Dow 20,000 January effect all-time high breakout

Updated 6:55 a.m.

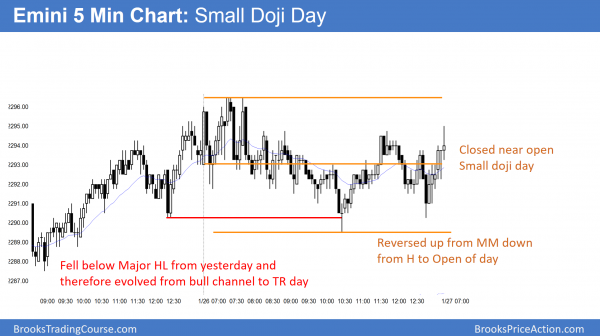

The bears made money selling above highs yesterday. That therefore increases the chances that the bull trend will transition into a trading range. Because the bulls keep getting higher lows, the bull trend is still in effect. Therefore, the bears need to get below prior major higher lows for traders to conclude that the bull trend has become a trading range.

Bears made money selling above yesterday’s high. In addition, they made money selling with a stop below the 2nd bar. These are signs of a transition from a bull trend into a trading range.

The Emini reversed down and then up. This means that it is in breakout mode. Furthermore, it increases the chances of a trading range for the 1st hour or two. Because the odds are against a strong bull trend after yesterday’s broad bull channel, today will probably be a trading range day. It is in the process of deciding where the top of the range is. A trading range has legs up and down, and that therefore is likely today.

Pre-Open Market Analysis

The Emini had good follow-through buying after Tuesday’s breakout to a new high. Yet, when a market gaps up to a new high, it is more likely to go sideways for 2 – 4 days than continue straight up. As a result, the odds are that today will not be a strong bull trend day. Therefore, the Emini will probably begin to have deeper pullbacks and more trading range price action.

Since the 2 day rally has been strong, the odds are against a strong bear trend. Therefore, the best the bears will probably get is a day and a half of sideways to down trading. Because the rally has been so strong, the bears might only get a pause for a couple of days.

Overnight Emini Globex trading

The Emini continued up overnight, but then reversed back down at 2299.50. It therefore saw the 2300 Big Round Number as resistance. While the odds still favor higher prices, the buying has been extreme. Hence, the 2 day rally is a buy climax. As a result, the Emini could pull back for about 10 bars on the 60 minute chart. Therefore, about a day and a half on the 5 minute chart.

While major tops can come from buy climaxes, strong bull trends rarely become bear trends without forming at least a micro double top. Therefore, bulls will probably buy the 1st reversal down.

The bull channel yesterday was broad. That is a weakening of Tuesday’s trend. It therefore increases the chances of a minor reversal down and the formation of a trading range. The overnight selloff might be the start of that process. While a continued bull trend is possible, the start of a trading range for a day or two is more likely.

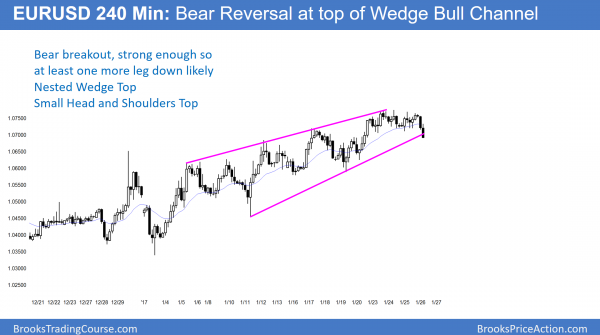

EURUSD Forex Market Trading Strategies

The EURUSD 240 minute chart reversed down from a wedge top overnight. The odds favor a test of the 1.0600 higher low, and then a trading range.

The EURUSD 240 minute chart had a nested wedge at the top of a wedge bull channel. The rally on the daily chart was weak. Hence, the odds favored a test down today or tomorrow.

Ovenight EURUSD Forex trading

The bears created a reversal down overnight. Since the selloff reached the bottom of the wedge bull channel, the bears will take partial profits. Furthermore, aggressive bulls will buy for scalps. Yet, the overnight selloff was probably strong enough so that bears will sell the 1st reversal up. Therefore, the odds are that there will be at least a 2nd leg down. Furthermore, when there is a reversal from a wedge top, there are usually 2 legs down. In addition, the selloff usually reaches at least one of the major higher lows in the bull channel. Finally, the entire pattern usually evolves into a big trading range.

Because there is always an opposite argument, traders have to be prepared for a failed bear breakout and a continued bull channel. Yet, the breakout and context are good enough so that the bull case has only a 40% chance at the moment.

In conclusion, the 240 minute bull channel is probably in the process of evolving into a trading range. In addition, the selloff will probably work down to the closest higher low, which is around 1.0600.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After a 4 hour endless pullback on the open, buyers came in after a dip below a major higher low from yesterday. The Emini rallied back above the open, but remained in a small trading range day. Since it closed at the open, it was a doji day.

Tuesday was a tight bull channel. Yesterday was a broader and therefore weaker channel. The odds were that today would continue to weaken and become a trading range day, which it did.

Because the rally was so strong this week, the odds still are that the bulls will buy the 1st reversal down. Furthermore, this is true even if there is a gap down and an island top. Hence, the odds still favor higher prices.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

I wish in future after you finish your cours project if you can combine the trading room with Forex So we are Forex trader’s we will able to took upon your shoulders and to how you look to price live.

Thanks You.

Thank Al . I entered EURUSD short base on your analysis here and I and now my position shown some profit running .

I stop out of my short position as price continue higher above 17-01-2017 high where i replace my stop.

Did my stop was place in right area or not , Thanks

I think the EUR/USD still in broader channel because still making higher lows on 240 hours may the price will test the top the tight trading range once again .

Al,

Thank you for the early update. I think the bull could possibly continue after the mentioned trading range, pullback do to the friendly business climate. I am waiting to see what happens of course. Your updates are great.