Market Overview: S&P 500 Emini Futures

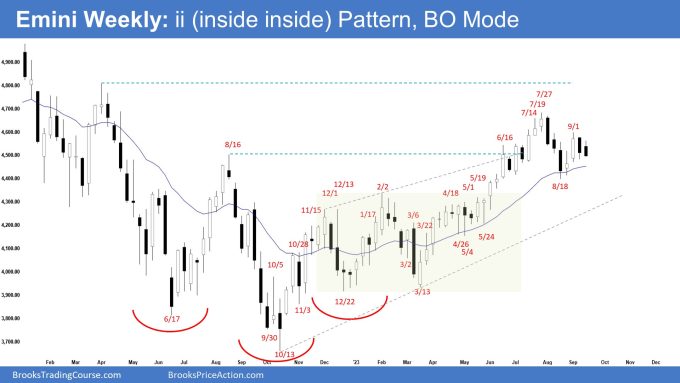

The weekly chart formed an Emini ii pattern (inside inside). The market is in breakout mode. The first breakout from an inside bar can fail 50% of the time. Traders will see if the bears can get a breakout below with follow-through selling or will the market trade slightly lower but reverse to close with a long tail below or a bull body.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was an inside bear bar with a small tail above.

- Last week, we said that the bulls want a breakout above while the bears want a breakout below the inside bar and sometimes, the candlestick after an inside bar is another inside bar, forming an ii (inside inside) which is a breakout mode pattern.

- Previously, the bulls got a strong trend up (since March) in a tight bull channel.

- That increases the odds of at least a small second leg sideways to up after a pullback. The second leg sideways to up formed (Sept 1) but did not get to the July 27 high.

- They hope that this week was a continuation of the small pullback from last week and want a breakout above the ii (inside inside) pattern.

- They want a retest of the July 27 high followed by a strong breakout above.

- The next targets for the bulls are the March 2022 high area and the all-time high.

- If the market trades lower, they want a reversal up from around the 20-week exponential moving average or from a double bottom bull flag with the August 18 low.

- Previously, the bears got a pullback from a climactic move and tested the 20-week exponential moving average.

- They want another leg down from a lower high major trend reversal.

- They will need to create follow-through selling trading far below the 20-week exponential moving average to increase the odds of a deeper pullback.

- The bears want a breakout below the ii (inside inside) pattern with follow-through selling.

- The ii (inside inside) pattern means the market is in breakout mode.

- The bulls want a breakout above while the bears want a breakout below the ii (inside inside) pattern.

- Because this week’s candlestick was an inside bear bar closing near its low, the market may first break out below the inside bar.

- The first breakout from an inside bar can fail 50% of the time.

- Traders will see if the bears can get a breakout below with follow-through selling or will the market trade slightly lower but reverse to close with a long tail below or a bull body.

- While the Emini could still trade a little lower, odds slightly favor the market to still be Always In Long.

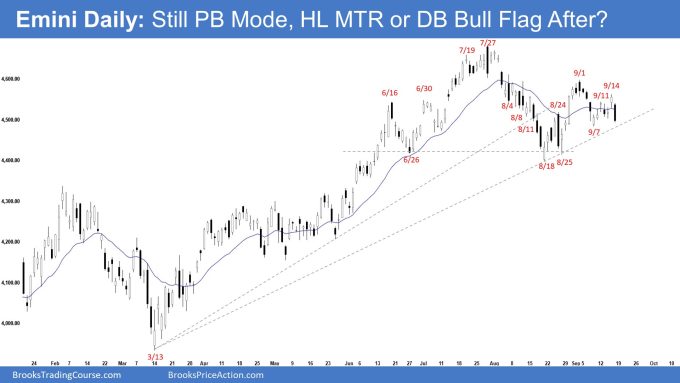

The Daily S&P 500 Emini chart

- The Emini traded sideways to down for the week. Thursday traded higher but there was no follow-through. Friday was a big bear bar closing near its low.

- Last week, we said that while the Emini could still trade a little lower, odds slightly favor the market to still be Always In Long.

- The bears got a reversal from a climactic move and a wedge pattern (Dec 13, Feb 2, and Jul 27).

- They want a second leg sideways to down from a lower high major trend reversal and a double top bear flag (Sept 1 and Sept 14).

- They want another strong leg down testing the August 18 low.

- They will need to create consecutive bear bars closing near their lows, trading far below the August 18 low to increase the odds of a reversal down.

- The bulls want a reversal up from a higher low major trend reversal followed by a retest of the July 27 high and a strong breakout above.

- If the market trades lower, they want a reversal up from a double bottom bull flag with the August 18 low.

- Since Friday was a bear bar closing near its low, it is a sell signal bar for Monday.

- Odds slightly favor the market to still be in the sideway to down pullback phase and to trade at least a little lower early next week.

- Traders will see if the bears can create follow-through selling or will the market trade slightly lower but find buyers near the August 18 low area.

- For now, while the Emini could still trade a little lower, odds slightly favor the market to still be Always In Long.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Emini weekly. Can you confirm the ii pattern is on the continuous weekly chart? I do not see the ii breakout mode on the continuous weekly. I only see it on the front month (Dec) weekly chart. For daily and higher (weekly, month) time frames, I understood Al only uses the continuous contract for charting and not the front month? Would like to confirm if I am following the correct chart filters or if I’m dealing with data variance (again) between trading platforms.

Thank you if you have time to clarify.

Dear F H,

Thanks for going through the report..

Yes, using the ticker @es.d on Tradestastion, it is an ii pattern.. you can see it visually here..

https://www.brookstradingcourse.com/wp-content/uploads/2023/09/Emini-Weekly-ii-inside-inside-Pattern-BO-Mode.jpg

Alternatively, you if you use SPY (looks slightly different) or SPX on trading view both are also inside inside pattern..

Let me know if that answers your questions.. have a blessed week ahead..

Best Regards,

Andrew

Excellent Analysis Andrew. We used to include a monthly chart analysis in these weekend reports. Adding that back in would further strengthen the bull case for at least a little bit more up. The double bottom of 8/18 and 8/25 and the strong rally up following it on the daily should give us a second leg up after this high 2 correction at the MA.

Dear CZ,

Thank you very much for going through the report.. and thanks for your input too..

The monthly chart analysis will be published on the weekend after the last trading day of the month..

I agree, market still looks to be in Always In Long.. until the bears can show otherwise, I’m in favor of sideways to up after the current pullback phase..

Let’s see how the market plays out over the next few weeks..

Have a blessed week ahead CZ..

Best Regards,

Andrew