Market Overview: S&P 500 Emini Futures

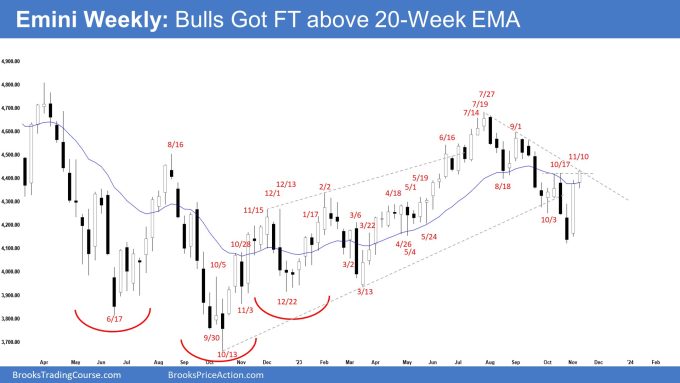

The weekly chart formed an Emini follow-through bull bar closing above the 20-week EMA and the October high. The bulls need to continue creating follow-through bull bar trading above the bear trend line to increase the odds of a retest of the July 27 high. The bears want the October high and the bear trend line to act as resistance. They want a reversal down from a double top bear flag.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a bull bar closing near its high.

- Last week, we said that odds slightly favor the market to trade at least a little higher and traders will see if the bulls can get a follow-through bull bar closing above the 20-week EMA and the October high.

- This week traded higher closing above the 20-week EMA and the October high.

- The bulls see the move down (from July 27) as a deep pullback of the whole move up which started in October 2022.

- They got a reversal from a wedge bull flag (Aug 18, Oct 3, and Oct 27) and a trend channel line overshoot.

- They saw the big bull bar last week as evidence of bears taking profit aggressively, believing that the whole move down was simply a wedge bull flag.

- The bulls got a follow-through bull bar this week. If they get a couple of strong consecutive bull bars, the odds of the bull trend resuming will increase.

- If the market trades slightly lower, they want a reversal up from a higher low major trend reversal.

- Previously, the bears got the third leg down forming the wedge pattern (Aug 18, Oct 3, and Oct 27).

- They wanted a strong breakout below the bull trend line, but the market reversed up with strength instead.

- The bears see the recent strong rally simply as a deep pullback and hope to get another leg down to retest the October low from a double top bear flag (Oct 17 and Nov 10).

- They want the 20-week EMA or the October high to act as resistance.

- Since this week’s candlestick is a bull bar closing near its high, it is a buy signal bar for next week.

- The market may gap up on Monday. Small gaps usually close early. (Side note: MOODY’S cut U.S. credit outlook to negative. Will we get a gap down instead?)

- Odds continue to slightly favor the market to trade at least a little higher.

- Traders will see if the bulls can get another follow-through bull bar, closing above the bear trend line.

- If the market trades slightly lower in the coming weeks, odds slightly favor the bulls to get at least a small second leg sideways to up.

The Daily S&P 500 Emini chart

- The Emini traded sideways to up for the week. Thursday was an outside bear bar closing near its low but there was no follow-through selling on Friday, closing as a bull bar above October high.

- Previously, we said that the odds slightly favor the market to trade a little lower. However, a small pullback can begin within 1-3 weeks.

- The pullback has started and the move up is strong.

- The bulls saw the previous selloff as a deep pullback of the whole rally which started in October 2022.

- They want a reversal from a wedge bull flag (Aug 18, Oct 3, and Oct 27) and a trend channel line overshoot. They got what they wanted.

- The move-up was in a strong spike with several big gaps that remained open and a 9-bar bull microchannel.

- Thursday ended the bull microchannel streak. Odds favor buyers below the first pullback from such a strong bull microchannel.

- The bulls need to create follow-through buying above the October high, trading far above the bear trend line to increase the odds of the bull trend resuming.

- If the market trades lower, they want the 20-day EMA to act as support and a reversal up from a higher low major trend reversal.

- The bears wanted a strong breakout below the bull trend line but did not get sustained follow-through selling.

- They hope that the recent rally simply formed a double top bear flag (Oct 17 and Nov 10) and want reversal down to retest the prior leg’s extreme low (Oct 27).

- They want the bear trend line to act as resistance.

- Since Friday was a bull bar closing near its high, it is a buy signal bar for Monday.

- Traders will see if the bulls can create sustained follow-through buying (preferably early in the week) trading far above the October high and the bear trend line.

- Or will the market trade slightly higher but stall around the bear trend line area?

- For now, odds slightly favor the market to still be in the sideways to up phase.

- If the market trades slightly lower, odds slightly favor the bulls to get at least a small second leg sideways to up.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

The move up from the 10/27 low was quite strong as noted in the analysis. You would expect any reversal to be minor with a second leg up. Friday does qualify since it went above the first leg but it is so much smaller than that first leg that a realistic expectation would be for a bigger leg up. There are a lot of momentum based funds and algos in the market and they will keep buying until there is a clear sign of a reversal.

Dear Andrew,

A good day to you.. I agree..

Let’s see if the bulls can create follow-through buying, and if the market trades lower, the strength of the pullback and whether the bulls can create another strong 2nd leg up..

Have a blessed week ahead..

Best Regards,

Andrew

Hi, nice analysis as always, but something I don’t get is how SP500 can continue to go up like this after a 7-8% move with no pullback. Top SP500 holdings like AMZN, MSFT, META, NVDA are up over 20% in 1-2 weeks with no pullback. Common, would you really chase and buy after a 20% move in these economics condition. Look at the size of the daily candles in the last few days, it’s very weak except for these institutions who try to protect their investment because they got trapped by Powell dovish comments (and then he gives the red light a few days after lol). Al Brooks also says in his course that a buy climax bar like Friday often marks the end of the move short term. I think these institutions got trapped, and try to form a trading range higher to dump what they bought (the recent 20% rally) at higher prices. Also, something very interesting is an inverse head and shoulder that could form if there’s a pullback in the next weeks. That would be way more bullish and realistic than just go straight up (where’s the structure to support such a move, this is a liquidity grab). Give me a pullback. Have a good day Andrew.

Ola Alex,

A good day to you..

Let me give my thoughts on some of your questions.. my answers are not meant to sound bullish or bearish.. merely my thoughts on the issue..

1: Common, would you really chase and buy after a 20% move in these economics condition. – The keywords are ‘these economic condition’.

I’ll bring you back to 2020-2021 – millions effected by covid (a lot didn’t make it), businesses closed all around the world, and ‘these economic condition’ during that period was as bad as it can get. But market kept making new highs month after month. See? The key is just to read the charts.. the economics side is too hard and too multifaceted for anyone to truly know everything.. Even the Fed (central bankers) don’t know everything..

2: Al Brooks also says in his course that a buy climax bar like Friday often marks the end of the move short term. – True, but for me, the largest bar I would usually be looking for them at trend extremes.. like extreme highs or extreme lows of a move.. usually not in the middle of a move..

3: Give me a pullback. – yeah.. sometimes the market just traps traders out and stuck traders in.. it’s the pullback that never comes.. it can either be:

1) buy/sell vacuum to test some support/resistance

2) It’s really a strong move..

3) or others..

But eventually, a pullback will come.. and we will see the strength of the pullback and analyze again then..

These are just some of my thoughts on the issue.. hope it helps..

Have a blessed week ahead!

Best Regards,

Andrew