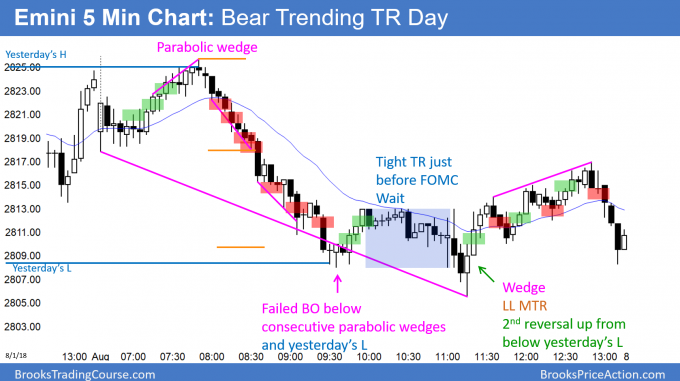

Here are several reasonable stop entry setups for today. I sometimes also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not in a position at the moment, these entries would be logical times for him to enter.

The Emini formed an outside down day yesterday. It was also a bear trending trading range day. Tomorrow has an increased chance of being an inside day. It would then form an ioi breakout mode setup.

The odds still favor a 2nd leg down before a break above last week’s high. But, there will probably be a new all-time high within a couple months.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

I didn’t get in the bear trend until bar 24

I assume you got in early at bar 17. I initially thought today will be a range day, it broke through a number of key support.

The price action remains same as it always, but the higher volatility definitely made me miss a few trades since the bars changes quick compare with price action in 2017

On that H2 right at the EMA where Al marked it as a long entry. Where would be a reasonable place to exit.

If you are talking about the one at 7 a.m., I mentioned in the room that many bulls would exit below bar 16 at the high because it had a bear body, it was a failed breakout above yesterday’s high, the rally was a parabolic wedge, and it was near bar 18 when the market often reverses. Alternatively, a bull could have exited below the bear bar 2 bars later because it closed near its low and it was the 3rd consecutive bear bar.

isn’t the report today?

Yes, you are correct. The FOMC Statement is today. Report edited for Al.

Thanks.