- Market Overview: Weekend Market Analysis

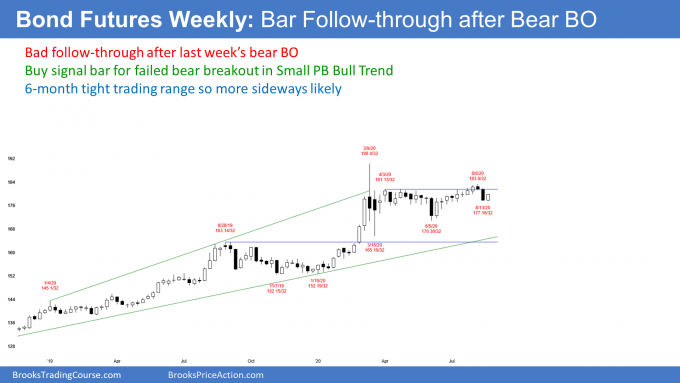

- 30 year Treasury Bond futures

- Weekly chart should have one more leg down

- Bond futures daily chart has bear flag

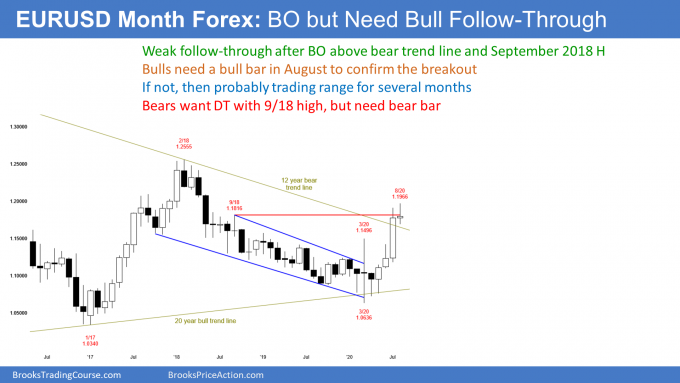

- EURUSD Forex market stalling at September 2018 high

- Monthly chart has weak follow-through after strong July breakout

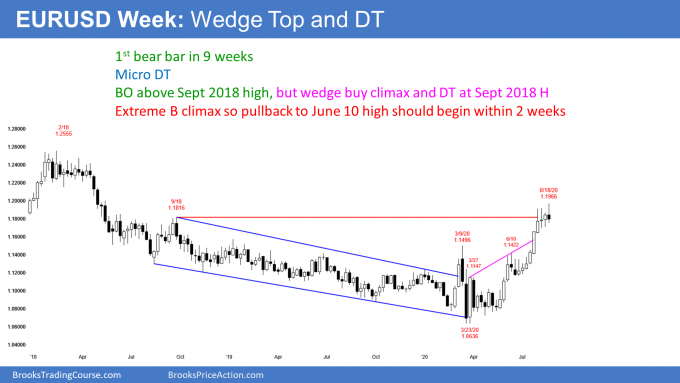

- EURUSD weekly chart is reversing down after parabolic wedge buy climax

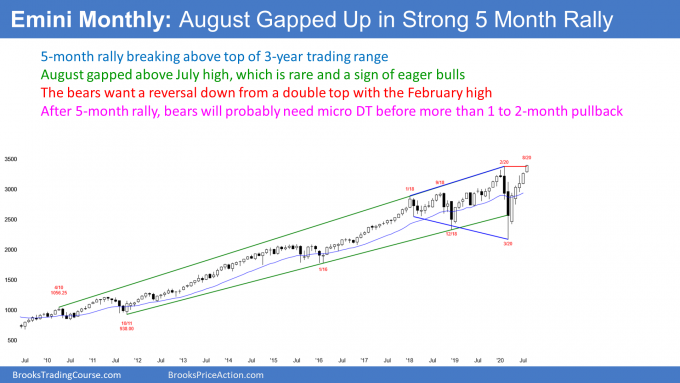

- S&P500 Emini futures

- Monthly Emini chart has 5 consecutive bull bars

- Weekly S&P500 Emini futures chart has 8 week micro channel at July high

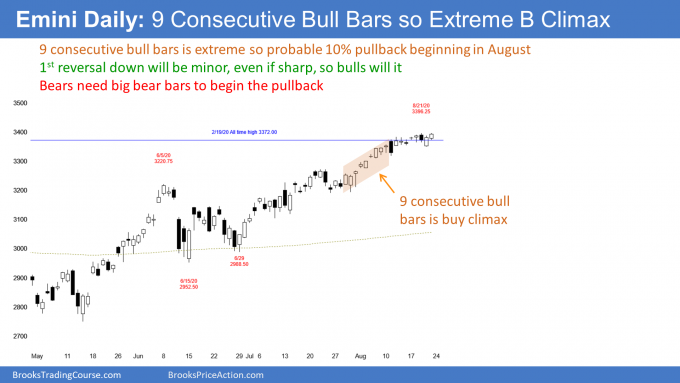

- Daily S&P500 Emini futures chart had a streak of 9 consecutive bull bars

Market Overview: Weekend Market Analysis

The S&P500 Emini futures market might gap to a new all-time high on the weekly chart next week. But the streak of 9 consecutive bull bars on the daily chart that ended 2 weeks ago should lead to a pullback to 3200 starting within a couple weeks.

Bond futures are bouncing after last week’s selloff. Traders should expect a 2nd leg down to the June 16 low to begin within a couple weeks.

The EURUSD Forex has a parabolic wedge buy climax for the 2nd leg up to a double top with the September 2018 high. This will probably lead to several weeks of selling to below the March 9 high.

30 year Treasury Bond futures

Weekly chart should have one more leg down

The weekly bond futures chart has been sideways for 5 months. Traders expect reversals. When there was a downside breakout in June, the market reversed up the following week. The bull breakout earlier this month reversed down.

Last week broke below a 2 month bull channel. While this week did not completely reverse the selloff, it was a bull bar. Traders are unwilling to hold onto positions because they think the trading range will continue. They buy low, sell high, and take quick profits.

Last week’s selloff retraced about half of the 2 month rally. The bulls hope it will be just a pullback in a Small Pullback Bull Trend since the June low.

Because this week was a bull inside bar, it is a buy signal bar for next week. However, last week fell far below the 2 month bull trend line and this week only erased about half of that selloff. That increases the chance of at least slightly lower prices. You can see the reason for a 2nd leg down on the daily chart below.

Bond futures daily chart has bear flag

The daily chart rallied in a Spike and Channel Bull Trend since June. The 4 day rally that ended on June 11 was a Spike up. There was a 3 day pullback to the June 16 low. The bull trend continued up for 2 months in a bull channel.

Traders expected a break below the bull channel because that is what happens 75% of the time. Next, they look for 2 or more legs down to where the channel began.

There has only been one leg down from the August high. Furthermore, the selloff has not gotten close enough to the June 16 low to convince traders that the test down is adequate. Consequently, this week’s rally on the daily chart is probably a bear flag. There should be another leg down to around the June 16 low.

At that point, traders will expect a bounce. The bonds bounced there in June. Traders suspect the bonds will do the same this time.

The result is that the selloff below the bull channel usually leads to a trading range. That is what typically happens when there is a Spike and Channel trend.

Since the entire pattern is within the 6 month range, traders are already expecting more sideways trading, possibly for the remainder of the year.

EURUSD Forex market stalling at September 2018 high

Monthly chart has weak follow-through after strong July breakout

On the monthly EURUSD Forex chart, the 2 month selloff in early 2018 was a spike down. The bounce in September 2018 led to a bear channel, and the 2 year bear trend was a Spike and Channel Bear Trend.

Traders look for a break above the bear channel and then a rally to where the channel began. That is the September 2018 high.

July was a big bull trend bar and it broke above that high. So far, August is a small bull bar. August is the follow-through bar, which always is important after a breakout. Will the breakout continue and lead to a trend, or will it reverse and lead to a trading range?

If the August candlestick has even a small bull body, traders will expect sideways to higher prices in September. If it is a big bull candlestick, traders will look for a test of the February 2018 high by the end of this year. That will probably not happen because a Spike and Channel Bear Trend usually evolves into a trading range.

If August closes on its low, traders will conclude that the July breakout failed. If August is a strong enough bear bar, traders will wonder if the EURUSD will undo the entire rally and test the March low.

August will most likely have either a small bull or bear body, and that will lead to a sideways to down September. The weekly chart below has a couple of reasons to expect lower prices.

EURUSD weekly chart is reversing down after parabolic wedge buy climax

The EURUSD weekly chart has rallied strongly from the March low. But the rally has had 3 legs up in a tight bull channel. That is a parabolic wedge buy climax, which typically attracts profit takers.

This is especially true when the rally is testing important resistance. Here, the rally has stalled at the September 2018 high, which was the start of the 18 month bear channel.

This week formed a bear reversal bar. It is a sell signal bar for next week. There is a parabolic wedge rally to a double top with the September 2018 high. That is a common combination that typically results in at least a couple legs down. A measured move down based on the height of the trading range of the past 4 weeks would result in a test of 1.14, which is around the June 10 high breakout point.

Reversing down from a Spike and Channel Bull Trend

The rally after a Spike and Channel Bear Trend typically tests the start of the bear channel. It then stalls and the chart evolves into a trading range. That is what is likely here.

The stop for the bulls is far below. They have to reduce their risk and the easiest way to do that is by taking some profits. They will probably begin to take profits over the next few weeks. If enough bulls take profits, there will be a reversal down. Traders expect a test of the breakout points, like the March 9 high and the June 10 high.

Streak of 8 consecutive bull bars

The bulls have an added problem. This rally has been too strong. There are now 8 consecutive bull candles on the weekly chart. That is unusual and therefore unsustainable and a buy climax.

The last time that there was a streak of 8 or more bull bars was in 2004. That streak was 11 bull bars. The EURUSD went sideways for a couple months and it then retraced most of the streak.

A streak like this in a trading range usually leads to a reversal down and the selloff typically retraces most or all of the streak. This current streak began with the June 26 low of 1.1169.

Will there be a selloff this year to that low? Probably not, but there should be a test of at least the March 9 high, which is about 500 pips below this month’s high.

Eight bull bars is climactic, but it also tells us that the bulls are aggressive. They will probably buy the selloff, even if it falls 500 pips.

It is important to note that it could be sideways for a month or two instead of down. However, after a streak, a market usually retraces at least half of the streak. Traders should expect lower prices.

S&P500 Emini futures

Monthly Emini chart has 5 consecutive bull bars

The monthly S&P500 Emini futures chart has another big bull bar so far in August. However, because of the buy climax on the daily chart (see below), there is an increased chance of a selloff starting in the next few weeks. If it starts in August, this month’s candlestick could look very different once it closes.

The bulls have been in control for 5 months. They want August to close on the high of the month and above the July high. That would increase the chance of higher prices in September. But if August closes below the July high, traders will not expect September to be another strong bull bar.

If there is a big tail on top of this month’s candlestick, September will probably mostly overlap August. Also, there would be an increased chance that it would close below the open of the month. That would create the 1st bear bar in 6 months.

After 5 strong bull bars, traders will buy the 1st 1 – 2 month pullback. The bears will probably need at least a micro double top before they can retrace half of the 5 month rally. Consequently, there is not much downside risk for a few months. If there is a sharp selloff in September, the selling would probably end in October. The Emini has a good chance to end the year near the high, even if there is a pullback in September and October.

This is true whether Biden or Trump wins the upcoming US election. Presidents are important in many ways, but the political party has no influence on the stock market. The economy is much bigger and much more powerful than whoever is sitting behind the desk in the Oval Office.

Weekly S&P500 Emini futures chart has 8 week micro channel at July high

The weekly S&P500 Emini futures chart again closed near its high. Four of the past 7 weeks gapped up. While only one of the gaps stayed open, this is a sign of eager bulls.

With this week closing on the high and at a new all-time high, there is an increased chance of another gap up on Monday. If it is a big gap up, traders will wonder if it might be the start of a new bull trend to far above the 3 year trading range.

Will it lead to a 1,000 point measured move up? That is unlikely, but since the market is overbought and the odds favor a pullback, the short side might be crowded. That always increases the chance of the opposite. Therefore, instead of a pullback for a few weeks, there could be a short squeeze up for a few weeks.

If the Emini starts to go up, the shorts will buy back their shorts in a panic. Also, many bulls waiting to buy a pullback will be afraid there will be no pullback and they will buy in a panic as well. Consequently, there is an increased potential of a short squeeze next week in addition to an increased chance of several weeks of profit taking.

Buy climax so traders expect profit taking soon

The weekly chart has not had a pullback in 8 weeks. An 8 week bull micro channel is a sign of strong bulls. They will probably buy the 1st 2 – 3 week pullback.

However, an 8 week micro channel is getting extreme. This is especially true when most of the weeks have had small bodies and prominent tails. A rally with bars that look like that typically soon evolves into a trading range. Also, a rally to an old high usually stalls for several bars. Traders should expect a 2 – 3 week pullback to begin soon. A trading range could develop and last through October.

How much of a pullback?

At a minimum, the Emini will probably fall below the most recent major breakout point. That is the June 5 high of 3220.75. The 3200 Big Round Number is just below and it is a magnet. Traders therefore should expect a test of 3200 in September.

Can the selloff reach the bottom of that June 5 week trading range? That trading range came late in a bull trend. It is therefore a reasonable candidate for a Final Bull Flag. The bottom of a Final flag is always a magnet.

There is currently a 40% chance of a pullback in the next 2 months to that level, which is around the 3,000 Big Round Number. If the Emini pulls back to the 3200 breakout point, the odds of it continuing down to 3,000 will go up to 50%.

Daily S&P500 Emini futures chart had a streak of 9 consecutive bull bars

The daily S&P500 Emini futures chart had a streak of 9 consecutive bull bars that ended last week. A streak of that length comes every couple years. It is a buy climax and traders should expect profit taking to begin within a couple weeks.

There was a streak of 8 consecutive bull bars in June. The Emini fell 9% over the next 5 days.

The most recent streak with 9 bars was in January 2018. That rally was stronger than the current rally, and there were 2 more brief legs up after the 1st bear body. This formed a parabolic wedge buy climax. The Emini then reversed down 10% over the next few weeks. It fell below the bottom of the 9 bull bars.

How much higher can the Emini go at this point? Since the 9 bars were not especially strong, the Emini will probably not go much higher before correcting. However, it could continue sideways for a week or two more before turning down.

What are the targets for the pullback?

One goal for the reversal down is to retrace the most recent buy climax. Traders therefore should expect a test down to the bottom of the 9 consecutive bull bars. That it around 3200. If the Emini dips below, traders will look at the next major higher low as another magnet. That is the bottom of the June trading range at around 3,000.

It is important to note that the pullback in June got near the breakout point of the April 29 high, but did not overlap. When there is a subsequent breakout, like in July, and then another pullback, that pullback typically falls below the breakout point. Here the major breakout point is the June 5 high of 3220.75. Traders should expect a test of 3200 before the Emini goes much higher.

How to reconcile the strong weekly chart with the streak on the daily chart?

This is one of those situations where the unstoppable force of the weekly bull trend is hitting the immovable object of the buy climax streak on the daily chart. Which is more important? Streaks usually win over everything, but the trend often continues further than what seems likely before reversing. For example, in 2017, there were streaks on the daily, weekly, and monthly charts that were the most extreme in the 100 year history of the stock market, and then continued a long time before ending. They lead to the current 3 year trading range.

Does the Emini have to pull back after a streak? No, but it usually does, even if it continues up for a couple more weeks first. Remember, the weekly chart is unusually bullish and it might gap up to a new all-time high next week.

While the weekly bulls want a 1,000 point measured move up based on the 3 year trading range, there will probably be a pullback on the daily chart first. Also, the odds are that the 3 year trading range will be a magnet for many years. This is true even if the Emini rallies to 4,000 within a couple years.

On the daily chart, a gap up next week would be a breakout above a 50 point tall, 8 day tight trading range. Traders would expect some profit taking after reaching a measured move up from that small trading range. The weekly breakout therefore might run 50 points before the bulls take profits and the Emini falls to below the June 5 high. Traders should expect a 5 – 10% correction to start by the end of the month.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Al, there is an expanding triangle trendline above at around 3550. Is that a reasonable area of target for the bulls?

I wrote about that many times over the past 2 years, including after the reversal up in March. The momentum up is strong and there is no sign of a top. That makes it likely that when a top finally comes, it will follow a break beyond resistance, like the top of the expanding triangle.

Also, after 5 strong months going up, the 1st reversal down will likely be minor. A reversal down from an expanding triangle is always a higher high major trend reversal. I do not think the Emini will have a major reversal down on the weekly chart without at least a small double top on that time frame.

Dear Al, alright thank you very much for your input.. Take care and stay safe..

Can you once a month or so do a market update on the Gold market? Thanks

I would prefer the written reports. There will be a loss of chart details with a video podcast. It would be impossible to put comments on the charts. And to be honest, the previous video sound qualities are not that good.

Hi Vincent,

The poor audio you are referring to comes from trading room recordings with very low audio quality being used to keep file sizes down. For a video podcast the audio quality would be fine.

Thanks for the clarification. I really found the daily setup charts invaluable. There would first be a clean chart to trigger our thoughts , then in the following slide Al then annotate and explain the setups. So weekly updates in podcast video is fine as long as the charts are big and clean so that a snapshot can be taken.

Dear all,

We are considering replacing one weekend market report each month with a video podcast review. Many members have asked to see more of Al himself!

If you would like to see such a video podcast each month, just click the post “Vote” button below. Or reply and add your comment if preferred. No, it will not be possible to do a written report AND a video podcast! 🙂

I prefer the written reports, I print them out and refer to them Daily. With a video podcast I would have to take very fast notes and might miss something. The printed reports are best!

Maybe the video’s could also be transcribed? There are many online options to do this at relatively little cost these days? It is quite nice to have the written version to refer to and reference back to the charts. Difficult to have any sort of firm opinion without seeing one first to compare I guess.

Richard,

How about posting a video podcast review one weekend in place of a written report and THEN asking people to vote.

I always benefit from the written reports, but would like to see a video review for comparison. I assume the video review would contain charts, and those so inclined could take screen shots.

Great idea, video is much easier to consume, and also hearing it from Al as a teacher is always better

Video would be great, I think you should do every week that way, and keep the daily ones written.

Either way the information you guys give us is priceless so i’ll be happy either way

As much as I enjoy seeing Al, I would like to see him save his voice as much as possible. Like when he takes a break in the Trading Room.

Video podcast sounds awesome!

I think it would be a fantastic addition to all that Al has to offer. There is just something so different when you get to actually see/hear Al explain vs reading an article written by him (His blogs truly are great though). Thanks and just wanted to share my two cents. Happy either way with the outcome.