Trading Update: Monday January 8, 2024

S&P Emini pre-open market analysis

Emini daily chart

- The Emini is stalling following a test of the moving average after being away from it for over 40 bars. The Bulls are expecting a bounce lasting a couple of days at a minimum.

- The bears are hopeful that the recent selloff is strong enough to make the market Always In Short. However, the bears need to do more and get strong closes below the moving average before traders conclude that the moving average support level will fail.

- This means that the moving average will probably act as support and lead to a bounce.

- The recent selloff last week is strong enough for a second leg down. Bears will be looking to sell any pullback betting on a second leg down.

- The risk the bears face selling this close to the moving average is an upside breakout that traps the bears into a losing short position.

- This is similar to what happened to the bears on the next day, following the December 20th outside down bar.

- The bulls see last year’s March 2022 high and the December 28th high. These are magnets for the bulls, increasing the probability of the market having to test closer to both.

- If the market tests up to those magnets mentioned above, sellers will probably be near them. Unless the Bulls can get a strong upside breakout, forcing the Bears to cover shorts.

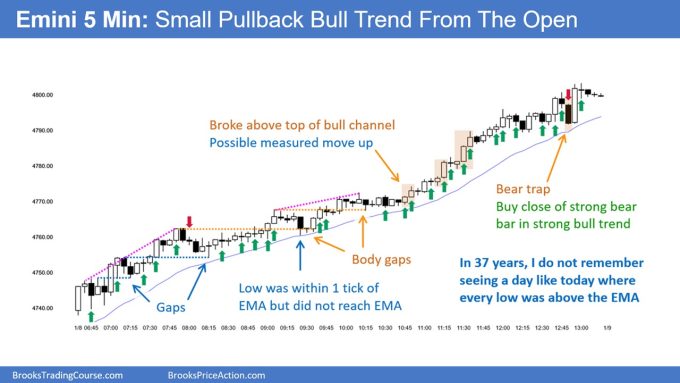

Emini 5-minute chart and what to expect today

- Emini is up 3 points in the overnight Globex session.

- The overnight Globex market rallied with several overlapping bars for most of the session.

- The U.S. Open will likely have little to no gap on the open.

- As I often say, most traders should avoid trading during the first 6-12 bars, unless they are comfortable with lower probability traders and greater uncertainty.

- The open often has several reversals due to the market deciding on the direction of the opening swing.

- Most traders should focus on the opening swing that often begins before the end of the second hour. It is common for the open swing to begin after the formation of a double top/bottom or a wedge top/bottom.

- The most important thing on the open is to exercise patience and discipline. It is easy to become excited on the open to trade. Traders must only take trades when they have a profitable trader’s equation. Without one, a trader will lose money over time.

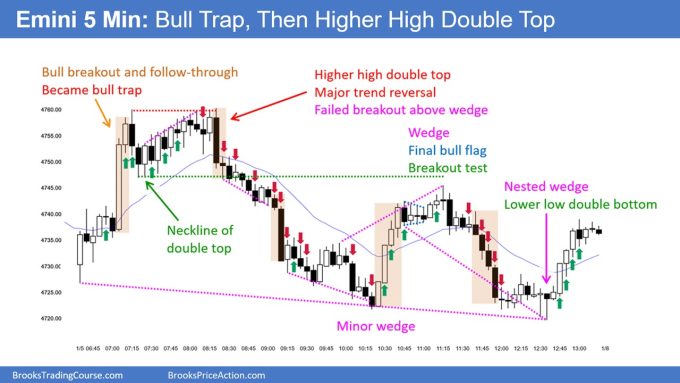

Friday’s Emini setups

Al created the SP500 Emini charts.

Here are reasonable stop entry setups from Friday. I show each buy entry bar with a green arrow and each sell entry bar with a red arrow. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a near 4-year library of more detailed explanations of swing trade setups (see Online Course/BTC Daily Setups). Encyclopedia members get current daily charts added to Encyclopedia.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

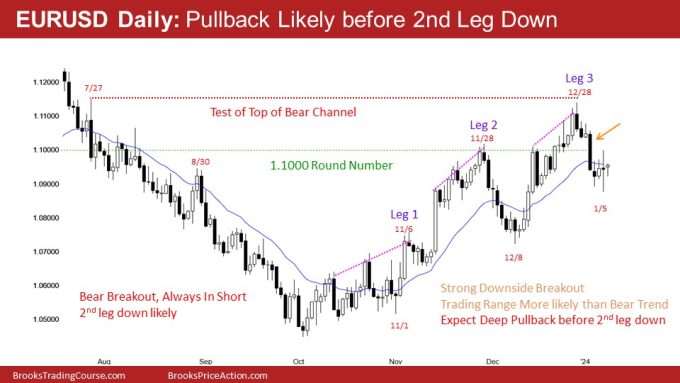

EURUSD Forex daily chart

Brad created the EURUSD chart.

- The EURUSD is going sideways at the moving average. The bears are failing to get strong follow-through, following the January 2nd bear breakout.

- The January 2nd bear breakout is strong enough for a second leg down. However, the market is likely in a trading range, which means the bulls may get a rally before the bears get their second leg down.

- Overall, the odds favor the Bears getting a second leg down. The bears must be prepared for the market to test above the midpoint of the January selloff before they get their second leg down.

Summary of today’s S&P Emini price action

Al created the SP500 Emini charts.

End of day video review

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.