Donald Trump’s stock market effect

Updated 6:46 a.m.

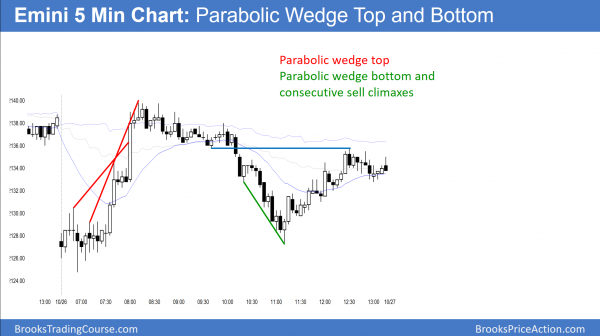

While the Emini opened with a big gap down, 2 of the first 3 bars were dojis. Therefore, there was no sense of urgency.

Because this is a bear breakout below bear channel, there is a 75% chance of a sideways to up move to the top of the bear channel. Furthermore, is usually begins within 5 bars. Since the bear channel is also present on the 15 minute chart, the reversal might take five 15 minute bars before it begins.

This does not mean a bull trend day. Yet, it makes a big bear trend day unlikely. Because of the initial small bars and the 4 month trading range, most likely today will have a lot of trading range price action, even if there is an initial trend.

At the moment, the Emini is Always In Long, but the bulls need big bull trend bars if this is going to be a big bull trend day. More likely, it will be mostly a trading range day. Furthermore, the dojis increase the chance of a 1 – 2 hour trading range before a swing up or down begins.

Pre-Open Market Analysis

Since yesterday traded below Monday’s low, it triggered a sell signal on the daily chart. Furthermore, it closed the gap above Friday’s high. Yet, the Emini is still at the apex of a 4 month trading range. It therefore is still in Breakout Mode. The odds are slightly greater for a drop below the July 2015 high of 2084.50 than for a new all-time high. Especially relevant is that the Emini will probably reach both targets over the next few months. Whichever one it hits first will probably provide a setup for a reversal to the other.

While October 26 to November 5 is a reliably bullish time of the year, the gap below on the monthly chart is a strong magnet. Furthermore, the election results could surprise traders. If Trump were to win, or if the democrats get the House, the surprise could cause a big breakout up or down. As a result, despite the bullish seasonality, the Emini could quickly fall to 2050 over just 2 – 5 days.

Because of the persistent trading range, day traders will bet that every day will be another trading range day until there is a strong breakout.

Overnight Emini Globex trading

The Emini is down 7 points in the Globex session. Hence, if it opens here, it will gap down and create a 2 day island top. Because gaps and island tops and bottoms are common in trading ranges, they lack predictive value. They are therefore simply legs within the range.

Yesterday was the entry bar for a breakout below an 8 day bear flag at the moving average. Furthermore, it was a small bar. Hence, the bears need one or more big bear trend bars before traders will believe that this is the start of a 2nd leg down from the all-time high.

Since the Emini is still in its 4 month trading range and every move has reversed within a few days, the odds are that this pattern will continue. Yet, the triangle since the August 23 high is now tight. The Emini will probably break out soon.

Forex: Best trading strategies

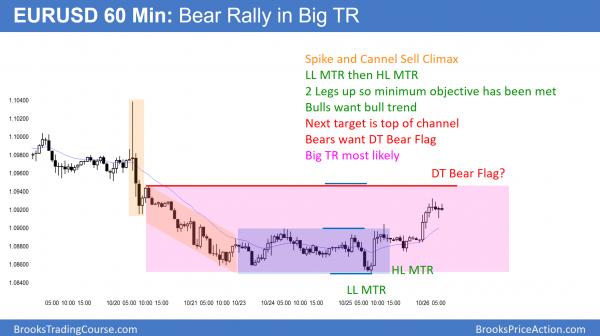

The 60 minute EURUSD Forex chart has met the minimum objective of the Lower Low, then Higher Low, Major Trend Reversal. It has had at least 2 legs and ten bars up to around a measured move.

The 60 minute EURUSD Forex chart reversed up from a Final Bear Flag yesterday. Yet the reversal lasted only 1 hour. While the bulls might get a couple days of sideways to up trading, the daily chart is still in a bear trend. Hence, bears will look to sell a rally.

Because of the uncertainty of the upcoming election, the EURUSD chart might enter a trading range over the next 2 weeks.

Overnight EURUSD Forex trading

Because of the Spike and Channel Sell Climax on the 60 minute chart last week, I have been writing that there would soon be a 2 legged bear rally. The EURUSD market met the minimum objective. There is still some room to the top of the channel. Yet, it could easily pull back 20 pips to test the breakout point at the top of the trading range.

When there is a major reversal, the EURUSD Forex market is more likely to begin a big trading range than a bull trend. That is what is likely here. Hence, this rally is a probe to find the top of the range. It is often at the top of the bear channel in the Spike and Channel bear trend. There, the rally will probably test down today or around 20 pips higher, at the 1.0945 top of the bear channel.

What follows a Spike and Channel Bear Trend?

The bears want a double top bear flag with that October 20 lower high. In addition, they then want a measured move down from below this week’s low, which is the neck line of the double top. The bulls will buy a reversal down. Hence, they will try to create a protracted series of higher low. That would therefore be a bull trend. Yet, what usually happens is a deep selloff to higher low, and then one more rally. At that point, both bulls and bears will be disappointed and confused. As a result, the EURUSD would be back in a trading range and in breakout mode again.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After a parabolic wedge rally, the Emini sold off in to a parabolic wedge bottom.

Today had a strong rally and a strong selloff. Hence, this was a Big Up, Big Down day. It therefore creates confusion, which increases the chances that tomorrow will again be a trading range day. The market is still at the apex of a 4 month triangle, but will probably break out soon.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.