Breakout above April stock market high leading to correction

Updated 6:47 a.m.

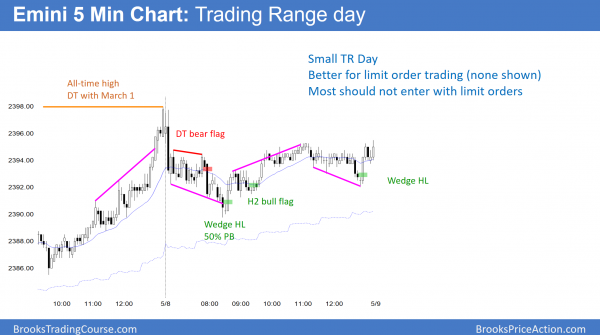

The Emini reversed down from 1 tick below Friday’s high, which was a perfect double top with the March 1 all-time high. Friday’s rally was also parabolic. Yet today’s 1st bar created a Big Down move after a Big Up Move. This creates Big Confusion, and therefore usually leads to a trading range for an hour or two. In addition, it increases the odds that today will be another trading range day.

The bulls want a new all-time high, but the bears want a reversal down and a bear trend day. The first several bars have alternated direction. The odds are that the Emini will enter an early trading range. At the moment, the odds still favor a break to a new all-time high at some point this week, and then the start of a 2 month selloff.

Pre-Open market analysis

April was a buy signal bar on the monthly chart. Furthermore, the chart is in a strong bull trend. The buy signal triggered on Friday when the Emini rallied above the April high at the end of the day.

In addition, it rallied exactly to the prior all-time high. Since the momentum up is strong, the Emini will probably make a new all-time high this week. Yet, because this is the 26th week without touching the weekly moving average, the odds are against the rally lasting more than a few weeks.

Overnight Emini Globex trading

The Emini is down 4 points in the Globex market. It sold off early from above 2400 and has been in a tight range. The bears want a double top with the March 1 all-time high. While a top is likely soon, picking the exact day in advance is a low probability bet.

Because a 100 point reversal down is likely to begin at any point in the next 3 weeks, traders need to be ready for a series of big bear trend days. Yet, the process has not yet begun. Furthermore, most days over the past 2 months have been trading range days. Consequently, today will likely be another trading range day.

Since Friday was a big bull trend bar, there is an increased chance of a rally in the 1st 2 hours. In addition, the bulls will probably try again to get above both the March 1 all-high and 2400. Because the Emini is at such important resistance, there is an increased chance of a big breakout above the resistance. Furthermore, the rally could last several days. Yet, even if they succeed, the odds are that any strong bull breakout will fail within a few weeks.

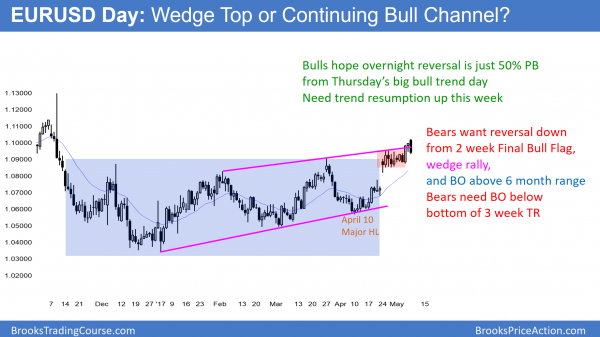

EURUSD Forex market trading strategies

The EURUSD daily Forex chart has been in a broad bull channel for 5 months. Since the channel is a wedge and within a 2 year trading range, the bull breakout above the 5 month trading range will probably fail.

The EURUSD daily Forex chart rallied from a 15 year low in January. Yet, because it is still in a 2 year trading range, I have been writing all year that the odds are every strong rally and selloff will reverse. Consequently, every strong move is likely simply a leg in the range and not the start of a trend.

Fundamentals are useless to traders

The daily chart broke out last week above a 2 week trading range.

I said that it would probably rally to about a measured move up and then reverse. Macron’s victory last night is theoretically bullish for Europe. Yet, the EURUSD Forex market sold off. How can that happen? It is because the market is trading more technically than fundamentally. It is range bound. There it is constantly probing for the extremes of the range.

Traders expected Macron to win and bid the market up. Yet, they are now deciding that they probably priced it too high. Furthermore, they are correctly thinking that it is just one tiny piece of fundamental information in a market with thousands of other pieces. They are therefore immediately discounting it and looking ahead to the next piece of information.

Each piece can seem extremely important in the weeks leading up to the news. Yet, when traders step back and look at the monthly chart, everything that seems important today is meaningless compared to the 500 days in the monthly trading range.

Overnight EURUSD Forex trading

The EURUSD bulls have achieved their minimum objective of a breakout above the 2 week trading range. Many are therefore taking profits, and bears are beginning to sell. Hence, what happens over the next few days affects what will happen over the next month.

The bears want follow-through selling after last night’s reversal down. They want the reversal to continue far below the 3 week trading range and at least 50 pips back into the November to April trading range. If they succeed, they would then expect at least a 50% pullback from the month long rally, and possibly a test of the April 10 major higher low.

The bulls know that their 3 week breakout above the 5 months range has been week. They hope that the overnight selloff is just a sharp 50% pullback from Thursday’s strong rally. Hence, they need the selloff to reverse back up this week. If they are successful and get a strong breakout above last week’s high, which is unlikely, they will next try to get above the November 9 top of the huge bear reversal.

Last night’s big reversal down after Thursday’s big rally creates a Big Up, Big Down pattern. This means Big Confusion and hence a likely trading range for today. The EURUSD has been sideways for 4 hours and it will probably continue sideways for most of the day. Yet, its direction over the next week will probably determine what it will do for the next month. The odds favor a continuation of the 5 month and 2 year trading ranges.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Today was a quiet trading range day, inside of Friday’s strong bull breakout.

While the bears still have a double top major trend reversal with Friday’s high and the March 1 high, the momentum up on the daily chart is strong. Therefore, the Emini will probably break to a new all-time high this week. Yet, because of the weekly buy climax, the Emini will probably begin to turn down within a few weeks for a 100 – 150 points correction.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.