Trading Update: Monday February 13, 2023

Emini pre-open market analysis

Emini daily chart

- The Emini had bad follow-through after Thursday’s large bear breakout bar. Bears want second leg down.

- While the bulls are hopeful that Friday’s bull bar is enough to cause the bears to panic out of shorts, more likely, the bears will get the second leg down after Thursday’s bear breakout.

- At the moment, the odds favor a test of the January 30th bottom of the third leg in the wedge (January 23rd, January 27th, and February 2nd).

- If the bulls are going to prevent the bears from getting their second leg down from Thursday, and test the January 30th low, they will need to trap the bears and force them to exit shorts. This means that bulls need to create a 2nd leg trap and get 2-3 consecutive bull trend bars over the next couple of days.

- Overall, the daily chart is in a trading range, which means the odds favor more sideways trading this week.

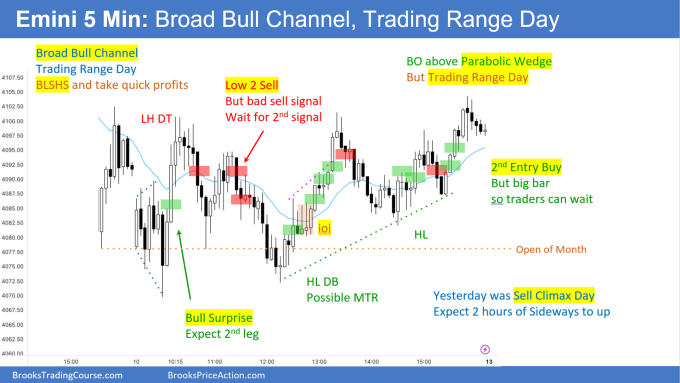

Emini 5-minute chart and what to expect today

- Emini is up 6 points in the overnight Globex session.

- The overnight Globex session sold off yesterday and began to rally in the light hours last night.

- The market has been in a tight bull channel since yesterday around 10:00 PM PT.

- Traders should assume today will have a lot of trading range trading and go mostly sideways today.

- Most traders should wait for 6-12 bars before placing a trade. This is because the open will likely have a lot of limit order trading, and unless a trader is comfortable fading breakouts, they should wait for more clarity.

- There is an 80% chance of a swing trade on the open beginning before the end of the 2nd hour. The swing trade will usually form after a double top/bottom or a wedge top/bottom, which means most traders can wait for one of the above patterns to form before placing a trade.

- Lastly, traders can wait for a credible breakout with follow-through and enter for the 2nd leg.

Emini intraday market update

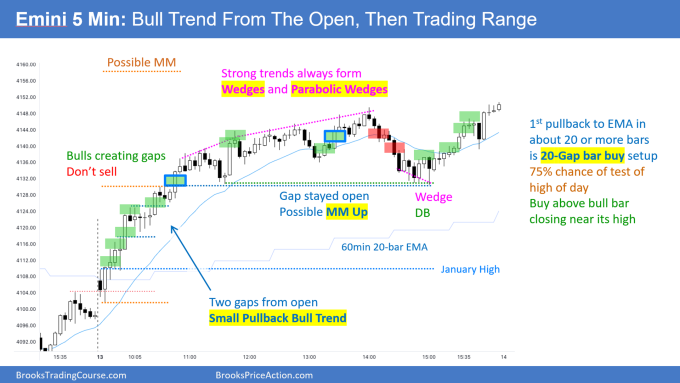

- The Emini formed a bull trend from the open since bar 2.

- The bulls have been very strong, and the bears have been unable to make money.

- While it is possible the small pullback bull trend can last all day, there is a 60% chance the market will form a trading range lasting several hours.

- This means the odds favor sideways to down and a test of the moving average.

- With the consecutive buy climaxes during the first two hours, the odds favor the bulls stepping aside for a couple of hours.

- The market will probably go sideways for a couple of hours and then decide on trend resumption or trend reversal going into the session’s final hours.

Friday’s Emini setups

Tim created the SP500 Emini chart from Al’s provided summary

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The EURUSD was able to get a small second leg down below the February 7th low.

- While the bears can argue that last Friday is the start of a second leg down, more likely, it is minor, and the market will need a deeper pullback before the bears can get their second leg down.

- The bears will likely need a test-up and formation of a lower high major trend reversal before the bears can get a second leg down.

- The bulls see the market as transitioning into a trading range. Therefore, they want to see a test of the top of the range (February 2nd high).

- Overall, traders should expect the market to go sideways over the next couple of days.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Tim created the SP500 Emini chart from Al’s provided summary

End of day review

- I will update at the end of the day.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.