Market Overview: FTSE 100 Futures

The FTSE futures market went sideways last week with a FTSE High 2 possible at the 20-Week Moving Average (MA.) We said last week a fifth bear bar on the weekly was unusual and traders expected a pullback.

The bulls see a pullback from a tight channel up to the range highs and want a smaller sized bar to buy for a test of the range above. The bears will continue to sell above bars betting on another successful measured move target below. Both are likely to be disappointed as we are around 50% of the recent range so expect sideways to down next week after a brief move up Monday.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures index was a weekly bull bar closing on its high with a long tail below, so we might gap up next week.

- It’s a possible FTSE High 2 at the 20-Week Moving Average (MA.)

- Bulls see a pullback from a 5-week tight bull channel in March after a sell climax and after rejecting the 50-week MA.

- Bears see a successful measured move after consecutive bear bars closing on their lows. We are also pausing at the November 11th prior breakout high.

- Bulls want to trade above next week’s high to set up a FTSE High 2 at the MA which is a high-probability buy setup in a bull trend. But are we in a bull trend still?

- 5 bull bars then 5 bear bars is likely trading range behavior so expect confusion and failed signals, especially stop entries.

- We’re still always in short since the two consecutive bear bars reversing down from the April 11th wedge top.

- Traders expected 2 legs sideways to down and it might have been completed last week.

- Who is doing most of the buying – bears exiting or bulls. Why?

- The problem might be the location – the middle of a trading range and traders will be unwilling to buy after 4 consecutive bear bars. The bears also don’t want to sell low in a trading range.

- The bears want the High 2 to fail. They are hoping for a sell climax like at the end of February down to the March lows. It is a nearly identical bar to the one before the collapse.

- The context is different now because we are not at the top of a trading range we are right in the middle. Bulls don’t want to buy high in a trading range so likely sellers above. And bears don’t want to sell low in the range either

- Expect some more sideways trading next week. Perhaps the bulls get the High 2 but scalp out near the prior week’s highs and we trade back down to the moving average again.

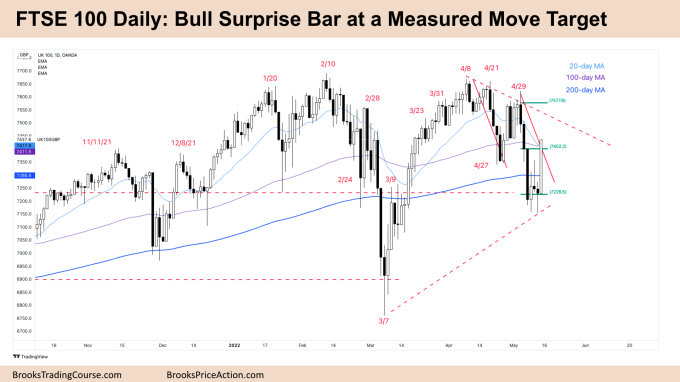

The Daily FTSE chart

- The FTSE 100 futures had a bull surprise bar at a measured move target closing on its highs on Friday so we might gap up on Monday.

- Friday also closed above Monday’s high just above the 20-day and 100-day moving averages (MA) so it was a reversal week.

- The bulls see 2 legs sideways to down after March’s tight bull channel. They see a double bottom with the March 9 lows and a strong reversal up from the 200-day MA.

- Because it is the third time we have reversed up from the 200-day MA it might now setup a higher low major trend reversal or wedge bottom for a move higher.

- The bars are big and so is the risk. The bulls want a follow-through bar closing on its highs but the location and math are bad, with 3 huge bear bars to the left.

- Even with a big move Monday expect sellers above.

- The bears got their measured move down but with no follow-through, they scalped out. As soon as the bears were buying back shorts and bulls buying, it raced back up to the prior breakout point.

- The bears see a broad bear channel from April 8th. They want a lower high with April 29th which is far above. They see this week as a breakout test of April 27th and will look for the bars to go sideways before selling a Low 1 or Low 2 at the MA with less risk.

- Big down, big up, big confusion. We are right in the middle of the several month trading range so it hasn’t been a good environment for stop entry traders

- Look at the limit trading last week: Big bear bar Monday, Tuesday they bought below. Wednesday they sold above. Thursday they bought below. What do you think will happen next week? If limit order traders are making money we will likely be going sideways again.

- If the bulls can get consecutive bull bars that might stop bears shorting above the highs until we get higher up in the range.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.