Market Overview: EURUSD Forex

The EURUSD Forex formed a minor pullback following a 5-bar bear microchannel. Often, there are sellers above the first pullback from such a strong bear microchannel. The bulls hope to get at least a retest of the April high after the current pullback. They want the 20-week exponential moving average to act as support.

EURUSD Forex market

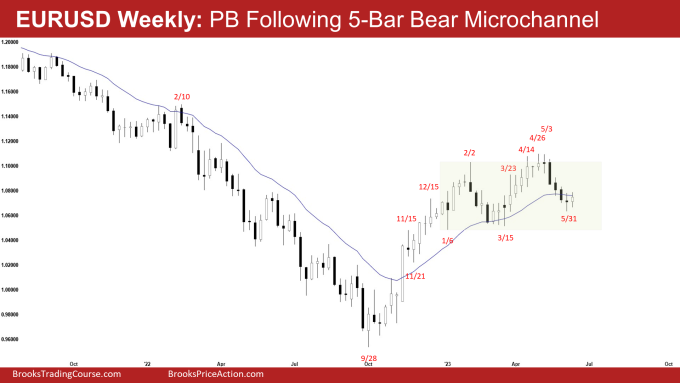

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bull doji with tails above and below.

- Last week, we said that the odds slightly favor a small second leg sideways to down after a small pullback.

- This week traded above last week’s high but closed below it.

- The bulls hope to get at least a retest of the April high after the current pullback.

- They want the 20-week exponential moving average to act as support.

- They hope the EURUSD will reverse back above the 20-week exponential moving average (20-EMA) soon.

- While this week traded above the 20-EMA, the market reversed to close slightly below it.

- The bulls will need to create follow-through buying trading far above the 20-week exponential moving average to increase the odds of higher prices.

- If the EURUSD trades much lower, they want a reversal up from a double-bottom bull flag with the March low.

- The bears got a reversal down from a higher high major trend reversal and failed breakout above the February 2 high.

- The move down was in a 5-bar bear microchannel. That means strong bears.

- There are often sellers above the first pullback from such a tight bear microchannel.

- The bears want a retest of the March 15 low. They hope that this week was simply a minor pullback and want at least a small second leg sideways to down, testing the current leg low (May 31).

- Since this week’s candlestick is a bull doji, it is a buy signal bar albeit weaker.

- However, it is following a tight bear channel down. It is not an ideal buy setup.

- Traders will see if the bulls can create a follow-through bull bar closing above the 20-week exponential moving average or will the market stall around the 20-EMA and sellers sell the first pullback from a tight bear channel.

- For now, odds slightly favor a small second leg sideways to down after the current pullback.

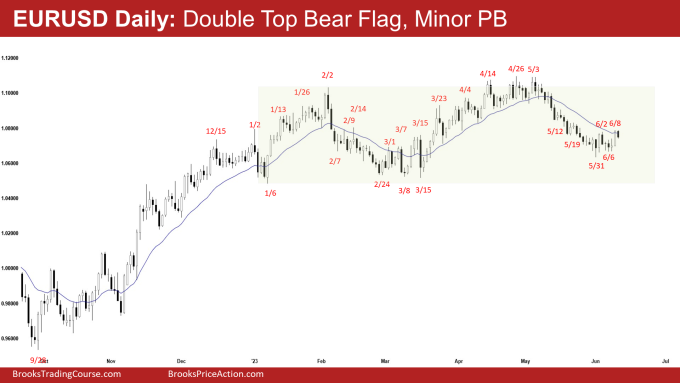

The Daily EURUSD chart

- The EURUSD traded sideways earlier in the week but pushed higher on Thursday. Friday was an inside bear bar reversing back below the 20-day exponential moving average.

- Previously, we said that while the tight channel down means strong bears, the selloff is also slightly climactic. There may be a minor pullback followed by a second leg sideways to down retesting the current leg low.

- The minor pullback (bounce) started from the March 31 low and is currently underway.

- The bears got a tight bear channel down from the May high. That means persistent bears.

- The selloff is strong enough for traders to expect at least a small second leg sideways to down after the current pullback.

- They want a retest of the March low from a double-top bear flag (Jun 2 and Jun 8).

- At the very least, the bears want a retest of the current leg low (May 31).

- They hope Thursday and Friday formed a micro double top and want a breakout below Friday’s inside bear bar.

- The bulls hope that the current pullback will form a higher low.

- They want another strong leg up completing the wedge pattern with the first two legs being February 2 and April 26.

- At the very least, they want a retest of the prior leg extreme high (April 26).

- They want a reversal up from a parabolic wedge (May 15, May 19, and May 31) and a higher low major trend reversal (Jun 6).

- If the EURUSD trades much lower, they want a reversal up from a larger double-bottom bull flag with the March low.

- The bulls need to create consecutive bull bars trading far above the 20-day exponential moving average to increase the odds of a retest of the April High.

- Since Friday was an inside bear bar, the EURUSD is in breakout mode. The bulls want a breakout above while the bears want a breakout below the inside bar.

- Because it is a bear bar closing near its low, odds slightly favor a breakout below the inside bar.

- The first breakout from an inside bar can fail 50% of the time.

- For now, odds slightly favor at least a small leg to retest May 31 Low after the current pullback (bounce).

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.