Market Overview: S&P 500 Emini Futures

S&P 500 Emini futures consecutive bear bars on weekly chart. The bears are hoping to get the 3rd consecutive bear bar trading far below March 3 high. If they get that, the odds of a test of the February low increases. The bulls see this as a 50% pullback and want a 2nd leg sideways to up to re-test March 29 high.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a bear bar closing near the low with small tails above and below. It closed slightly below the March 3 high.

- Last week, we said that odds slightly favor sideways to up after a pullback but if the bears get consecutive bears bars closing near the low, odds will swing in favor of a test of the February low and possibly a breakout below.

- Bears want the Emini to stall around February 2 high and reverse lower from a double top bear flag. They got the consecutive bear bar this week which represents follow-through selling.

- The bears want a strong break below the February 24 low which is the neckline of the double top bear flag and a measured move down towards 3600 based on the height of the 8-month trading range.

- We have said if the bears get strong consecutive bears bars closing near their low, odds will swing in favor of a test of the February low and possibly a breakout below. This remains true.

- Bulls hope that the move up from March 14 is the start of the reversal to re-test the trend extreme followed by a new high.

- The bulls expect at least a small second leg sideways to up, even if there is a pullback first.

- The bulls want next week to be a bull bar, even if the Emini trades slightly lower first. They see the current move as a 50% pullback of the strong rally from March 14.

- So, which is more likely? A pullback and a continuation higher or a double top bear flag and a reversal lower to test the February low?

- The Emini is currently trading around the middle of the 8-month trading range. Lack of clarity is the hallmark of a trading range. Trading ranges tend to disappoint both the bulls & bears and have poor follow-through.

- There have not been 3 consecutive bear bars since October 2020. Will next week be another bear bar? Or will the bears be disappointed with a bull bar instead?

- Odds are, the prior leg up from March 14 was a bull leg within a trading range, not the start of a new bull trend.

- Since this week was a bear bar closing near the low, it is a reasonable sell signal bar for next week. Odds are, the Emini will trade at least slightly lower.

- It may even gap down at the open. However, small gaps usually close early.

- If the bears get another bear bar next week, especially if it is big and closes near the low, the odds will swing in favor of a test of the February low.

- However, if next week trades lower, but reverses to close near the high, odds of a reversal from a wedge bull flag to re-test the March 29 high increases.

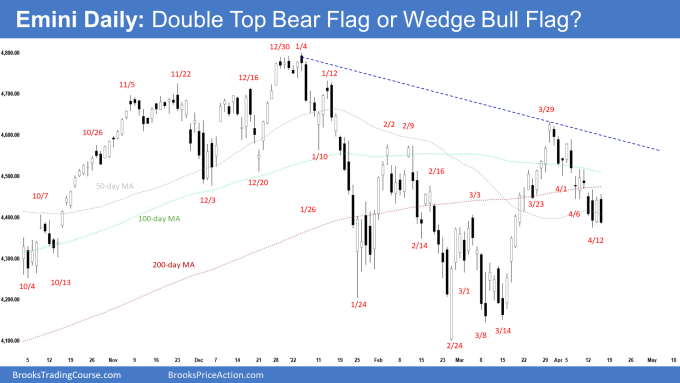

The Daily S&P 500 Emini chart

- The Emini traded lower testing the March 3 high and stalled around the 50-day moving average for the whole shortened week (market closed on Friday).

- Last week, we said if the 3rd leg sideways to down forms but then stalls around the March 3 high, there would be a wedge bull flag pattern. From there, odds are we will see buyers return and the second leg sideways to up to re-test March 29 high begin.

- We also said if the bears manage to get strong consecutive bear bars trading far below the March 3 high instead, the odds of a test of February low increases.

- The last 4 trading days were sideways and consolidated around the March 3 high. While it did close slightly below the March 3 high, the bears will need to create consecutive bear bars closing far below it to convince traders that a re-test of the February low is underway.

- The bears want the Emini to reverse lower from a double top bear flag (February 2 and March 29). They then want a strong break below February 24 low and a measured move down to around 3600 based on the height of the 8-month trading range.

- The bulls want the rally from March 14 low to re-test the trend extreme, followed by a breakout to a new all-time high.

- We have said that the rally from the March 14 low was in a tight bull channel and strong enough for traders to expect at least a small 2nd leg sideways to up. The bulls see the current move lower as a 50% pullback and a wedge bull flag.

- There are two problems with the bull’s case: 1) The bears are starting to get big bear bars closing near the low and 2) The bull bars have weak or no follow-through buying.

- The bulls need to start creating strong consecutive bull bars here and prevent the bears from breaking far below the March 3 high.

- The current pullback from March 29 is in a tight bear channel. However, it has a lot of overlapping bars and a wedge pattern. The bears are not as strong as they could be.

- The market has been in a trading range for 8 months. Lack of clarity is the hallmark of a trading range.

- The trading range is more likely to continue than a strong breakout from either direction.

- We will likely see traders BLSH (Buy Low Sell High) at the extremes of the trading range.

- Since Thursday was a bear bar closing near the low, it is a good sell signal bar for Monday. It may even gap down on Monday. Small gaps usually close early.

- Odds slightly favor sideways to down early next week. Traders will be monitoring whether the bulls can create a reversal up from a wedge bull flag, or the bears continue to create consecutive bear bars trading far below March 3 high.

- If the bears manage to get strong consecutive bear bars trading far below the March 3 high instead, the odds of a test of the February low increases.

Trading room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Thanks Andrew for the report. What level of weight if at all will you provide given there is a body gap on the weekly chart from last week open vs previous one close?

Dear Eli, thanks for going through the report.

Gaps are important measure of strength of the trend. Refer to the list of strengths of a trend in Al’s books.

If there are multiple gaps, micro gaps, etc, that tells us the bears or bulls are strong.. It’s an important clue..

Take care and have a blessed week ahead!

Best Regards,

Andrew

Andrew – Which Al’s book are you referring to?

July 20 CME Advanced Gap Techniques PDF file

Thanks Andrew

Thank you, Andrew.

Vinod, a good day to you.

All 4 books has the list. I don’t have them with me now so I can’t refer them to you which page etc, but it lists all of the characteristics of strength for bulls and bears. The more you have those characteristics / factor, the higher the odds of a successful breakout.

Have a blessed week ahead!

Al has said a body gap is useful but less so than a true gap between the price extremes.