Market Overview: EURUSD Forex

EURUSD Forex weak bear follow-through retesting low and the bears got a weak follow-through bar on the weekly chart. The bears want a breakout below the May low followed by a measured move down based on the height of the 7-year trading range. The bulls want a reversal higher from a double bottom major trend reversal following the trend channel line overshoot and wedge bottom.

EURUSD Forex market

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bear doji closing around the middle of the bar.

- Last week, we said that odds are this week should trade at least slightly lower. Bears want a strong follow-through bear bar while the bulls want a bull bar closing near the high, even though the EURUSD may trade slightly lower first.

- While the bears got follow-through selling this week, the bear doji indicates that the bears are not as strong as they could have been.

- We said that the bears want a retest of the 2017 low followed by a strong breakout and a measured move down based on the height of the 7-year trading range. This week was weak follow-through retesting low.

- However, the bears were not able to get a breakout below the May low.

- Since this week was a bear doji, it is not a strong sell signal bar for next week. Selling below a weak sell signal bar at the bottom of the 7-year trading range may not be an ideal setup.

- This week fulfilled the minimum requirement for a second leg sideways to down for the bears.

- The bulls hope that the sell-off since March was a sell vacuum test of the 7-year trading range low. They want at least a 2-legged sideways to up pullback.

- The bulls hope that this week was simply a retest of the low and want a reversal higher from a double bottom (May 13 and Jun 15) following a trend channel line overshoot and a wedge bottom (Aug 20, Nov 24 and May 13).

- The first target for the bulls is the May 30 major lower high. They need to create consecutive bull bars closing near their highs and trading far above May 30 high to convince traders that a reversal higher may be underway.

- If the EURUSD trades slightly higher in the next 1 to 2 weeks but stalls around or below the May 30 high, or around the 20-week exponential moving average, the bears will likely return to sell the double top bear flag.

- Al has said that the market has been in a trading range for seven years. Reversals are more likely than breakouts and a measured move down. This remains true.

- Therefore, as strong as the sell-off has been, it is still more likely a bear leg in the seven-year trading range than a resumption of the 15-year bear trend.

- For now, traders need more information, therefore more bars. The EURUSD would likely need to trade sideways for a couple more weeks for traders to get more clarity.

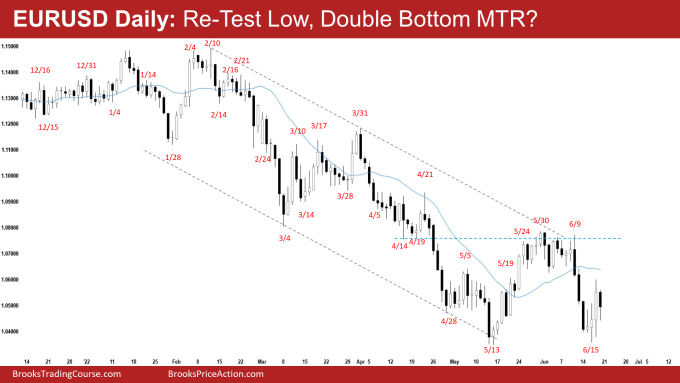

The Daily EURUSD chart

- The EURUSD tested May low by Wednesday but did not trade below it. Wednesday reversed into a weak bull bar and the bulls got follow-through buying on Thursday. Friday was an inside bear bar with a long tail below.

- Last week, we said that odds slightly favor the EURUSD to trade at least slightly lower and traders will be monitoring whether the bears get follow-through selling and a retest of the 2017 low, or the EURUSD stalls and reverse from a higher low.

- This week did test the 2017 low but did not quite reach it and reversed slightly higher from a higher low.

- The bulls hope this week was simply a retest of the May low.

- The bulls want a reversal higher from a double bottom higher low major trend reversal following a trend channel like overshoot and a wedge bottom (Jan 28, Mar 4 and May 13).

- Since Friday was an inside bar, it is a breakout situation. The bulls want the EURUSD to trade above Friday’s high to trigger the buy entry.

- We have said that there should be at least a small second leg sideways to down once the pullback is over. This week fulfilled the minimum requirement for the second leg sideways to down.

- The bears want a re-test of the 2017 low followed by a breakout and a measured move down based on the height of the 7-year trading range.

- They see this week simply as a pullback and want at least a small second leg sideways to down following June’s leg down.

- Friday’s bear inside bar is a sell signal bar for Monday. However, the long tail below makes it a weaker sell signal bar, especially following 2 bull bars at the bottom of the trading range.

- While the context slightly favor sideways to up pullback, the bulls will need to create consecutive bull bars closing near their highs to convince traders that a deeper pullback may be underway.

- If the pullback is more sideways and stalls around or below May high or around the 20-day exponential moving average, odds are the bears will return to sell the double top bear flag or lower high.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

I for one, am finished looking for a holy grail and I am grateful to have found Al’s course along with those people who regularly contribute technical analysis to Al’s Blog.

I have learned probability along with risk/reward must be considered. Funny enough, I have never encountered another ‘edge’ that considers probability as Al’s presents. All of my frustration was in employing a method and not understanding probabilities. Most ‘educators’ mistake win/loss ratio as the probability of their edge. As opposed to the probabilities of the bulls vs the bears bar by bar.

Though I am new to this line of reasoning, I have stopped the bleeding. Goal number one: Stop losing money. Check.

Trading an “I dont care size” I am learning to let the PA tell me when to place a trade.

Al, Andrew & Brad (sorry if I missed any contributors) do a fantastic job sharing their knowledge and do so with very little thanks. I suspect this is because they enjoy what they do.

I am grateful for all of your work – what a resource. Thank you

Dear Martin,

Thanks for your wonderful and encouraging comments.

Happy to contribute.

Wishing a blessed week ahead to you.

Best Regards,

Andrew

I have been a Brooks member for many years and have come to the realization that this is all flufg

Oops… *fluff*. It is not that it is not important but NONE of this helps anyone actually trade.

All of it is either what clearly already happened, *you just explain it in Brooks terms*, or if you happened to be right. You guys say “as we said last week” so often when it suits you ad nauseam.

This took me along time to realize you guys have NO idea either.

Sure you maybe good traders. Maybe NOT, who knows these days but it’s all just ANALYSIS anyway.

ABSOLUTELY NOTHING AT ALL TO DO WITH TRADING!!!

Might as well be CNBC. Al always, always, always, tells you what HAS ALREADY happened.

Always! How is that different than a news organization making up stories.

It’s a completely made up story after the fact that ends in a PREDICTION!!!

The fact is you certainly CONVEY that you guys KNOW more likely where the markets going. Right? I mean look at how much information and charts and writing you guys do.

Your TELLING everyone what the market IS DOING.

You guys have all the answers. Obviously.

Why else would you have AN EXPLANATION FOR EVERYTHING.

You had no idea where the market was going last week. Anyone can go back and read how wrong you guys were on a consistent basis but people don’t and that’s never mentioned.

I do believe in support and resistance and such but ANALYSIS NOT TRADING!

Al says every trade is 50/50. I believed him for years. Lol. How the hell does ANYONE know the odds on the next trade? You CAN’T!!!

See… YOU CANNOT!!!

Between 60/40 lol. Really? Again how the hell do you know that. You KNOW for FOR A FACT THE NEXT TRADE HAS AT LEAST A %40!!!!

That’s the kind of thinking that has messed me up for years.

If you think ANY trade you put on has AT least a %40 chance of going twice the distance of your stop (even one times) you are going to BE SADLY MISTAKEN AND BROKE!

This is CATEGORICALLY NOT TRUE!!!

Why do I read these? I think you guys know something… so do you, that’s why you do, but I think it’s just entertainment because just like Al chuckles at the TV pundits he does the EXACT same thing.

He give his detailed analysis of what happened… IN the past.

Encyclopedia of Chart patterns. I love this one. Oh OK much easier, just have to identify one out of a few million variables and then FIT it to some chart from thousands in the past THEN trade that pattern and see if it worked.

Oh that makes much more sense.

I have learnt a TON from Al but am at the end of my rope with ANALYSIS as if PEOPLE make money with analysis.

DOES AL MAKE MONEY TRADING??? Who knows. Could be %100 NOT.

Maybe he had ONE big trade years ago like most big traders and that set him for life?

DOES ANYONE? Yes I’m sure. But do they talk about it in terms of analysis… I actually think not.

I believe Al’s teaching is second to none yet I also believe %99.9 of people CANNOT make money with it.

Even the guys on the support forum all trade differently when I asked about discrepancies in trying to trade Al “analysis”.

They don’t trade like him they say!??!

Well wtf then. What’s the point of all this?

Then it hit me reading this. Andrew doing a great job “REPORTING” what the market DID in terms of “ALTV”. There is nothing there but entertainment.

There on other post on here. A person is asking what based on a bunch of analysis what Andrew/Al think.

Well I can tell you.

The bulls pushed to bla and then there was a nested wedge so bla, but there was a slightly higher high so probabilities say bla, so NO CLUE but, bla bla bla, so it could go either way. I will explain after it happens don’t worry.

See I said it would go here, it didn’t quite go there but well just totally ignore that fact and move on to the thing I WAS right about…

I am NOT being facetious.

NO ONE KNOWS where the markets going and you DON’T NEED to!!!!

But I get the constant impression here you guys ACT as if you KNOW and are consistently profiting from KNOWING where the markets going.

That just doesn’t sit right with me. It’s misleading to say the least.

Hi,

TL;DR

I have no time to validate your negativity. Further such post will be deleted.

I will not let you spoil the learning for others.

Thanks.

Hi Andrew,

I’ve followed your report since you’ve done it but just reading with no comment. I think you have done a great job.

I see last Thursday as a second leg trap of the bulls. After everyone saw 3 strong consecutive bear days (9-10-13 June), the minimum second leg down on 15 June is too little. Because Friday is a bear bar even if it is a weak sell setup but surely trapped buy-the-close bulls. Moreover, after breakout below 20 May low with very good follow-through (failed double bottom), the market came back to test this low and 20EMA and leaving the negative gap with 20 May. With these following reasons, I think the bulls will try to exit around the Friday’s close or higher and there might be more sellers than buyers above Thursday’s high. I still bet on the bears, at least another leg down, not higher low major trend reversal. But if Monday is a bull bar closing far above Thursday’s high and EMA, I will change my mind.

What do you think?

Thank you for your sharing.

Cheers,

Wei

Are you looking for confirmation?

They can tell you WHAT happened but how do they know anything? Your just differing your responsibility to them to tell you what they think.

We all see the same thing. The market is in a bear trend (lower highs and lows).

Then it pulled back to a trendline, found resistance in the form of NO MORE BUYERS willing to buy higher at the confluence of prior broken support becomes resistance witnessed at the double top where it subsequently fell below the MA and found support at the previous double bottom and reversed back up.

NOW…. THIS… IS… CRITICAL…

They NO NO MORE THAN YOU.

THEY ARE CLUELESS.

Do they have a plan? Probably. And that’s the difference. They claim they know all this stuff. Lol. They have come so far they don’t even know what they don’t know anymore.

It has nothing to do with their analysis and everything to do with HOW they perceive the markets. THEY TRADE THEMSELVES.

So my point is what are you asking? What do you think they are going to say?

It’s slightly bearish (with a thousand reasons) but wait for a higher entry short. With a good signal bar. If it goes straight up get out?

Analysis is one thing. Trading is another.

Hey Wei,

Thanks for going through the report.

Yeah, what you said is possible. The re-test of the low is just the minimum requirement. It could still potentially grow bigger.

The EURUSD has been in a sideway trading range for the last 9 weeks. It’s very hard to make a high conviction call as the odds are fairly equal within a trading range.

The first breakout above an inside bar also has a 50% chance of failure. Just something to remember.

It could trade below and trigger the bear entry on the weekly chart, only to reverse back higher, or vice versa.

Let’s monitor it day to day.

Be well and have a blessed week ahead.

Best Regards,

Andrew