Monthly S&P500 Emini futures candlestick chart: Middle of trading range

The monthly S&P500 Emini futures candlestick chart is in the middle of its 2 year trading range after a 38 month buy climax.

The monthly Emini chart is still recovering from a buy climax. It held above the 20 month EMA for 38 months, which has happened only twice in the cash index in the past 50 years. The two prior times were followed by 36% and 22% corrections. The current correction has only been 14%. Also, the breakout above the double top around 1600 has never been tested. The buy climax is the kind of environment that could lead to a breakout test. However, the Emini is still within its trading range. Because of the extreme buy climax, the odds are still about 55% that the Emini breaks below the bottom of the trading range before it breaks above the top. There is also a 30% chance that the selloff will reach the March 2000 high, just above 1600.

Weekly S&P500 Emini futures candlestick chart: Reversing the January selloff, but still a possible nested head and shoulders top

The weekly S&P500 Emini futures candlestick chart has had 4 strong bull bars in its reversal up. It is in the top half of the trading range, and still might form a nested head and shoulders top.

The weekly char had a big bull trend bar this week, which might simply be a buy vacuum test of the top of the January sell climax. There is a small chance that Monday will gap up and create an island bottom with the January gap down. However, island tops and bottoms in trading ranges are meaningless since there is an 80% chance that any breakout attempt within a trading range will fail. If the current rally fails, it will form a nested head and shoulders top.

A nested pattern is one where the 3rd part subdivides into a smaller version of the same pattern. Here, the right shoulder of the 2 year pattern subdivides into a smaller head and shoulders top. Nested patterns have a higher chance of success, but most tops are trading ranges and only have about a 40% chance of a swing down. It is more likely that the trading range continues to grow and form other top and bottom patterns. Eventually, there is a successful breakout. There is no sign of one yet, and the current rally is just another strong move within the range. The rally has reached the top half of the range, and bulls will begin to take profits and bears will start looking for sell setups.

Daily S&P500 Emini futures candlestick chart: Learn how to trade a Low 4 sell climax candlestick pattern

The daily S&P500 Emini futures candlestick chart is rallying strongly, but the rally is a buy climax.

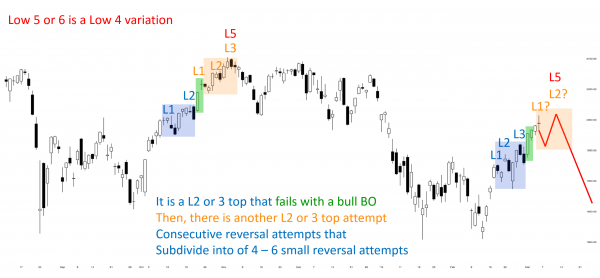

The daily S&P500 Emini futures candlestick chart has a potential Low 4 top, like it did after the October rally (a Low 5 is a type of Low 4).

The daily chart is currently the most interesting because of a potential Low 4 sell setup. The October rally failed with a Low 4 top. A Low 4 top is made of a top that fails, and it is followed by a 2nd top. Each top has 2 or 3 legs up within in. I coined the term “Low 4” because the simplest version is a Low 2 top, followed by a bull breakout above the top, and then a 2nd Low 2 top. However, either or both of the tops can be a wedge top instead of a Low 2 top, and therefore a Low 4 can actually be a Low 5 or Low 6. They are all variations of the same price action.

In October, the Low 2 top triggered, and it was immediately followed by a strong bull breakout above the top. A strong breakout usually has at least 2 legs up. That breakout had 3 legs up, creating a wedge top. The Low 2 and then the Low 3 adds up to a Low 5, but a Low 5 is just a variation of a Low 4. That October Low 4 was followed by a 10% correction.

The Emini had an expanding triangle top 2 weeks ago that triggered when Monday traded below the February 26 low. This was followed by a very strong 4 day bull breakout above that top. Since this week’s bull breakout was strong, the 1st reversal down will probably be bought. If Monday trades below Friday’s low, that would make Friday a Low 1 sell signal bar. Since there is a 70% chance that there will be buyers below Friday’s low and then at least one more leg up, there is a potential Low 4 sell signal coming within the next couple of weeks.

For example, if there is a 1 – 3 day pullback next week below Friday’s low, and then one more push up to above Friday’s high, and then another reversal down, that reversal down with be a Low 2 sell entry. Since this Low 2 would be following the Expanding Triangle Low 3, the entire pattern would be a Low 5 top, which is a variation of a Low 4 sell setup.

If this happens, it would have about a 70% chance of a TBTL Ten Bar, Two Leg correction for its minimum goal. It would also create a head in a potential nested head and shoulder top.

There are other topping patterns as well, and I will write about them if they become more likely than they are now. The important point is that the current rally is happening within a 2 year trading range, and the odds are that this rally will reverse down toward the bottom of the range.

Since the daily chart has been forming lower highs and lows since February and it is therefore in a broad bear channel. The odds of a bear breakout go up if there is a topping pattern as well. However, traders who trade the markets for a living know that until there is a breakout, there is no breakout. Traders learning how to trade the markets have to learn that strong rallies and strong selloffs are the building blocks of trading ranges, and they should look for trading range reversals and not breakouts.

Trading ranges contain both early bull and bear trends. Most of these trends fail, and the trading range then continues. It is more profitable to keep looking to sell near the top and buy near the bottom until there is a successful breakout.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al

You have mentioned for several weeks that you feel a downside breakout has a greater than 50% chance. However, you also say that the current trading range is also a likely bull flag. How do you reconcile the two? Thank you. It has been fascinating watching your (very accurate) read of the markets over the past several months

Both the bulls and bears always have reasonable reasons to take positions. Only 10% of the bars on any chart are in a strong breakout. When they are, there is a 70% chance that the trend will continue for the next few bars will continue.

For 90% of the bars, the odds for the bulls and bears are between 40 – 60%. From the Market Cycle, everyone knows that the 2 year trading range on the monthly chart will be followed by a trend, but no one knows the direction. Without more information, it is usually 50%. If the trading range is just beginning, it is still more of a pullback and the odds favor a resumption of the prior trend (here, up).

This trading range has enough bars so that the probability of a bull breakout is about the same as for a bear breakout. However, there is one thing very unusual about this trading range, and I have been talking about it for about 18 months now. It is forming after one of the most extreme buy climaxes in 50 years. The prior 2 similar climaxes were followed by 36% and 22% corrections. The current correction was 14%. Because of the extremely unusual buy climax and what has happened in the past, I think that the bear case is more likely than the bull case until the bulls get their breakout. This means that the probability for the bears is always at least 50% in the trading range. When the momentum down is strong, like 5 weeks ago, the probability is 60%. During a strong rally, the odds for the bears is less than 60%, but still more than 50%,

Hi Al,

Isn’t it funny all this up and down business, the punters on CNBC calling doom prior, china issues and all the other crap on TV !

Confusion plus

We went from Abyss to Bliss in just one week back in late FEB ??? (and that’s the game don’t get sucked in)

All media engineered, and set out by the big players

PRICE ACTION STORY FOLLOW IT not media shite !

We had an MTR happen right in front of our eyes, textbook ! Just like you teach. (on daily)

But many including myself still wondered, still doubted the reversal was taking place.

I don’t think many understand the focus and conviction required to stay on track, maybe that comes in time maybe our psychie determines whether we get it or not.

Trade what u see. EOStory

Charts really do tell the story but experience needed to translate it’s language.

Rant over apologies if applicable : )