Posted 7:03 a.m.

The Emini had a buy climax at the open that reversed down strongly from a wedge top. The 2 strong bear bars made the Emini Always In Short. Since yesterday’s bull channel was so tight, the odds are that the selloff will lead to a trading range rather than a bear trend. A trading range has at least one bear leg and one bull leg. This means that the selloff will be followed by a rally at some point. Also, because the rally yesterday was so strong, the Emini might just go sideways for 2 or more hours, and then decide between trend resumption up or trend reversal down. The 1st targets are the bull trend line and the higher low. Below that, there is the 60 minute moving average and the open of the month.

There is a 25% chance that this selloff will turn into an opening reversal up from the moving average and create an early low of the day. There is a 75% chance that the Emini will be sideways to down for at least a couple of hours. There is also a 75% chance that there will be a 1 – 2 hour rally at some point.

Pre-Open Market Analysis

S&P 500 Emini: Day traders expect a pullback in today’s price action

The Emini had an exceptionally strong rally yesterday with only brief pullbacks fr the final 2 hours. This is unsustainable and therefore climactic. There is a 50% chance of continuation on the open for 1 – 2 hours, and only a 25% chance that this strength will continue all day. There is a 75% chance that there will be at least a 2 hours sideways to down move that starts by the end of the 2nd hour. It often begins on the open, and sometimes at the end of yesterday. The final 10 bars of yesterday might be the start of the trading range.

Online day traders will be ready to buy early strength, in case there is a rally for an hour or two. Although they will also be ready to sell a reversal down, the channel up was tight. This means that the 1st reversal down will probably be minor, which means that it will probably be bought. The bears usually need to create more selling pressure within a trading range before they can create a credible trend reversal down.

Without a clear top, the other way that the bears can take control is by creating a big bear breakout in the form one huge or two or more big bear trend bars. Without that, day traders will be more inclined to scalp for their first short trades. If a trading range begins to form, their 1st shorts are often with limit orders, selling new highs and above weak bull flags. Once the Emini begins to go sideways, they will then start to take stop entries below good sell signal bars. If a leg up is strong, the bears will wait for 2nd signals before shorting.

After the market goes sideways to down for 2 or more hours, day traders will watch to see if there is trend resumption up after yesterday’s bull trend. The Emini is at the February high, which is the neck line of the double bottom on the daily chart.

Last week’s momentum up was strong enough so that Friday’s high of 1943.75 was likely to get tested. That is why I have been saying that the selloff that ended yesterday would probably only last 2 days. The odds are that the Emini will break above the neck line within the next week.

Whether or not it does before the end of the month is irrelevant. Without a strong selloff into Monday’s close, the candlestick pattern on the monthly chart will be a buy signal bar. Since the monthly chart is in a bull trend, the odds are that the buy signal will trigger by March going above February’s high.

It is not a strong buy setup. The signal bar will probably be weak, and it is forming in a trading range that came after an huge buy climax. The odds are that there will be seller’s above and the bull reversal will fail. If instead March becomes a strong bull entry bar, then the odds for the bulls getting a new all-time high before a bear breakout below the 2 year trading range will go up to 50%.

The Globex market is unchanged with 40 minutes to go before the day session opens. This does not affect anything that I wrote above about what is likely today.

Forex: Best trading strategies

The EURUSD sell climax of the past 2 weeks is now just above the January/December trading range. Seven of the last 8 bars on the daily chart overlapped prior bars a lot and had prominent tails. Even though the channel down has been steep, this is trading range price action and it usually leads to a trading range. The big move up move of the 1st half of February was followed by a big move down. Big Up, Big Down means Big Confusion, which is a hallmark of a trading range. The odds are that the EURUSD will transition from its 2 week selloff into a trading range that will probably last at least a couple of weeks. No one knows if the bottom of the range will be around the current level, at the top of the 2 month trading range. Alternatively, Monday’s bear breakout might be a measuring gap that will be followed by a move down to the bottom of the 2 month trading range and then a trading range within that old range.

Less likely, there will be a strong reversal up and the bull channel that began on December 3 will continue, or there will be a strong bear break below the 2 month trading range without first forming a trading range.

Since the odds favor the start of a trading range and the past 3 days have been sideways, day traders will mostly scalp for 10 – 20 pips today. If there is a strong breakout up or down, they might swing trade part of their position. The EURUSD has been in a 40 pip range for 24 hours, and when that is the case, most traders scalp.

On a 60 minute or 240 minute chart, trades can see the bear trend. This means that swing trading from the short side is reasonable. Bear will sell rallies near moving averages and put stops above the top of the most recent strong bear breakout. That is currently the top of Monday’s selloff at around 1.1150. They can also scalp by selling above prior minor highs and buying below minor lows. Since the 3 day range is so tight, scalpers will probably have to take only about 20 pips profits.

It is too early for the bulls to swing trade on the 60 or 240 minute charts. There is not a clear major trend reversal, nor is there yet a strong bull breakout.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

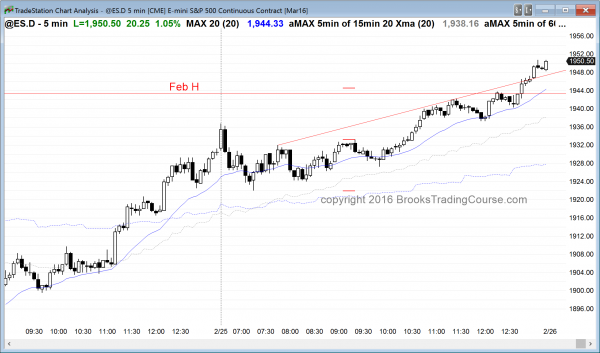

The emini had the expected 2 hour trading range after yesterday’s buy climax. It then had trend resumption up to above the February high.

The bears want a double top on the daily chart with the February 1 high. The odds are that March will go above the February high, whether or not the Emini goes higher over the final 2 trading days of the month. Today’s bull close was strong and there might be a gap up and bull trend tomorrow. The downside risk over the final 2 days of the month is small. If, however, there is a strong reversal down, traders will sell and not question it.

The 60 minute chart has a potential expanding triangle, but this 3rd leg up is so strong that the 1st reversal down will probably be bought.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Dr. Brooks,

If I remember correctly, you said that a trader who takes the swing buy above bar 9, would not scale in below. This is because if the market went below 9, if would be a failed H2, and may result in 2 more legs down (the bulls failed twice).

In general, how do you decide which market context is NOT appropriate for scaling in? Is it because you think that another move against the position will result in a reliable failure trade?

(One example may be if a trader buys above a bull RB in a Wedge reversal, they may not want to scale in below, because below may be a failed wedge. Where else do you make this decision?)

Thank you

Michael

I don’t remember what I said, but that low became the low of the day. I said before the open that a trading range was likely to start within the 1st 2 hours. It began with the 2nd bar. The question then was whether the bottom of the range would be around the last higher low of yesterday (and it turned out to be the case), or the prior low. If the reversal up at bar 9 failed, there would have been a bear breakout below the double bottom with yesterday’s higher low. I think it would be ok to scale in lower, but I would not. I would have waited for a reversal up from that lower higher low.

I think that the wedge bottom was minor and the double bottom was a bigger and more important pattern.

If you have been in the room a while, you know that I talk about this type of situation regularly. When there is an obvious stop for the bulls, there is a 50% chance that a break below the stop will lead to a swing down and a 50% chance that the bear breakout will fail and result in reversal back up. I thought the risk of a big bear trend was small today, especially after seeing the 1st 9 bars. With that in mind, buying below bars like bar 9 is an ok thing to do IFFF a trader manages his trade correctly.