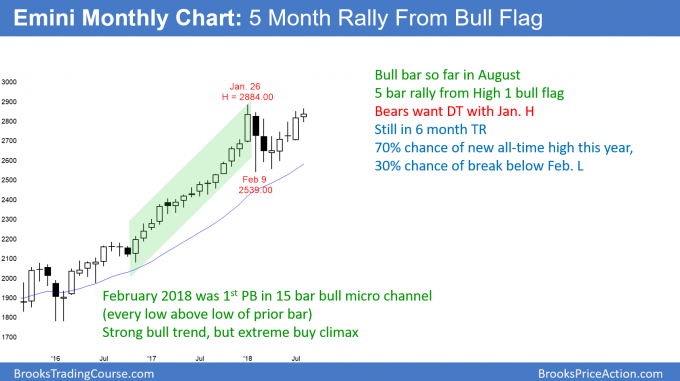

Monthly S&P500 Emini futures candlestick chart:

5 month rally, testing all-time high

The monthly S&P500 Emini futures candlestick chart has a doji bar so far for August. The bears want a double top with the January high. They need a strong bear bar in August for a sell signal bar.

The Emini monthly candlestick chart has been in a bull trend for 10 years. February ended the most extreme buy climax in the 100 year history of the stock market. As is usually the case after a strong bull trend, the climax led to a pause and not a bear trend. The bull trend has resumed for the past 5 months.

The bulls want a breakout above the January high and then a measured move up, based on the height of the 7 month trading range. That target is between 3,000 and 3,200, depending of which highs and lows a trader uses to make the projection.

Possible double top and measured move down

While the bears want a double top with the January all-time high, they need August to close near its low to create a strong sell signal bar. However, the reversal down would still probably be minor since last year’s rally was so strong.

The bears want a breakout below the February low. That is the neck line of the double top. A measured move down is around 2200. While that would be a 25% correction, a bear trend is unlikely. Instead, it would probably be a bear leg in what would become a trading range for 10 – 20 bars (1 – 2 years). However, it would be a bear trend on the daily chart.

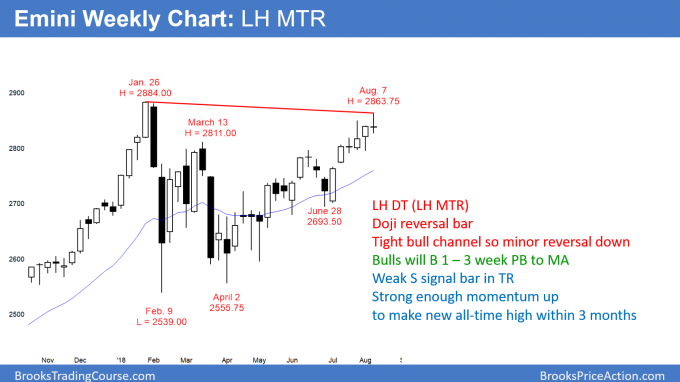

Weekly S&P500 Emini futures candlestick chart:

Lower high major trend reversal and at top of 5 month tight bull channel

The weekly S&P500 Emini futures candlestick chart formed a reversal bar this week for a double top with the January high. It is therefore a sell signal bar for next week. Because it is a doji bar and in a tight bull channel, it is a low probability sell signal.

The Emini weekly candlestick chart has rallied since the April double bottom with the February low. The rally was particularly strong for the past 6 weeks. This was a buy vacuum test of the January all-time high. It got close enough for the bears to create a credible double top. In addition, the rally was in a wedge bull channel.

This week’s reversal bar is now a sell signal bar for next week. But, it is a doji bar and the bull channel is tight. This reduces the chance of a big selloff. The odds are that the Emini will trade down for 2 – 3 weeks. I have said that even if the rally continues up to above 3,000, there would be swings down along the way. This is probably one of those bear swings.

I have been writing every week for months that there is still a 30% chance of a break below the February low and a measured move down to 2,200. Nothing has changed. The odds favor a minor reversal down, maybe to the start of the July buy climax at around 2700. The deeper the selloff and the bigger the bear bars, the less likely the bulls will make a new high this year.

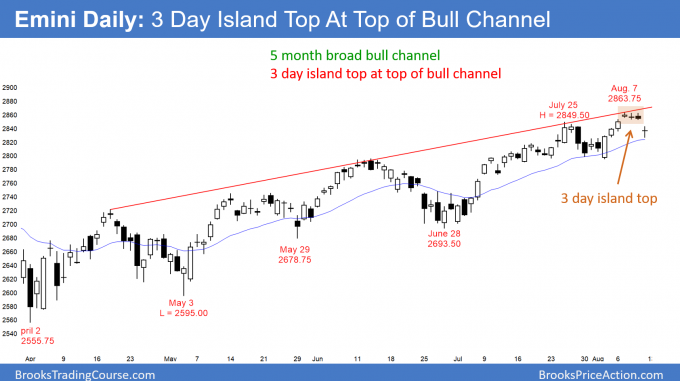

Daily S&P500 Emini futures candlestick chart:

Emini formed 3 day island top at top of bull channel and near all-time high

The daily S&P500 Emini futures candlestick chart had a gap down on Friday. This created a 3 day island top after a 4 day buy climax last week. The 1st target after a buy climax is the bottom of the buy climax. That is the August 2 low of 2795.

The daily Emini candlestick chart gapped down and sold off strongly for most of Friday from just below the all-time high. In addition, it was at the top of a 5 month bull channel. Even though it closed near the open, the selloff will probably test support below the 20 day EMA. If the selloff is persistent, the next major support is the August 2 buy climax low. Reversals usually have at least two legs down and last 10 or more bars. That is a reasonable minimum goal for the bears.

While the August 2 low is important, it is not as major as the June 28 low of 2693.50. As long as the selloff remains above that low, the daily chart is still in a bull swing in a 7 month trading range. But, if the Emini falls below that low, it would then be either in a bear trend or a bear leg in the 7 month range.

What about a new high this year? Friday’s reversal reduces the chances, but the odds are still 60%. They will fall if the selloff is deep. There is a 40% chance of a test of the February low, and a 30% chance of a big bear break below that low. I have been saying that for months, and it is still true.

How does a double top reversal form?

When a rally approaches a prior high, there are always sellers. The bulls who bought the January high were disappoint by the February selloff. They bought what they thought was a bull trend. Now, they believe they bought what now is the top of a trading range.

Traders want to buy low and sell high in a trading range. Therefore, those bulls want to sell out of their longs if the market allows them to get out around breakeven. This means there are bulls looking to sell up there. That is never a good thing for traders hoping for a strong breakout above the old high. Friday in part was caused by those bulls giving up.

The bears know this, and they, too, sold around the old high and on Friday’s reversal down. This selling by the bulls and bears usually causes the rally to stall. Once it does, traders begin to wonder if there will be a trend reversal down from the double top, rather than just a deep pullback.

Buy The Close rally in January

The January rally was strong enough so that many traders bought the closes of strong bull days. This includes the strong bull trend day on January 26, which was the top of the rally. When traders take a reasonable trade like this, they have an 80% chance of making a profit or at least avoiding a loss if they use wide stops and scale in.

The January 26 Buy The Close bulls were disappointed by February. If they scaled in above either of the big bull bars a couple weeks later, they could have exited at the midpoint of their 2 buys without a loss.

Since the January rally was so strong, the odds are that the current rally will get all the way up to the January 26 close of 2883.25 before breaking below the 7 month range. If it gets back to that January high close, traders will watch to see if there is a reversal down. If so, they will look to sell, betting that the bulls will give up and then only buy deep selloffs.

Alternatively, if the Emini rallies strongly to above that price without much of a pause, it will then probably continue up the the measured move target between 3,000 and 3,200.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

Can you start adding your “All In” entry locations to the Daily chart on the weekend reports? Thanks.

I try to relax on the weekend, and I therefore want to finish work as quickly as I can. I am already doing as much as I can, but I wish I could do more.

I completely understand. I’ll give it a shot myself. I do the it on the intraday, but I like to compare to your experience.

Thanks again Al.

I ve been taking off half at 50% It seems 50% of the time it will fall back in the red

Lonnie,

I am afraid of market maker will not give me to get out with an even 20% profit. This option price behaves wildly opposite that can be expected from Liquid options.

I only trade options in major markets because they have lots of institutional buying. This reduces the chance of the option sellers being able to steal. The spread is small and the rapid price drops are much less.

For example, I usually will only trade if most of the option contracts that expire next month have an open interest of at least 5,000 contracts, especially the ATM contracts, and a daily volume of at least 300 contracts in several strikes above and below the ATM option. When I trade less active options, I enter and exit with limit orders.

I trade SPY options more than any other. I often enter and exit at the market because the spread of an ATM SPY option expiring within a month is usually only 1 – 2 cents. The daily volume is usually > 10,000 contracts for the near the money strikes of options expiring within a few weeks.

Al,

I like trading options for stocks because sometimes options price increase 2-3 and even 4 times for 5-8 trading days. Spy behaves much smoother. And I want to learn to find and take options with 200-300% potential to be my swing trades. But liquidity is a big issue and my pre-mature exits..

Al,

Thank you for the Weekly update! For me Weekly chart looks good for bears, but Daily chart looks weak for them!

I have an interesting situation.

I happened to buy DNB 17 Aug 145 Put for 3.33. Yesterday DNB closed as 141.94. This put shows intrinsic value as 3,06 but Market price was just 1,82.

My question – suppose an hour before the Expiration there will be price around 142 and intrinsic value 3. If I put my closing order for 3, must the Market maker execute my closing order at 3 or must not ?

My plan was to keep this trade till Thursday and then decide on closing price and close it on Thursday-Friday.

And how would you manage this trade, Al?

The NFA does not allow me to discuss any actual trade that anyone is taking or planning to take. In general, most option traders close out their profitable trades at least several days before expiration. Another rule that I like is to take at least half off when I have a “double.” For example, if I buy a call for 1.00 and it becomes 2.00, I like to take at least half of the position off.

Al, Sorry for illegal questions!