Market Overview: FTSE 100 Futures

The FTSE futures market was a FTSE 100 micro double top at the 50-week moving average. Traders expected a second leg after the consecutive big bear bars and are deciding if we just finished the second leg. The bulls are looking for a second buy signal, but it’s a bear bar, so it’s a sell signal for next week. Bears want a second leg and measured move down to the June lows, but have had trouble getting consecutive closes down there.

FTSE 100 Futures

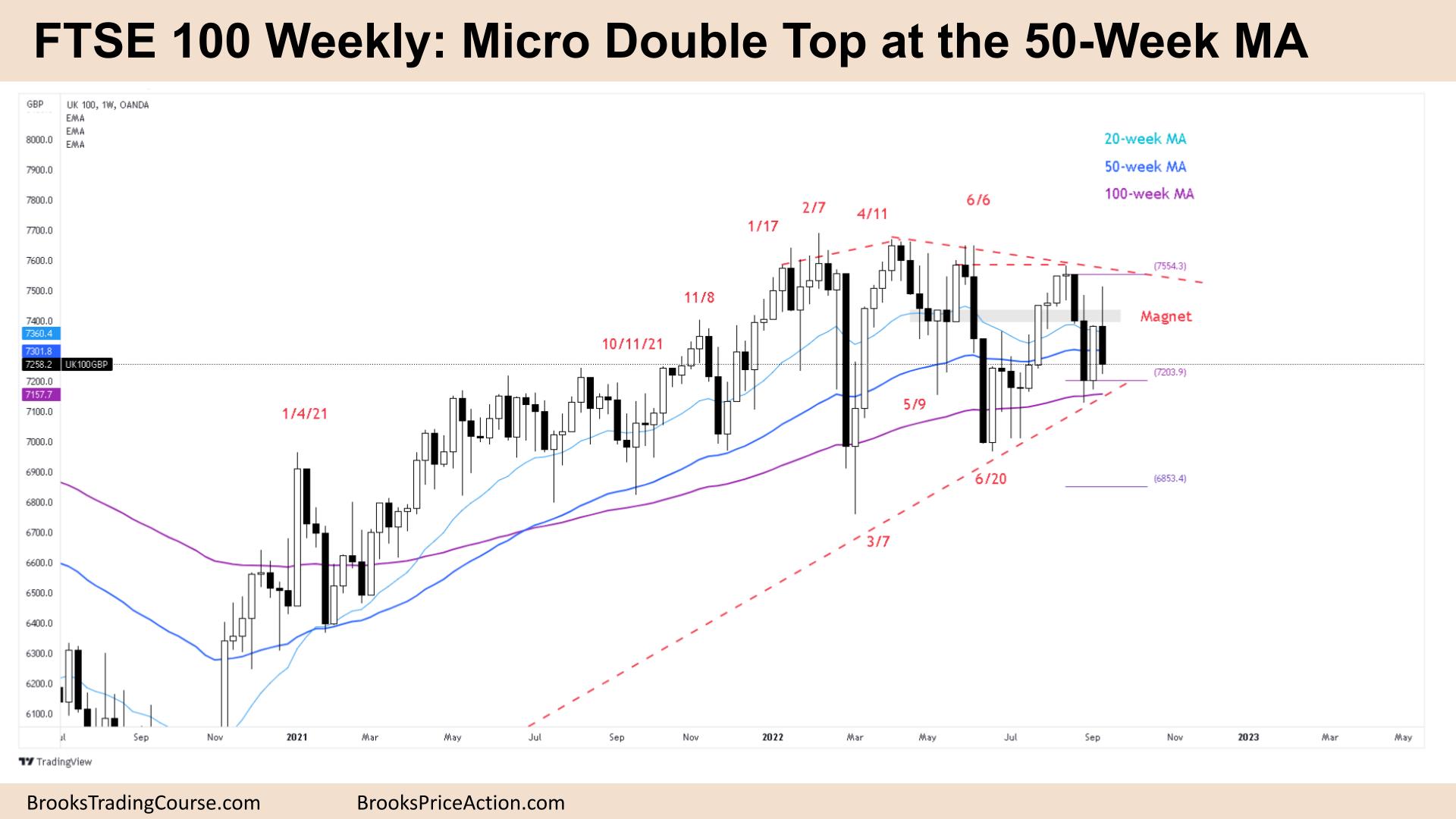

The Weekly FTSE chart

- The FTSE 100 futures was a bear bar closing near its lows. It is a micro double top at the 50-week moving average (MA).

- It’s a tight trading range just below a prior barbwire area which was a magnet so we expected to trade back there.

- The bulls see a pullback after a higher low with June and reversing up off the 100-week moving average. Because this week failed to break below the bull bar, some bulls will look to buy a second entry – a High 2.

- The bears see a second leg after the 2 consecutive bear bars, but we may have finished the second leg.

- It’s a limit order market, few stop entries on the weekly chart so next week is more likely to be a bull bar even if it trades below the low of this week.

- Its a bear bar, so it’s a sell signal, but the small tail below will reduce the sellers. They might wait for a second bar to confirm the move down.

- The bulls want a second reversal to buy above, but because there is a tight trading range just above this week, it’s a bad place to enter. That’s why there was a tail on last week.

- If that tight trading range is the center of the wider trading range, then the math favors buying below this week, betting we will get back there, most traders should wait for a pause and a stop entry before trading.

- Bulls will buy below and scale in lower – look left, buying below strong bear bars has been a profitable strategy for many months, so it will continue until it is no longer profitable.

- Bears want a measured move down to the June lows but have been unable to get a decent second leg to hold below the 100-week MA.

- If the bulls get a small bull bar next week that would be a reasonable buy signal back up to the range highs.

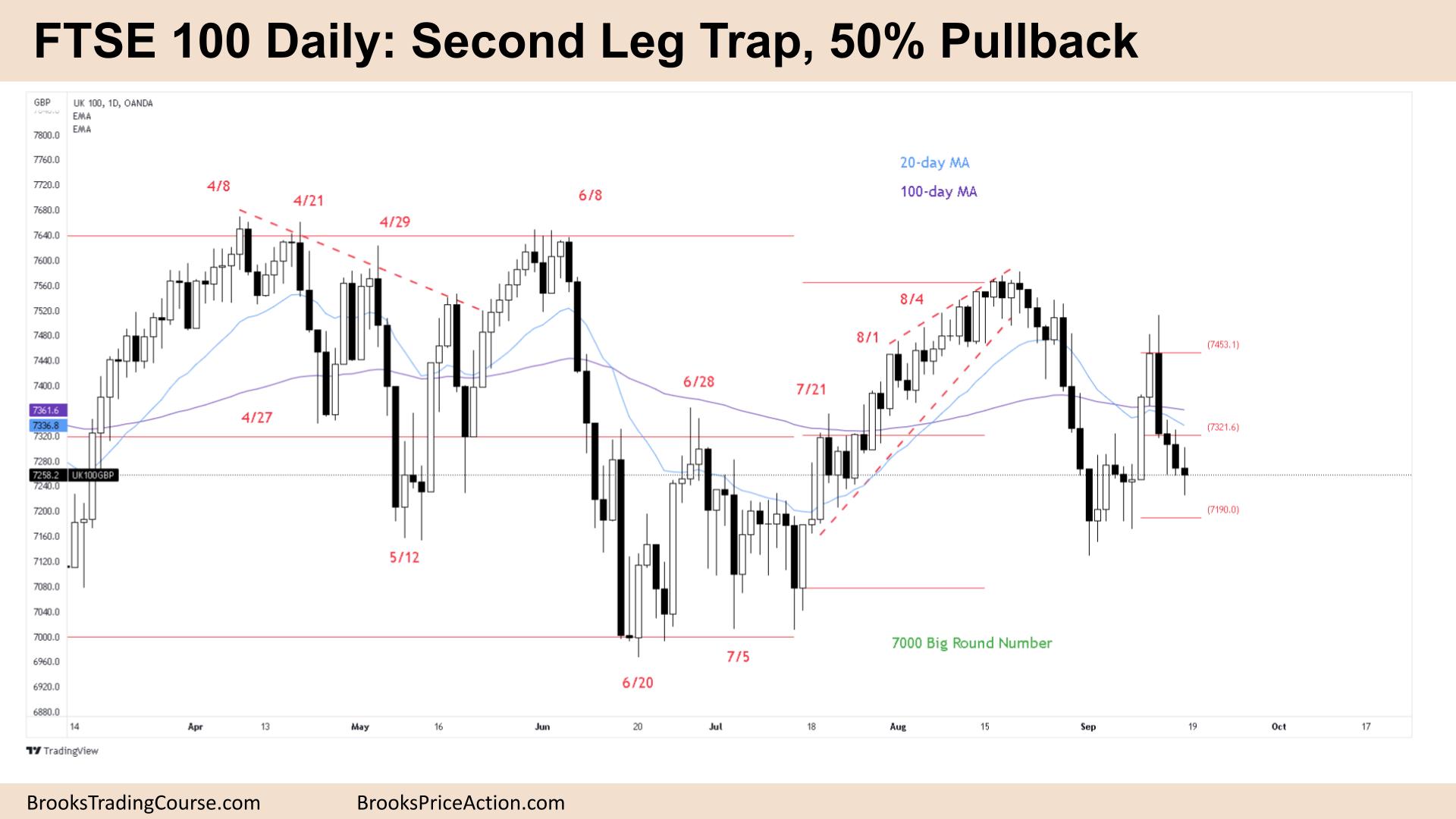

The Daily FTSE chart

- The FTSE 100 futures was a bear doji on Friday so it s a pause bar and likely will attract limit order traders.

- Its the 4th consecutive bear bar so it’s a bear micro channel, and traders will expect a second leg down. We haven’t had 5 bear bars for many months so Monday will likely trade above the close.

- For the bulls, it’s a pullback and a higher low. It was a failed High 1 on the weekly and a micro double top, so traders might buy the High 2, which would be a higher probability buy for a bull reversal back up.

- But it’s 4 bear bars, so it’s a bad buy signal. The bulls want a strong bull bar to buy above, but with a doji there are probably sellers above.

- The bears see a 50% pullback from a bear leg. The trend resumption failed and now they want a measured move down to the range lows. But the bodies are shrinking so we will likely pull back soon.

- There are trapped bulls above, who need to get out, so even if we trade back to Tuesday, they might exit short and sell again.

- But it’s not as bearish as it could be, consecutive bull closes above the moving average mean we probably won’t go too much lower.

- We are in a broader trading range so reversals and limit order trading are both more common.

- If you had to be in, better to be short and get out above a bull bar closing above its midpoint.

- Traders will buy a reversal up here at a possible double bottom and second entry buy, particularly if it closes on its highs. If the other reversal has a tail above bears will sell again for another leg down.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.