Market Overview: EURUSD Forex

The EURUSD Forex is reversing up from a trend channel line overshoot and a parabolic wedge. EURUSD consecutive bull bars on weekly chart. Odds are a 2 legged sideways to up pullback has begun.

The sell-off since March was very strong. Traders expect at least a small second leg sideways to down after the pullback is over.

EURUSD Forex market

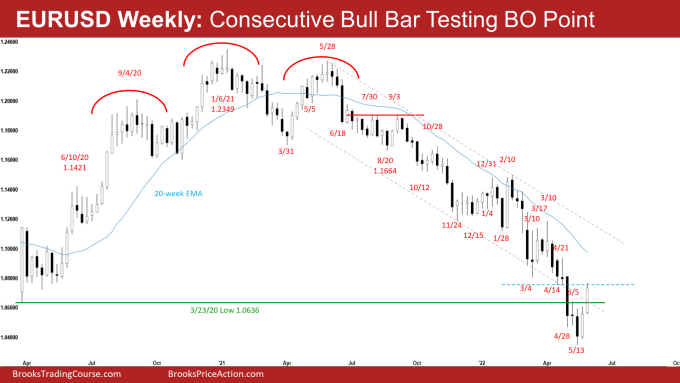

The Weekly EURUSD Forex chart

- This week’s candlestick on the weekly EURUSD Forex chart was a consecutive bull bar with a small tail above. It closed above the high of the last 3 candlesticks.

- Last week, we said that the bulls will need to create a follow-through bar this week to convince traders that a 2-legged sideways to up pullback may be underway.

- The recent selloff is climactic. Because of the market context (parabolic wedge, trend channel line overshoot), traders should be prepared for a 2-legged pullback (bounce) which may have begun last week.

- This week, the bulls got the follow-through bar that they wanted.

- The bulls want a reversal higher from a parabolic wedge (August 20, November 24, May 13) and a trend channel line overshoot.

- The bulls hope that the selloff since March was a sell vacuum test of the 7-year trading range low. They want at least a 2-legged sideways to up pullback.

- The targets for the bulls are the last major lower high on April 21 or around the 20-week exponential moving average or the bear trend line.

- The bears want a retest of the 2017 low followed by a strong breakout and a measured move down based on the height of the 7-year trading range.

- Because of the tight channel down, the bears expect at least a small second leg sideways to down after the pullback is over.

- Al has said that the market has been in a trading range for seven years. It is now near the bottom of the range. Reversals are more likely than breakouts.

- Therefore, as strong as the sell-off has been, it is still more likely a bear leg in the seven-year trading range than a resumption of the 15-year bear trend.

- Because of the market context (parabolic wedge, trend channel line overshoot, 7-year trading range low), the EURUSD likely have begun a 2-legged sideways to up pullback (bounce).

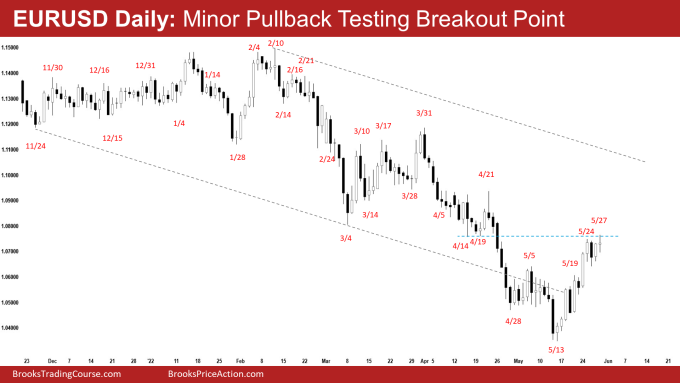

The Daily EURUSD chart

- The EURUSD continued higher this week closing far above the May 5 high. Wednesday pulled back slightly followed by a retest of the May 24 high by Friday.

- Last week, we said that the pullback may have already begun. The bulls will need to create consecutive bull bars closing near the high trading far above May 5 high to convince traders that a deeper pullback may be underway.

- The reversal up started after a failed breakout below the 10-day final flag and a test of the 2017 low.

- The move up has been in a tight bull channel. The bears did not get any consecutive bear bars in the leg up.

- The next targets for the bulls are the April 21 high and the bear trend line.

- We have said that the bulls hope that the sell-off since March was simply a sell vacuum test of the 2017 low. They want a reversal higher from a trend channel line overshoot and a parabolic wedge (April 14, April 28, and May 13) around the 2017 low. They want at least a 2 legged sideways to up pullback.

- So far, they have the first leg up.

- The bears hope that this is simply a minor pullback to be followed by a re-test of 2017 low and a measured move down based on the height of the 7-year trading range.

- The bears want the pullback to stall around the April low, which was the breakout point for the last leg down. They want a reversal lower from a lower high.

- Friday closed as a bull doji. It is not a strong buy signal bar for Monday.

- We have said that the sell-off since March 31 was in a tight bear channel. It means the bears are strong.

- Odds are, there should be at least a small second leg sideways to down once this pullback is over. This remains true.

- However, the selling has been climactic. The parabolic wedge and trend channel overshoot increase the odds that the current sideways to up pullback would last for at least another 1- to 2-weeks.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.