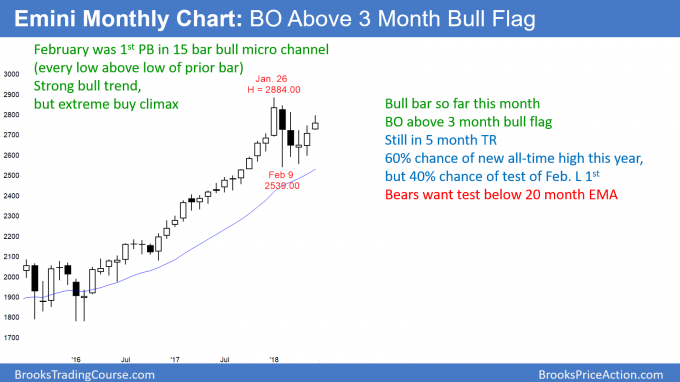

Monthly S&P500 Emini futures candlestick chart:

Small bull bar testing the January high

The candlestick on the monthly S&P500 Emini futures chart is a small bull bar so far this month. It is the 3rd consecutive bull bar. The bulls therefore hope this is a resumption of the bull trend. But, the bar is small and has a tail on top. If the month closes below its midpoint, it will be a sell signal bar for July.

The monthly S&P500 Emini futures candlestick chart is in a strong bull trend. It rallied for 15 months without a pullback. That is a 15 bar bull micro channel and a sign of strong bulls. However, it was also unsustainable and therefore climactic. When a micro channel lasts more than 10 bars and is therefore also a buy climax, it typically leads to a bull flag and not a bear trend.

But, the bull flag can last 10 or more bars. The Emini is currently deciding if the bull trend is resuming or testing the top of a developing trading range. If this month closes near its high, especially if the range gets bigger, the odds are that there will be a new all-time high within a couple months.

However, if it closes below its midpoint, it will be a sell signal bar for July. Furthermore, if it closes on its low and has a big bear body, the odds will favor at least a month or two of lower prices this summer.

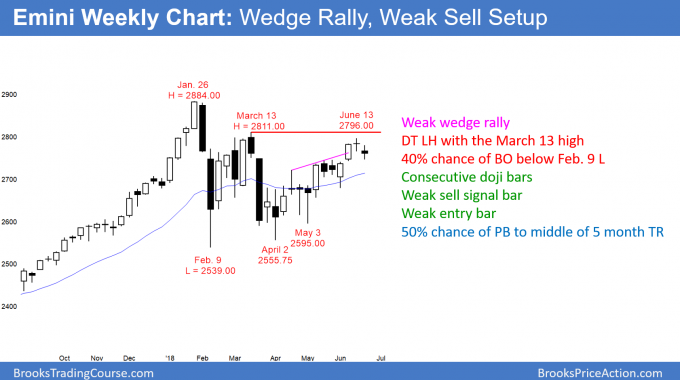

Weekly S&P500 Emini futures candlestick chart:

Emini wedge rally and double top in 5 month trading range

The candlestick last week on the weekly S&P500 Emini futures chart was a sell signal bar. There was a 3 month wedge bull channel and a 4 month double top. This week triggered the sell signal by falling below last week’s low. Since this week was only a small doji bar, it is a weak entry bar for the bears.

The weekly S&P500 Emini futures candlestick chart is in a 5 month trading range after last year’s bull trend. It is therefore in Breakout Mode, but in a bull trend. At the moment, there is a 60% chance that the bull trend will resume before there is a a strong bear breakout on the weekly chart. Yet, the 3 month rally has not been strong. It is a wedge rally and it lacks consecutive big bull bars. It therefore looks more like a bull leg in the 5 month trading range than a resumption of the bull trend.

Unless the bulls get a strong break above the March lower high, the bears will create another leg down. That leg would have a 50% chance of retracing at least 50% of the 3 month rally. In addition, if it was strong, it would have a 40% chance of falling below the April 2nd low and continuing down for 300 points. That is the measured move target for the double top with the March 13 high.

Daily S&P500 Emini futures candlestick chart:

Emini wedge rally stalling at top of 5 month trading range

The daily S&P500 Emini futures candlestick chart has been in a trading range for 5 months. There were 3 legs up from the April low. Therefore, the 3 month rally is a wedge bull channel. Furthermore, the past 2 weeks have traded down from the top of the range. Next week should tell traders if this is just a bull flag or the start of a 1 – 3 month bear leg.

The daily S&P500 Emini futures candlestick chart has been going up since the April 2 low. This week tested down to the May 22 high and reversed up without overlapping it. There is now a possible measuring gap for about a 170 point rally [see comments below].

But, the chart is in a trading range. It is more likely that the bulls and bears will both be disappointed repeatedly. Therefore, the daily chart will probably close the gap above the May 22 high next week.

In a trading range, reversals are more common that breakouts. Hence, most breakout attempts up and down fail. Consequently, predicting which leg will ultimately be the start of the next trend is making a low probability bet.

3 week bull flag or start of bear trend?

Is the 3 month rally a resumption of last year’s bull trend or simply another leg in the 5 month trading range? Since it is not particularly strong, it is more likely a leg in the trading range. Traders will find out over the next several weeks.

If the bulls are unable to break strongly above the March high, they will sell out of their longs. They will then likely not look to buy again until the Emini is at least back to the middle of the 5 month range. This means that there would probably be a 1 – 2 month selloff.

The Emini has reversed down over the past 2 weeks. At the moment, there is a 50% chance that this is the start of a 1 – 3 month swing down to the middle of the range. Furthermore, any trading range always has at least a 40% chance of a breakout below the bottom of its range.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al,

how to decide which levels have more probabilities to be achieved first?

I mean 2 magnets: Weekly MA (approximately 2710 level) and Resistance 2811.

And thank you for your thoughts!

I analyze each of the 3 time frames independently. For example, the daily chart can be in a bear trend while the monthly chart is in a bull trend.

The monthly chart has a bull flag. The weekly chart has a pullback that is growing into a trading range. Therefore the odds still favor a bull breakout. The daily chart is in a trading range. That means that the probability of a bull breakout is the same as for a bear breakout. However, a 100 point breakout on the daily chart would be big, if it reversed, it would be a small failed breakout on the weekly chart.

As a chart rallies in a trading range, the momentum favors higher prices, like a test of the top of the range. The closer the chart gets to the top of the trading range, the lower the probability of higher prices. Once it begins to get bear bars, the odds start to shift in favor of a test down to the middle of the range.

The weekly chart has lost its momentum up, but it has not yet formed a strong reversal pattern. That means there is uncertainty. The probability no longer clearly favors the bulls, but it does not yet clearly favor the bears. That means the probability of a test of 2800 has lessened and is now about the same as the probability of a test of the middle of the trading range, which is around the 20 week EMA.

Hi Mr. Brooks

Brooks says: “This week tested down to the May 22 high and reversed up without overlapping it”.

I think I understand that by reversing down and that reversals often end at signal bars from prior failed reversals.

Brooks says: “There is now a possible measuring gap for a 170 point rally”.

I cannot figure out where you are measuring from. Is this measured move based on a move from the middle og the trading rage, or AB = CD or a breakout pullback flag?

Best regards

Kent Johansen

Whenever there is a potential measuring gap, like above the May 22 high, traders look to the left for the most recent major higher low for the start of a measured move up. On the daily chart, that is the May 3 low. That low is 160.5 points below the May 22 high. If the computers instead use the April 2 low, the measured move would be 189.75. I used 170 as an approximate middle of the two. I just edited this week’s post to say “about a 170 point measured move [see comments below].”

As I wrote in this week’s post, the gap will likely close because it is in a trading range. Trading ranges disappoint bulls and bears. Therefore, the obvious was to disappoint the bulls is by closing the gap.